- Ethereum tumbles 9%; millionaires and mysterious institutes treat it like a clearance sale. How convenient. 😏

- BlackRock now hoarding 1.5 million ETH—clearly, they know something about the end of days (or the start of new ones?).

Picture it: June 13th—a date that will live in infamy (or perhaps, just as turbulence on some trader’s spreadsheet). Ethereum, our beloved child of volatility, inhaled deeply and plunged headlong—a fall of 9%, a scene drawn in the chiaroscuro of despair and avarice, with $298 million in liquidations echoing like the laughter of the gods upon 80,000 trembling traders.

Ethereum’s current market dynamics

As the rabble cried ruin and gnashed their teeth, whisperers of fortune—those eternal optimists (or perhaps, masochists?)—scrambled to amass ETH below $2,500. Such courage! Or folly? In Petersburg, they would call this “Thursday.”

The asset itself, like a Dostoevskian protagonist, sank from $2,771 to a shameful $2,443, a collapse that would make even Raskolnikov shudder. Yet, in cruel irony, it steadied itself at $2,509—never too high, never too low. Mediocrity, it seems, is the true fate of us all.

Trade war angst warmed the air, spurring a stampede to sell. Yet, beneath the panic—ah, beneath!—rose the bullish whispers: Open Interest swelled to $35.22 billion in 24 hours, with CME, Binance, Gate, and Bitget, those temples of fate, each juggling $4 billion in restless ETH positions. Who amongst us has not likewise gambled away his last ruble in hope’s feverish delirium? 🙃

Right on cue, ETH’s price flickered up to $2,538.66. CoinMarketCap utters a trembling “+0.37%,” a number as comforting as weak tea during a Siberian winter.

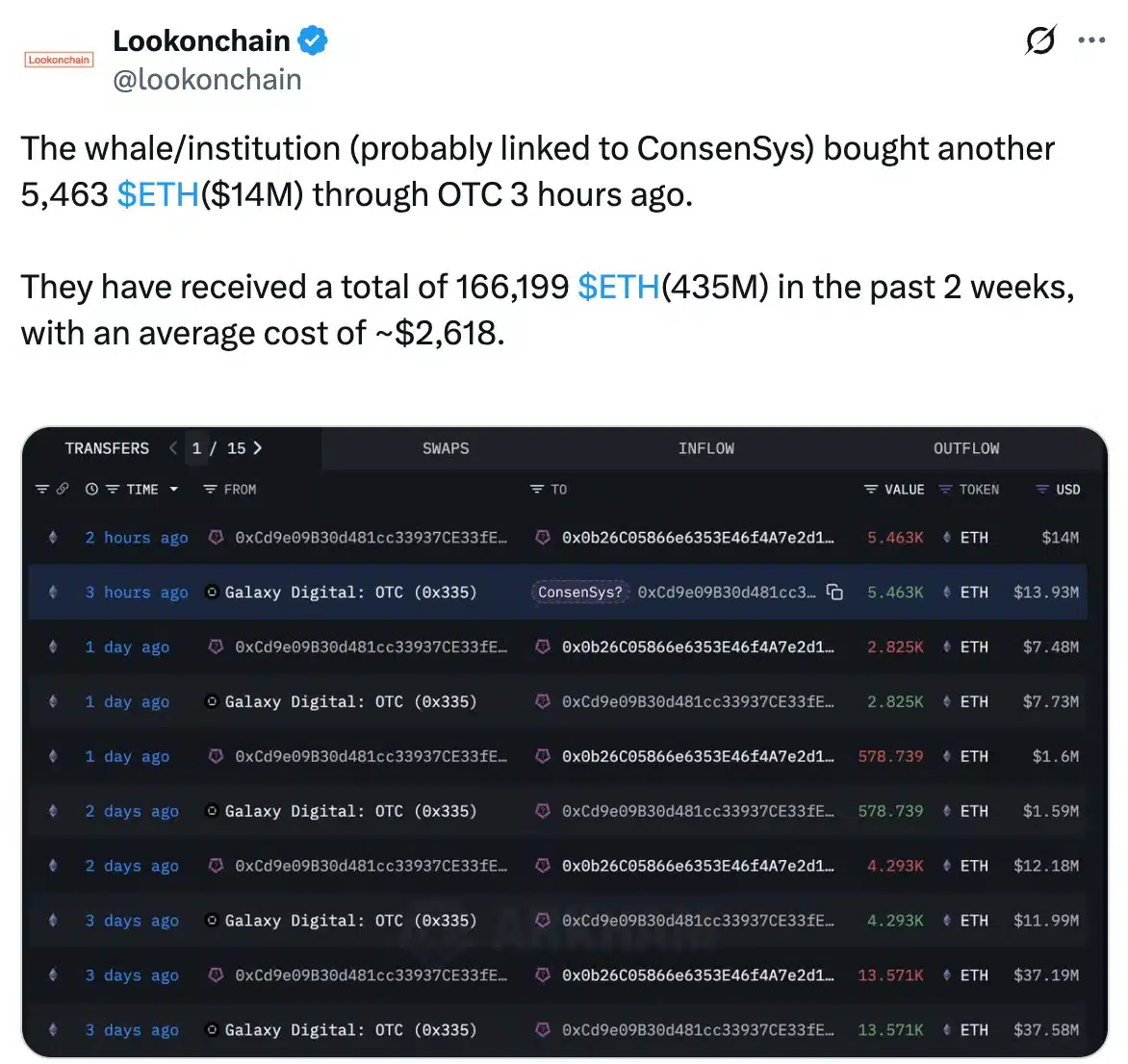

Imagine then—a single colossal whale, unmoved by the storm, plants a magnificent $16.6 million long. What is this if not a bet against entropy itself?

BlackRock chooses Ethereum despite volatility

But what of BlackRock, the icy behemoth with $73 billion in crypto—perhaps they, too, feel the hand of Destiny upon their shoulder? Two weeks and more, they snatch Ethereum daily. Habit or compulsion? Even the greatest minds cannot penetrate such mysteries, though one imagines their boardroom’s existential crises must be quite something. 😅

Plans, always plans! BlackRock declares the future: from $20 billion revenue to $35 billion by 2030. No Dostoevskian character ever made it out of a plan unscathed, but perhaps BlackRock can do what Rodion could not.

These recurring purchases—like a guilty man’s repeated visits to confession—speak of faith, or perhaps a penchant for martyrdom, as BlackRock gorges on ETH, eyes fixed on some salvation on the horizon.

Execs weigh in

Jeremy—yes, the ever-watchful Jeremy—pipes up:

“BlackRock has been buying Ethereum every single day for the past two weeks. They’ve now accumulated $570M worth of $ETH. Smart money isn’t slowing down, they’re doubling down.”

And the masses, hearing this, light another cigarette, squint at their screens, and wonder if a modest sandwich and rent money might not be a wiser investment. Optimism swells, institutional wallets groan with Ethereum, and even Arkham Intelligence confirms: BlackRock sits upon 1.5 million ETH, more than any rational chess player could need.

Not to be outdone in this theater of absurdity, SharpLink Gaming piles on, grabbing 176,271 ETH valued at $463 million. Is this crypto, or Dostoevsky’s “Gambling House” all over again? 🎲

Is ETH gearing up for a rally?

ETH ETFs are surging like the spirits of men after four cups of vodka and a nihilist lecture. Dare we believe in another rally? The technical prophets (RSI, MACD) mutter bearish warnings from the corners, their voices faint, but—ah!—the whales amass their ETH with the patience of saints (or lunatics), hinting not at despair, but a feverish faith in profit’s return.

If numbers are to be trusted (the greatest Dostoevskian tragedy of all), IntoTheBlock assures us: 77% of ETH holders now sit “in profit.” Confidence, or delusion? In crypto, it’s a distinction without a difference.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-06-15 02:21