Ah, Bitcoin (BTC), the digital currency that has all the stability of a hyperactive squirrel on espresso! As the Middle East crisis escalates, our beloved flagship coin decided to drop a staggering $103,396 on Tuesday, sending shockwaves through the altcoin market like a cat in a room full of laser pointers. 🐱💥

In the wake of this delightful chaos, over $513 million vanished from the crypto-leveraged market, with long traders contributing a hefty $421 million to the disappearing act. But fear not, dear traders! The BTC fear and greed index is still hovering around 68 percent, which is about as optimistic as a Vogon poet at an open mic night. 🎤😅

Bitcoin Demand Remains Strong

As Coinpedia has pointed out more times than a towel-waving hitchhiker can count, institutional investors are still clamoring for Bitcoin like it’s the last slice of pizza at a party. Despite the short-term bearish outlook, the Bitcoin balance on centralized exchanges has plummeted to about 2.08 million from 2.26 million on April 24, 2025. Talk about a diet! 🍕📉

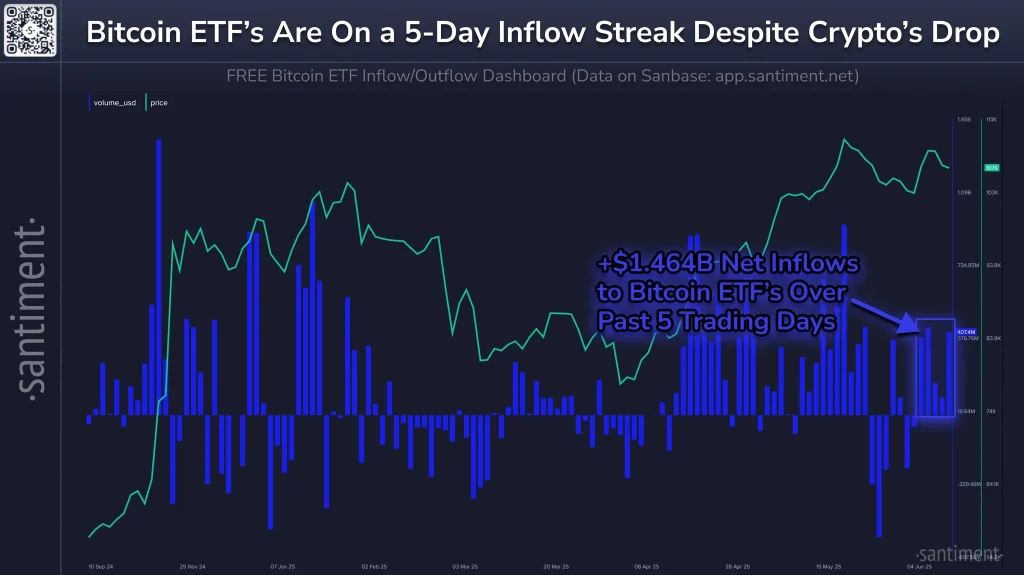

The U.S. spot Bitcoin ETFs and institutional investors, led by the ever-ambitious Strategy and Metaplanet, are the main culprits behind the dwindling supply of BTC on centralized exchanges (CEXs). In the last five days, U.S. spot BTC ETFs have seen a net cash inflow of approximately $1.46 billion, thanks to BlackRock’s IBIT, which sounds like a character from a sci-fi novel. 💰📈

What Next for BTC Price?

Despite the market resembling a rollercoaster designed by a mad scientist, BTC price has been forming a bullish continuation pattern. After a 5 percent drop in the past 24 hours to retest a crucial support level around $103k, BTC has bounced back over 1 percent to trade around $105k on Tuesday, right in the middle of the North American trading session. 🎢💵

In the two-hour timeframe, BTC price has retested a bullish breakout from a falling logarithmic trendline, which sounds impressive until you realize it’s just a fancy way of saying it’s trying to get back up. The Relative Strength Index (RSI) is hovering around oversold levels, suggesting a rebound is on the horizon—unless, of course, it decides to take a nap instead. 😴📊

However, if BTC consistently closes below the support range between $103k and $101k, we might see more bearish sentiment than a Vogon reading poetry at a funeral. So, hold onto your towels, folks! 🥳

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-06-17 22:40