What to know:

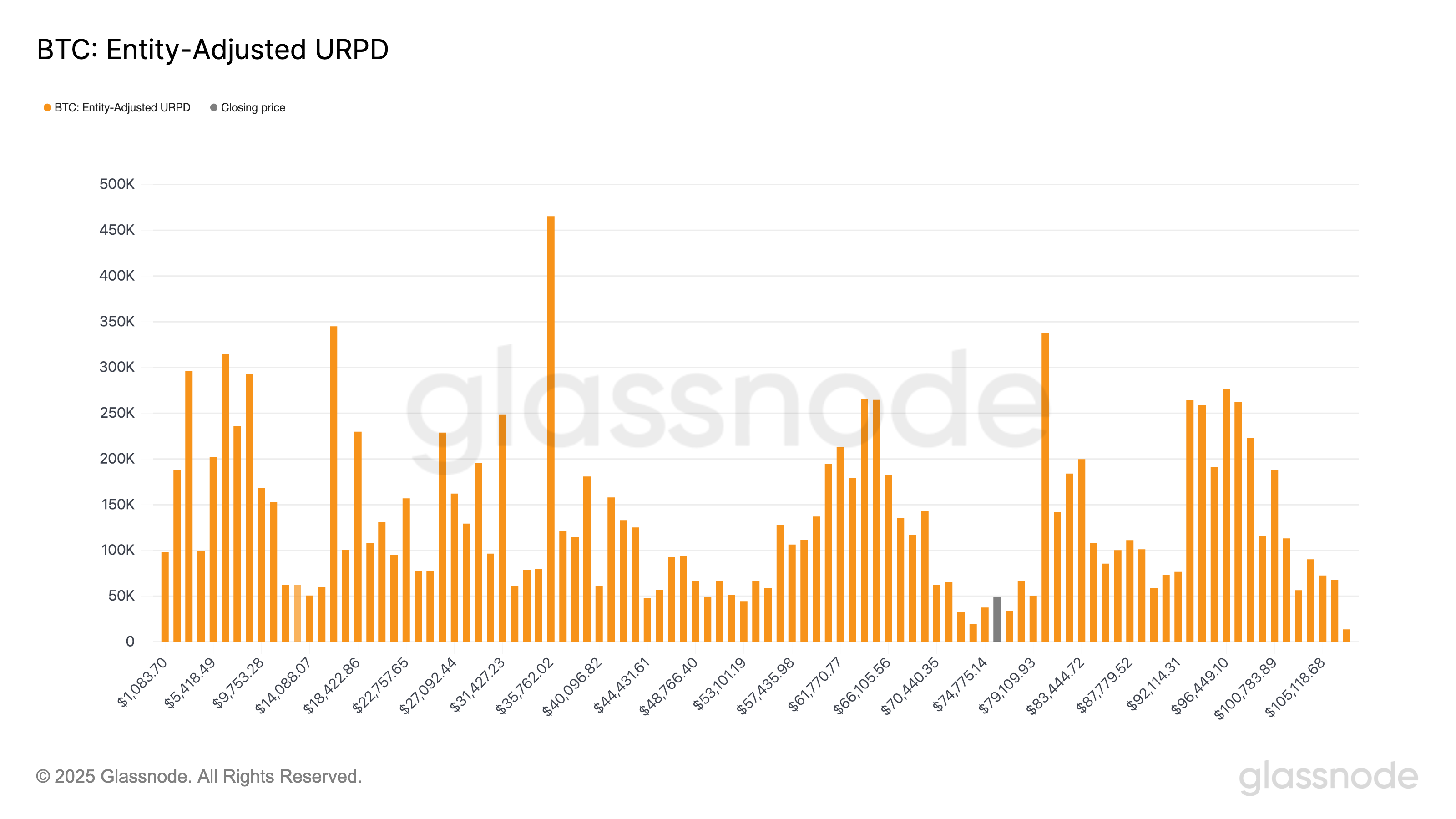

- Less than 2% of bitcoin‘s supply exists between $70,000 and $80,000, creating a thin liquidity zone known as an “air pocket.” Yes, an air pocket! Not quite the first class lounge you were hoping for, is it? ✈️

- Historically, bitcoin tends to revisit and consolidate in previously skipped price ranges before establishing a new trend. Think of it as a forgetful tourist returning to the same café for the third time. ☕

- Approximately, 25% of the bitcoin supply is sitting at a loss. A bit like that unfortunate investment in a novelty tie. 🎩

Ah, the bitcoin (BTC) price, that fickle mistress, is likely to become more volatile after dipping below $75,000 not once, but twice in the past week. It seems to be extending its dramatic descent from the all-time high of $109,000 reached on January 20. Quite the fall from grace, wouldn’t you say? 😱

This plunge has landed it in what Glassnode charmingly refers to as an “air pocket” between $70,000 and $80,000—an area created after the largest cryptocurrency soared following President Donald Trump’s election victory in November. Who knew politics could be so profitable? 🤑

In a rather theatrical turn of events, the largest cryptocurrency climbed to over $100,000 from $70,000 after the vote without ever revisiting its starting point. It’s like a magician’s trick gone awry! Historically, when bitcoin rallies without consolidating at key levels, it often returns to retest them later. This lack of price interaction implies low supply, increasing the likelihood of rapid movement. Fasten your seatbelts! 🎢

One way of showing this is to look at bitcoin’s unspent transaction output (UTXO), which represents the amount of bitcoin received but unspent—essentially, the money still sitting in your wallet while you ponder your next extravagant purchase. 💳

The UTXO Realized Price Distribution (URPD) shows the prices at which existing bitcoin UTXOs last moved. In this version, each holder’s average acquisition price is used to sort their full balance into the appropriate price bucket. It’s like sorting laundry, but with more zeros. 🧺

To establish a sustainable move—either higher or lower—bitcoin will likely need to consolidate within this “air pocket” range. As illustrated in the chart, less than 2% of total supply sits here, suggesting that price action in this region could remain volatile due to the lack of supply. A bit like a party with too few snacks! 🎉

Around 25% of bitcoin’s supply is currently held at a loss, primarily by short-term holders who bought within the last 155 days. They must be feeling like they’ve just invested in a sinking ship. 🚢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- M7 Pass Event Guide: All you need to know

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-04-09 12:00