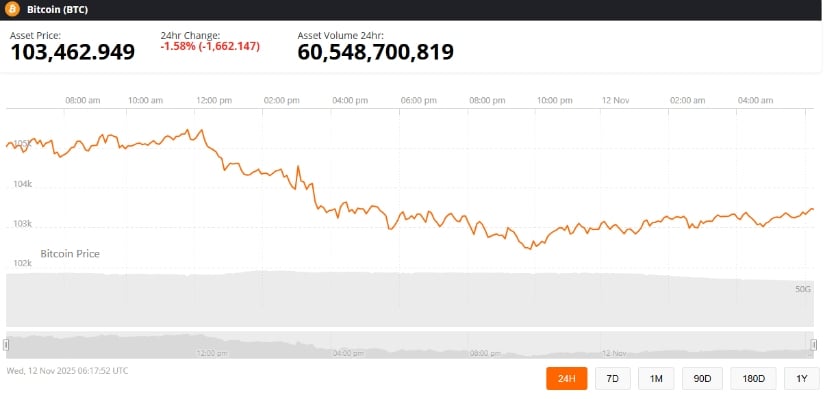

Ah, Bitcoin. The ever-elusive digital treasure. On November 12, 2025, it briefly dipped to $102,750, only to regain its posture like a drunk man pulling himself off the floor. Classic BTC. The market, however, isn’t concerned. Analysts and traders alike are biting their nails, waiting to see if this digital beast can summon the strength to break through $105K. What a spectacle this is.

Bitcoin Holds Key $102K Support

Our hero, Bitcoin, recently stumbled to the $102,000 zone, where it found the support it needed, much like a tired runner finding the last water station before the finish line. On November 11, 2025, Bitcoin took a 3% dip from around $106,000, but it quickly bounced back, as if to remind everyone it’s still the alpha in the cryptocurrency world. Analysts, of course, were thrilled to label this a “quick deviation then nuke” retest. Oh, the jargon we use to sound smart.

SuperBitcoinBro, the seasoned trader, wasn’t panicking. “I’m a buyer here,” he said, no doubt enjoying the thrill of the chase. According to him, Bitcoin’s history of bouncy rebounds from similar support levels suggests that this time may be no different. Well, if history is any guide, we’re in for an interesting ride.

Short-Term Volatility and Resistance Levels

Despite the dramatic flair of Bitcoin’s recent movements, it’s been hitting a brick wall around $107,500. We’re talking about a descending channel that refuses to budge. Bitcoin has been hitting the $102K mark again and again, like a car trying to park in a spot that’s already taken. ArdiNSC, the analyst with a penchant for Fibonacci retracements, noted that the $102K mark corresponds with the 61.8% Fibonacci level. We love these technical terms, don’t we? It’s all about the numbers, baby.

ArdiNSC gave us some insightful advice: “Bulls are defending $102.5K, but if we don’t break past $104.5K soon, we might just find ourselves flirting with the $100K mark again.” Short-term bearish signals, including MACD crosses and ominous head-and-shoulders formations, suggest a bit of caution. Caution, people! This is Bitcoin we’re dealing with.

Signs of a Potential $105K Rebound

Could the stars align for a short-term bullish reversal? Maybe. Bitcoin recently broke through a minor descending trendline after rebounding from $102,400. This subtle but optimistic move suggests that there might be some buying momentum creeping in, though nothing is ever guaranteed with Bitcoin. Price targets could reach up to $105,464 for some quick profits, but don’t get too excited. A rally toward $106,844 is also possible if the stars continue to align-if the stars feel like it.

As always, risk management is key. A drop below $103,000 could spell trouble, pushing Bitcoin back to lower levels, possibly retesting $102,400. So, if you’re in this for the long haul, consider a stop-loss around $101,376-$101,200. We don’t want any surprises.

Historical Patterns and Cycle Insights

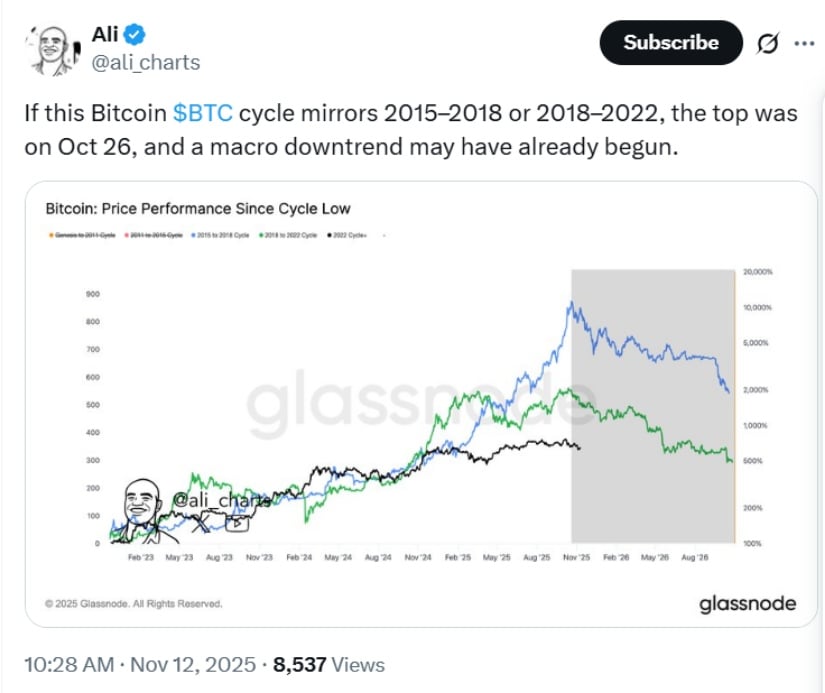

For those with long memories, the current market cycle might feel eerily familiar. We’re drawing comparisons to past Bitcoin cycles, such as the 2015-2018 and 2018-2022 periods. Analyst Ali shared a chart from Glassnode, suggesting that October 26, 2025, marked the peak of the current bull market, with a macro downtrend possibly underway. Bitcoin’s price fell around 12% from a high of $114,500 to $101,000 by November 12-reminding us that post-peak corrections can be quite harsh, sometimes plummeting 70-85%. But hey, it’s Bitcoin. What else do you expect?

A Reddit user also chimed in, forecasting that we had hit the local peak on October 6, 2025, at around $103,000. The same user believes that a wild 2026 BTC mania phase could lead us to $1 million per Bitcoin. A bit ambitious? Maybe. But who knows? After all, macroeconomic factors such as the Federal Reserve’s rate cut and the possibility of liquidity surges might just fuel another 2017-style rally. Don’t hold your breath, though.

Bitcoin Price Outlook

So, what’s the verdict? With support holding at $102K and early signs of buying momentum, Bitcoin’s short-term forecast points to a potential rebound to $105K. But don’t forget-Bitcoin’s volatile nature means the road ahead will be full of twists, turns, and maybe even a few potholes. Stay cautious, and remember to keep an eye on those pesky resistance levels and the looming historical trends. It’s a wild world out there.

For traders, this is a time for caution, optimism, and more than a little bit of luck. As always, Bitcoin marches to its own beat, and we’re all just trying to keep up.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-11-12 16:29