Ah, the price of Bitcoin, that elusive specter, has been flitting about like a drunken moth around a flickering light bulb since it reached its former all-time high of $123,800 in the balmy days of mid-July. It danced briefly to a new record of $124,120, but alas, it never quite managed to convince anyone that a fresh bullish escapade was on the horizon. Such is the tragicomedy of cryptocurrency!

In the past week, our dear market leader succumbed to the weighty embrace of bearish pressure, plummeting below the $112,000 mark on that fateful Thursday, August 21. But lo and behold! The Bitcoin price, along with the rest of the market, perked up like a cat at the sound of a can opener after the illustrious Jerome Powell, Chairman of the US Federal Reserve, graced us with his words of wisdom on Friday, August 22. Who knew monetary policy could be so thrilling?

Now, a certain on-chain analyst, who shall remain nameless but is quite the oracle on the X platform, has unearthed a price level that could be the Holy Grail for Bitcoin’s return to its bullish glory. Drumroll, please!

What Does A Return Above $118,000 Mean For BTC?

In a post that surely sent ripples through the digital ether on August 23, our crypto sage Ali Martinez declared $118,000 to be the magic number for Bitcoin’s next act. According to this digital prophet, the price of BTC must swiftly reclaim this level to hop back onto the bullish bandwagon. No pressure, right?

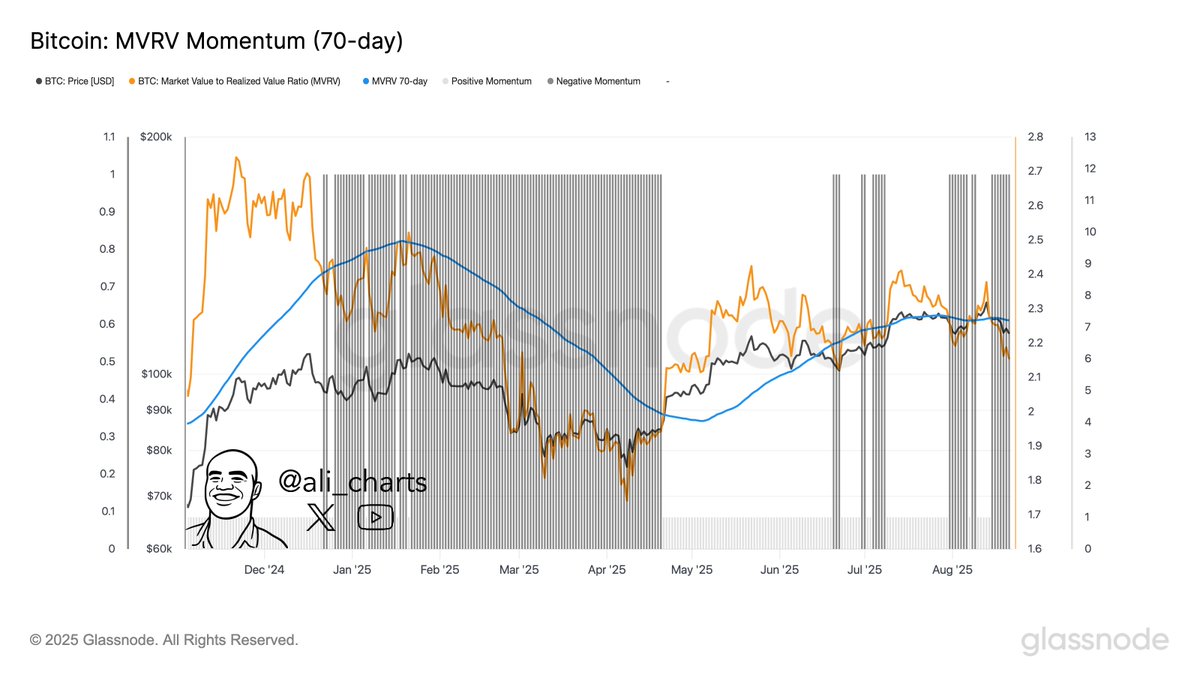

Enter the Glassnode MVRV (Market Value to Realized Value) Momentum indicator, a fancy tool that helps us mere mortals decipher the cryptic language of macro market trends. This metric, a concoction of the MVRV ratio and the 70-day simple moving average (SMA), is like the crystal ball of the crypto world.

When the MVRV ratio breaks above the 70-day SMA, it’s a sign that we might be entering the promised land of bull markets. Conversely, a break below this moving average signals a descent into the gloomy depths of bearishness. Oh, the drama!

Typically, when we see a strong break above the MVRV 70-day moving average, it indicates that a horde of Bitcoin was snatched up at prices lower than the current one, leaving holders basking in the glow of profit (the light area in the highlighted chart). But woe betide those who find themselves below the moving average, for they are the unfortunate souls who bought high and are now swimming in the red (the shaded area in the chart below). Such is the cruel fate of the crypto enthusiast!

As the chart above reveals, and as our dear Martinez has pointed out, Bitcoin is currently experiencing a trend shift. The 70-day SMA is hovering around the $118,000 mark, and for Bitcoin to regain its bullish momentum, the MVRV ratio must break free from the shackles of the moving average. Will it rise like a phoenix or remain a mere shadow of its former self?

Bitcoin Price At A Glance

As I pen these words, the price of BTC stands at a modest $116,217, reflecting a sprightly increase of over 2% in the past 24 hours. However, let us not forget that our flagship cryptocurrency is still down by more than 1% on the weekly timeline. Ah, the bittersweet symphony of crypto trading!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-08-23 21:09