The cryptocurrency markets, that fickle and tempestuous mistress, have once again proven why they are the darling of gamblers and the bane of savers. December arrived not with a whisper, but with a roar, as Bitcoin, that ravenous beast, clawed its way past $91,000 like a drunkard climbing a lamppost. Analysts, those modern-day prophets in tailored suits, now claim this is the “biggest daily gain since May 2025,” as if time itself paused to let them file their reports.

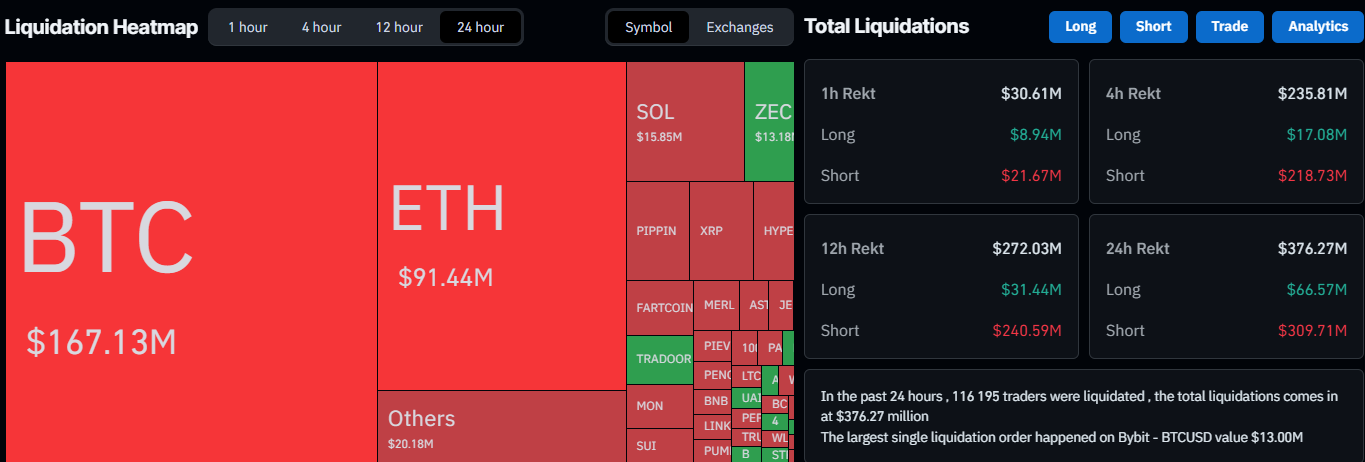

And what of the shorts? Oh, poor souls, tossed about like ragdolls in a hurricane. In 60 minutes, $140 million vanished like smoke-poof!-while longs barely coughed up $3 million. The Kobeissi Letter, our most esteemed oracle of chaos, declared: “Recent swings are ENTIRELY… mechanical.” One wonders if they mean mechanical bulls or something far less forgiving. 🤯

BREAKING: Bitcoin, now a 91,000-club member, is painting the town red while shorts weep into their coffee cups. The Kobeissi Letter says it’s all just “mechanical,” which sounds suspiciously like code for “we have no idea what we’re doing.”

Ethereum, Solana, XRP-all danced the waltz of greed, with ADA leading the pack at 15% gains. But let us not forget the casualties: $380 million in liquidations, with shorts bearing the brunt like a glutton at a feast. Bitcoin alone accounted for half the carnage, while Bybit’s $13 million liquidation was the market’s cruel joke on overconfidence. 🤦♂️💸

Analysts, ever the optimists, insist BTC will “resume its rally” if it conquers $91,800. A mere $800 from glory, yet the price of hubris is steep. One can only hope the survivors of this bloodbath remember: in crypto, even the ground beneath your feet is a trapdoor. 🚀💣

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- M7 Pass Event Guide: All you need to know

2025-12-02 20:04