Ah, Bitcoin, that digital gold of the modern age, has had quite the tumble in the first quarter of2025, marking its worst showing in seven long years. 😅

Investors are scratching their heads, pondering if it’s time to dive in or jump ship. A regular rollercoaster, ain’t it?

Bitcoin’s Rocky Start: A Seven-Year Lowdown

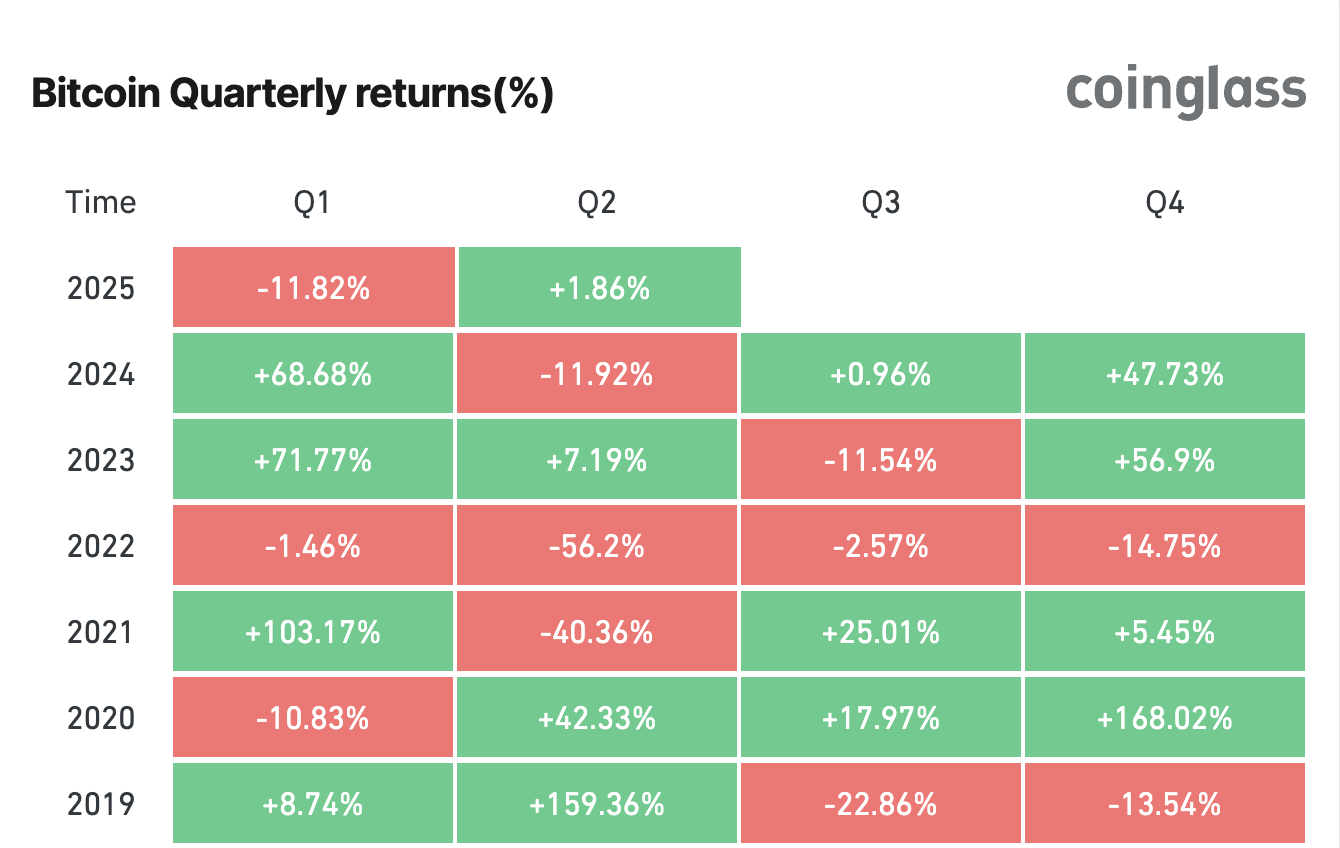

Bitcoin’s performance in Q12025 has been as lackluster as a mule in a horse race, the weakest since2018’s bearish nightmare. According to Coinglass, Bitcoin’s value shrunk by11.82%, a stark contrast to the68% jump it saw in Q12024.

By the end of March2025, Bitcoin had slumped from a lofty $106,000 in December2024 to a mere $80,200. This decline, my friends, is courtesy of a mix of economic headwinds and policy rollercoasters, mostly thanks to President Trump’s tariff antics. 🎢

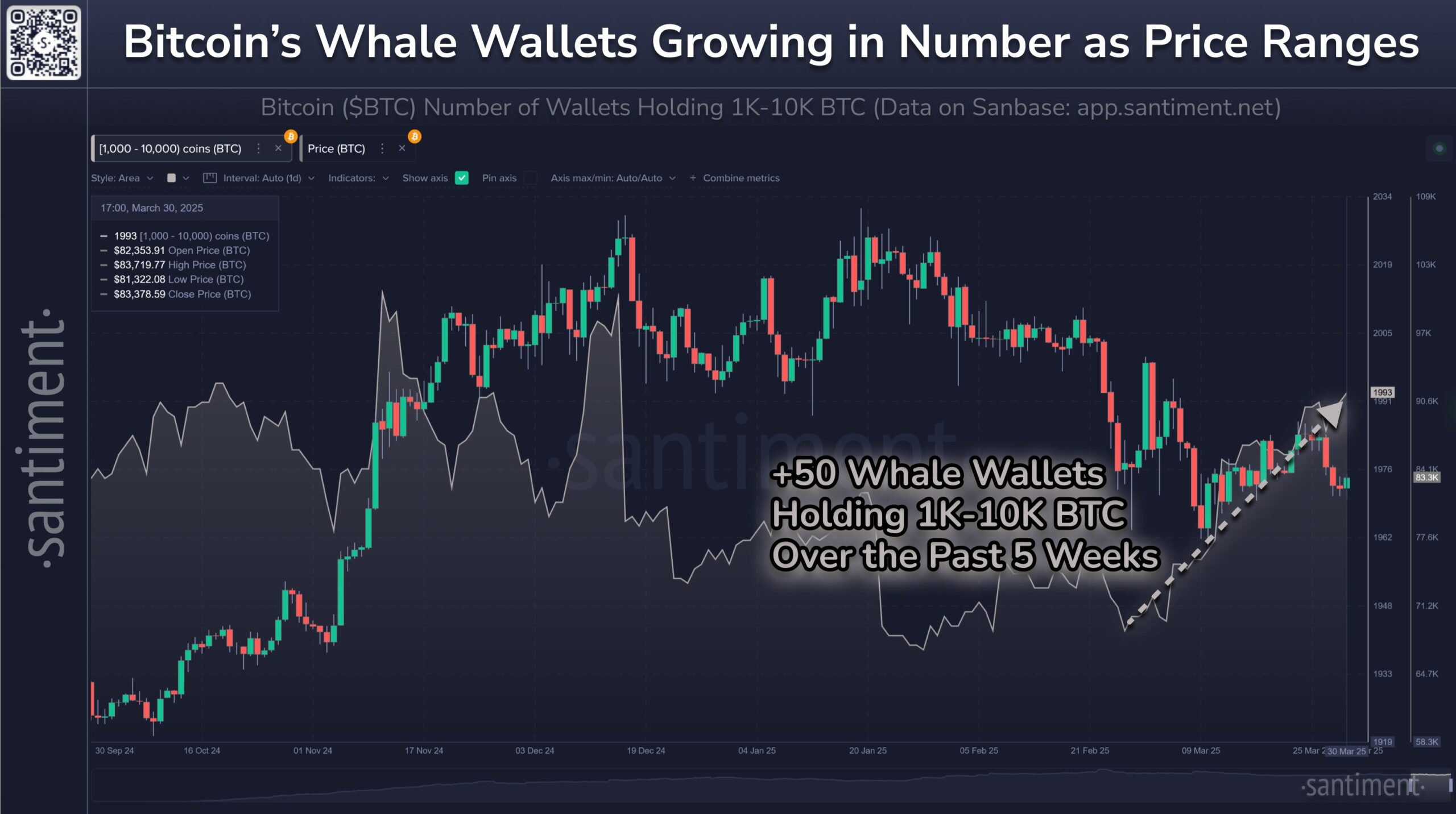

But 🐳

Glassnode chimed in, noting that trading activity from Bitcoin holders with a3-6 month horizon has hit rock bottom, the lowest since June2021. This tells us that the short-termers are either holding tight or making a quiet exit, easing up on the selling pressure.

“Spending from BTC holders is at the lowest levels since mid-2021. This inactivity suggests recent top buyers are holding their positions, undeterred by the recent volatility,” Glassnode reported.

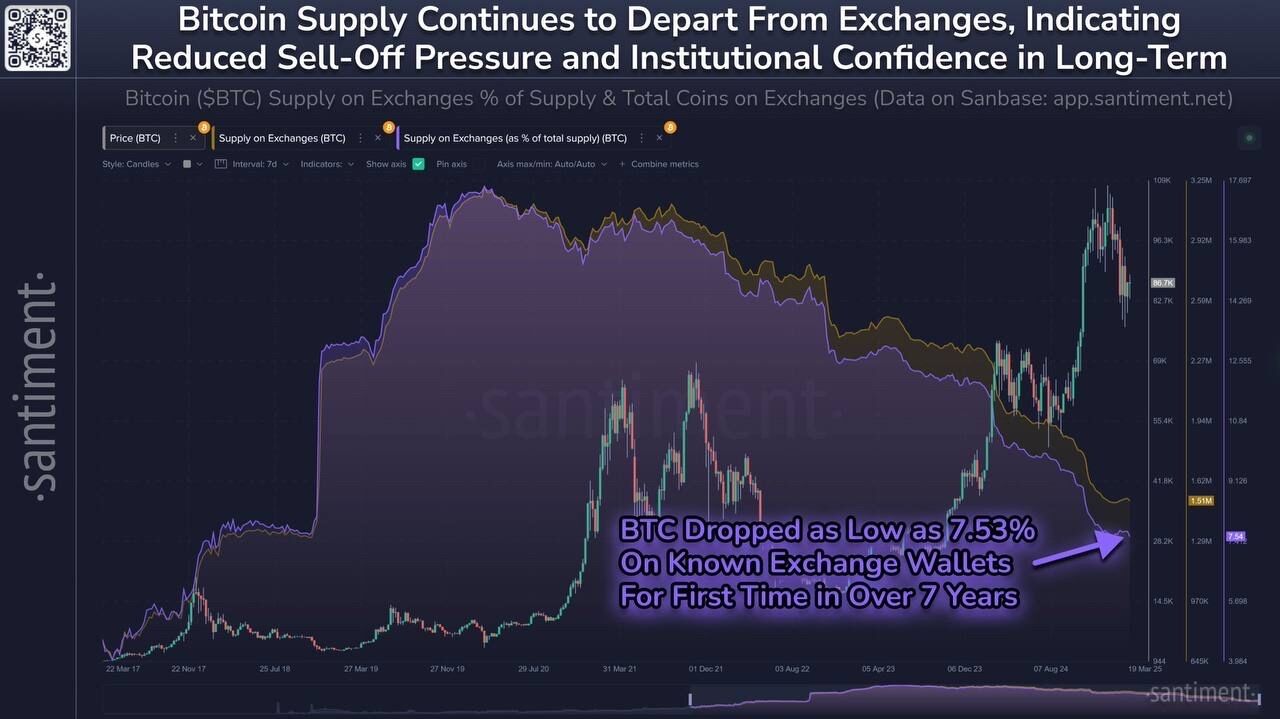

Moreover, Bitcoin’s supply on exchanges has dwindled to7.53%, the lowest since February2018. When less Bitcoin is lounging around on exchanges, it usually means folks are holding on tight, creating a scarcity that might just push prices north in time.

Market analyst Axel Adler Jr. declared on X that Bitcoin’s selling pressure has run out of steam. He’s eyeing a consolidation phase in April and May, hinting that the market might just catch its breath before making its next big leap.

Meanwhile, Fidelity Research is betting on Bitcoin gearing up for the next leg of its “acceleration phase.” They look at history and see that calm before the storm often precedes a surge, fueled by institutional interest and Bitcoin’s role as a hedge against inflation. This aligns neatly with the whale accumulation trend and the shrinking exchange supply, signaling potential upward momentum in the not-so-distant future.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- World Eternal Online promo codes and how to use them (September 2025)

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Hero Card Decks in Clash Royale

2025-04-01 15:35