In a plot twist that could only be described as a cosmic joke, Bitcoin has decided to take a leisurely stroll back to the $112,000 neighborhood, extending its weekly losses like a cat stretching in the sun. Meanwhile, its Realized Cap has crossed the magical $1 trillion mark for the very first time, proving that even in the world of digital currency, numbers can be as inflated as a hot air balloon at a particularly enthusiastic festival.

- Bitcoin takes a nosedive to $112K, deepening its weekly losses like a sad puppy.

- Realized Cap surpasses $1T, showcasing record capital inflows-because who doesn’t love a good influx?

- Ethereum is flexing its muscles with whale accumulation, making Bitcoin look like it skipped leg day.

On August 25, Bitcoin (BTC) decided to retreat to a cozy $112,378, marking a 2.2% drop in the past 24 hours and extending its weekly losses to a staggering 2.6%. This decline places the world’s largest cryptocurrency at the lower end of its seven-day range, which is like being stuck in a traffic jam between $112,023 and $117,016. Over the past month, BTC has shed about 4%, cooling off after a mid-summer rally that was hotter than a sunbather in the Sahara.

In stark contrast, Ethereum (ETH) is strutting its stuff like it just won the lottery. At press time, ETH was trading at $4,710-slightly lower on the day but still up 9% over the past week and a whopping 26% in the last 30 days. Its rally peaked at a fresh all-time high of $4,946 on August 24, making Bitcoin look like it’s still trying to find its socks.

Bitcoin Whales Make a Splash in ETH

It appears that some of the market’s oldest Bitcoin holders are having a midlife crisis and are now rotating into Ethereum. In a transaction that could only be described as a financial game of musical chairs, on-chain monitoring platform Lookonchain reported on August 24 that a dormant BTC wallet, which had been as active as a sloth on a Sunday, moved 6,000 BTC worth a staggering $689.5 million into ETH.

The Bitcoin OG moved out another 6,000 $BTC ($689.5M) to buy $ETH.

So far, he has bought 278,490 $ETH ($1.28B) at an average price of $4,585, and still holds a 135,265 $ETH ($581M) long position.

– Lookonchain (@lookonchain) August 24, 2025

This wallet has accumulated a jaw-dropping 278,490 ETH ($1.28 billion) at an average price of $4,585. It still holds 135,265 ETH ($581 million), suggesting a strong conviction in Ethereum’s trajectory-like a dog with a bone, but with a lot more zeros.

Ethereum has also been gaining ground in exchange-traded fund inflows and ETH treasury company accumulations. Such whale moves add weight to ETH’s relative strength in recent weeks, with traders speculating that capital rotation could sustain Ethereum’s momentum even as Bitcoin consolidates like a teenager in a corner at a party.

Bitcoin Realized Cap Hits $1 Trillion

Despite its short-term retreat, Bitcoin has notched a historic milestone on-chain. On August 24, CryptoQuant contributor Burakkesmeci highlighted that Bitcoin’s Realized Cap surpassed $1 trillion for the first time-because why not? It’s not like we have anything better to do.

Unlike traditional market capitalization, which multiplies supply by the latest price (a method as reliable as a weather forecast), Realized Cap values coins based on the price they were last transacted. This metric captures the “real” capital that has flowed into Bitcoin rather than just nominal market value-like counting the actual number of jellybeans in a jar instead of just guessing.

The $1 trillion threshold reflects record levels of liquidity entering the network and suggests that the rally is supported by tangible investment rather than speculative froth. “Just wait until Realized Cap hits $2 trillion-then you’ll really see our little guy shine,” Burakkesmeci quipped in his CryptoQuant note, probably while sipping a piña colada.

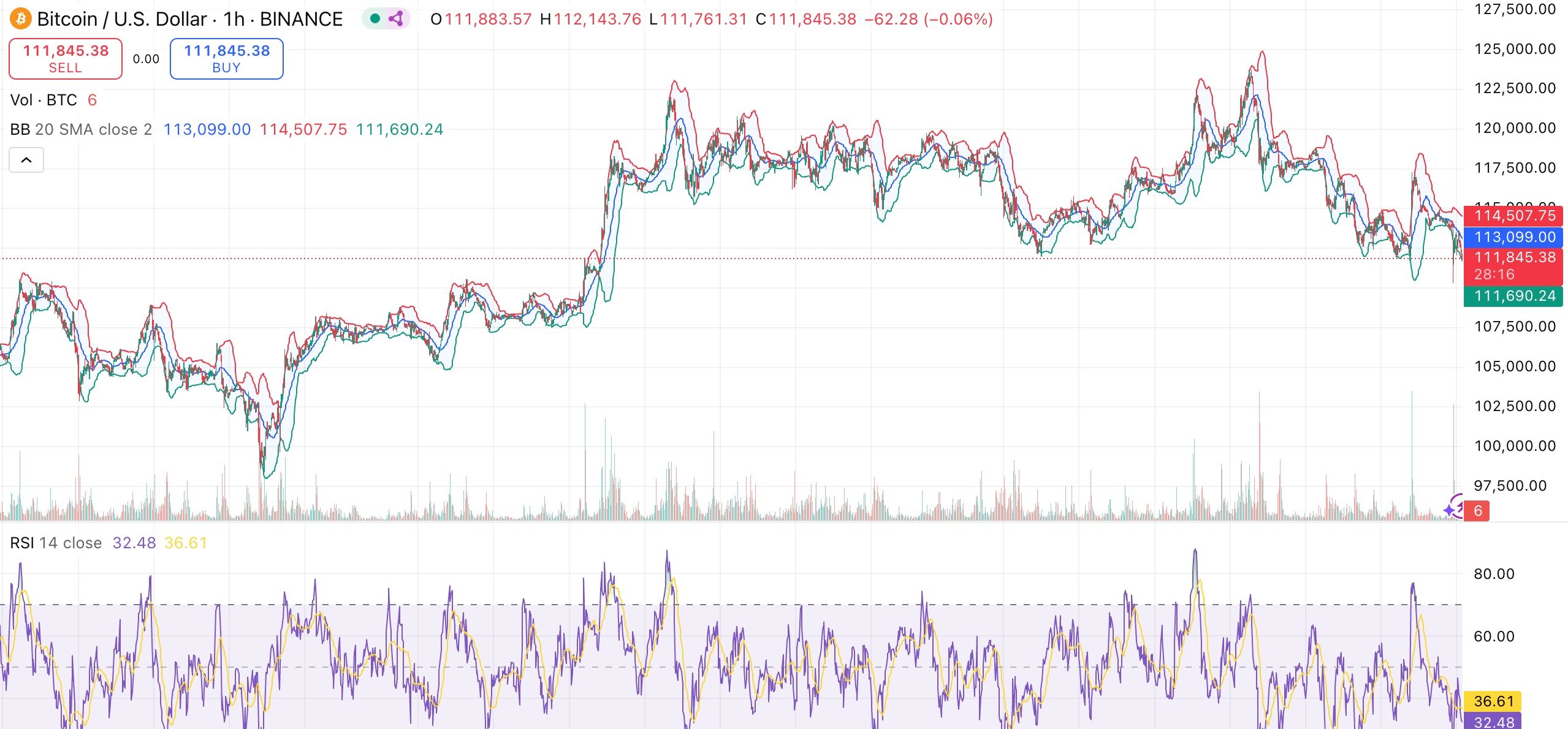

Bitcoin Technical Analysis: A Mixed Bag of Tricks

Bitcoin is showing mixed signals, much like a confused cat trying to decide whether to jump on the counter or not. The MACD is still in bearish territory, indicating that the downward pressure has not completely subsided, while the relative strength index is hovering at 48, indicating neutral momentum-like a traffic light stuck on yellow. Oversold conditions are also indicated by momentum indicators like the Stochastic RSI, which suggests that sellers may soon run out of steam, much like a marathon runner who forgot to hydrate.

Short-term moving averages tell a cautious story. Bitcoin is trading below both its 10-day and 20-day exponential moving averages, signaling continued weakness. However, the longer-term trend remains intact, with the 100-day and 200-day moving averages still pointing upward, reflecting structural support beneath current levels-like a sturdy chair that refuses to collapse under the weight of your existential dread.

Traders anticipate a possible rebound toward the $115,000-$117,000 resistance zone if Bitcoin maintains above $110,000. A deeper decline toward the $105,000 mark, however, might be possible if there is a break below $110,000-because who doesn’t love a good cliffhanger?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- M7 Pass Event Guide: All you need to know

- Sunday City: Life RolePlay redeem codes and how to use them (November 2025)

2025-08-25 12:06