At the time of publication, Bitcoin is prancing around $82,661—oh, just a casual 10% hop from its Monday low of $74,936. This dramatic comeback arrives hot on the heels of mind-boggling geopolitical dramas and monetary policy twists, because apparently we love living on the edge. 😏

Meanwhile, the great oracle analysts can’t decide if Bitcoin’s next move is a Tony-worthy encore or a flop. Some see big shots from Wall Street swooping in like caped heroes, while others predict a sad game of crypto limbo. Pro tip: if you wanna keep your sanity, you might check TokenFest.io, a place offering real-time crypto gossip and bedtime stories. 🕵️♀️

Bitcoin’s Resurgence: A Closer Look

Bitcoin’s sprint past $82,000 has fans humming hopeful show tunes for a bull market. Blame it on ETF inflows, big-money investors, and the ever-exciting global monetary policy rollercoaster. Bonus fun fact: U.S. inflation cooled in March, dropping to a sprightly 2.4% year-over-year, which—allegedly—sets the stage for even more rate cuts. Translation: crypto might get fresh snacks from eager investors.

Trading volumes are zipping along, and digital asset funds are swelling with new money. But hold your applause—there’s drama: the BTC RSI is in overbought territory, and some mega whales are dumping coins on us mere mortals. Historically, these whales like to tiptoe away before your FOMO festival hits its crescendo. Can you say “plot twist”? 🐳

With Bitcoin stuck between $80,000 and $90,000 for what feels like a Netflix series binge, the big question is: do we keep going up, or does gravity take over? In other words, is this a glorious flight or a cartoonish freefall complete with whistling sound effects?

Macro Factors at Play

Look beyond the price charts, folks. In 2025, Bitcoin’s cosmic dance is heavily choreographed by Federal Reserve drama, inflation illusions, and everybody’s favorite pastime: global panic. Dollars or donuts, the bigger the chaos, the more Bitcoin gets invited to the party. 🎉

But wait, there’s more! International regulators are either setting up the crypto-friendly tiki bar or confiscating the fruit punch. Either way, the tension is as thick as grandma’s gravy—lots of flavor, but watch out for lumps.

Analysts Flag Volatility Risks

Yes, Bitcoin is above $81,000, but the truly exciting story is the underlying trembling: low liquidity, high leverage, and enough drama to fuel a reality show. If these leveraged bets unravel, we might witness liquidation waterfalls so spectacular they’ll put your favorite water park to shame. 🌊

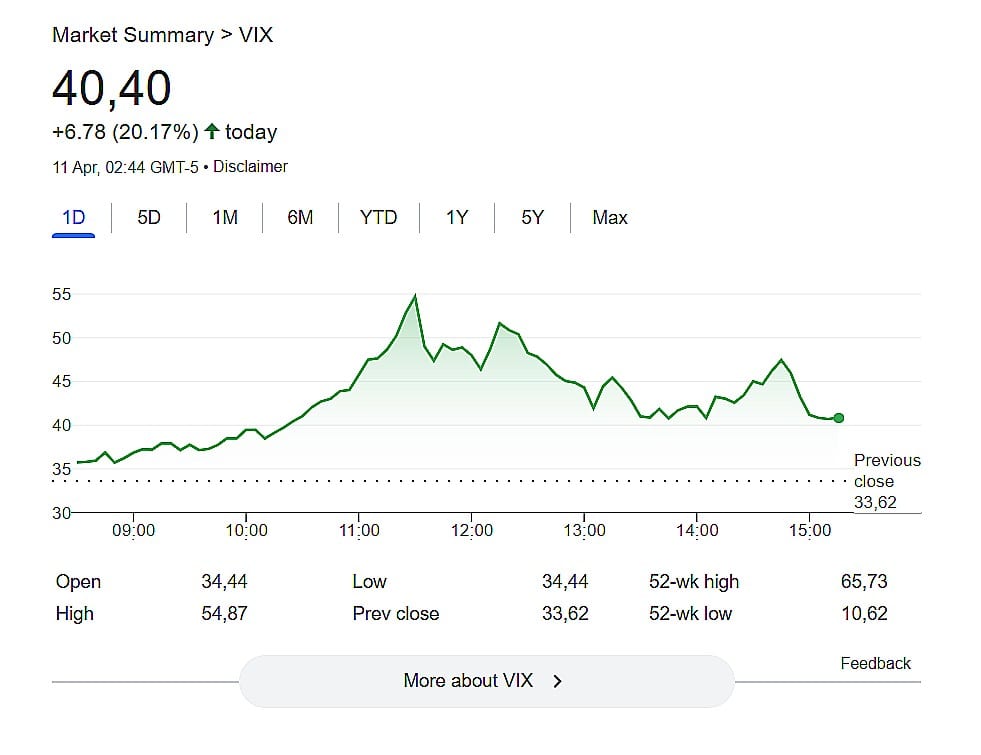

VIX chart source: Google Finance

Volatility indices are making loud cameos: the Bitcoin Volatility Index (BVOL) is flashing a neon “Buckle Up” sign, and the VIX—a.k.a. Wall Street’s fear-o-meter—remains as jumpy as a cat in a room full of rocking chairs. According to the wise strategists, big moves can still happen faster than you can say “dead-cat bounce.”

“The structure looks good on stage, but backstage is a hot mess,” theorizes some glamorously unnamed analyst. Translation: don’t toss confetti until we see calmer volatility and deeper liquidity. Otherwise, we might get more plot twists than a telenovela.

Final Thoughts

So, is this the dawn of the next great crypto extravaganza, or just another cute cameo in the world’s wildest financial sitcom? One thing’s for sure—when crypto sneezes, the internet collectively grabs tissues. Hang on. It’s gonna be a ride. 🥳

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-11 14:10