Journeying astride the tumultuous locale of Wall Street, there hovered the Bitcoin, steadfast at $111,092 per coin this Saturday, bound tight within a $110,032 to $111,369 range. An arid spell hovers over its momentum, yet steadfast it holds ground, as the captains of bull boats gear for a push past the steadfast shore of resistance. Possessing a market cap of $2.21 trillion and bountiful daily trades worth $22.66 billion, the world’s largest cryptocurrency clings to consolidation as the bulls it preps resisting potentially.

Bitcoin

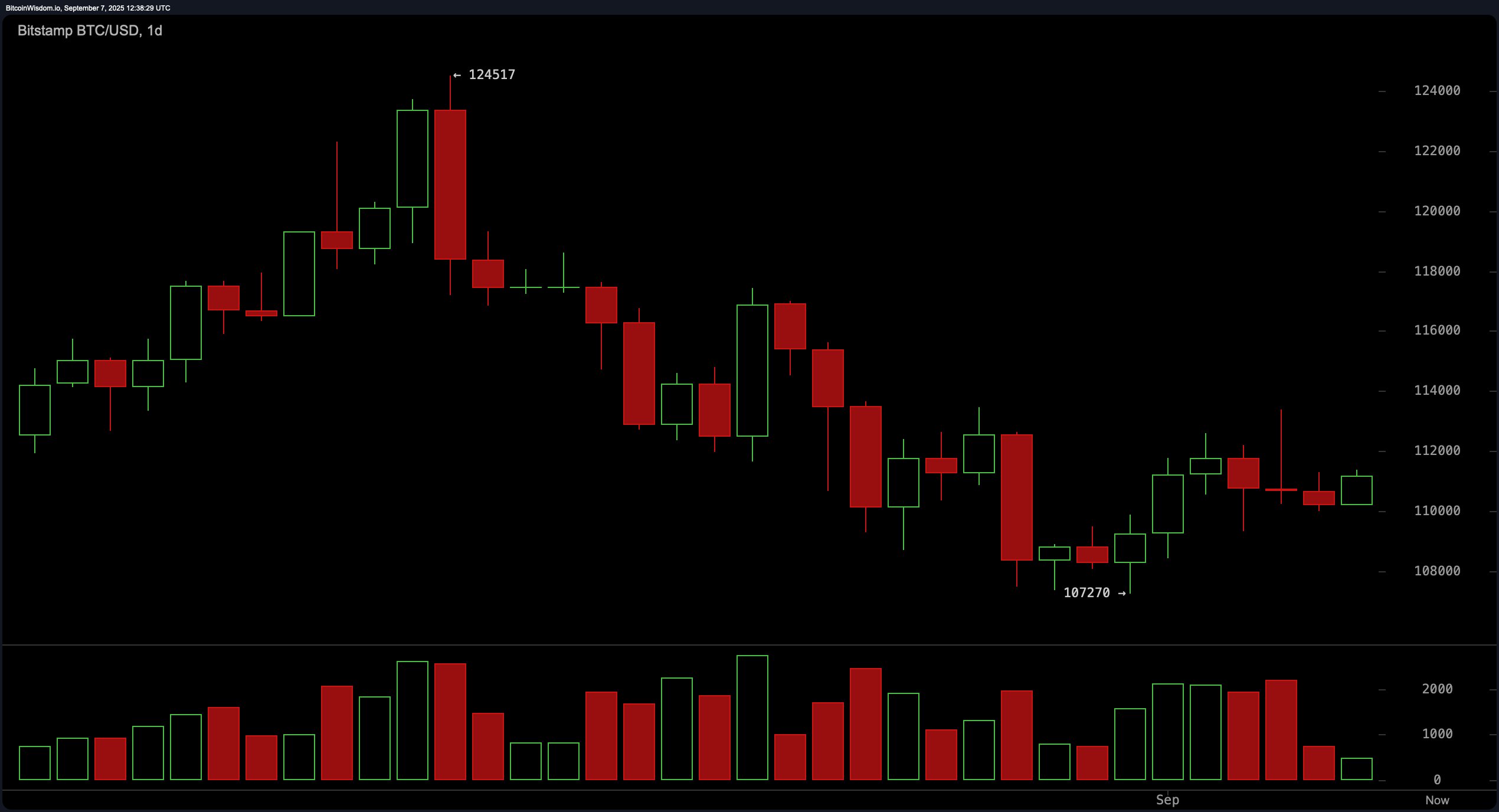

Cast an eye to the daily chart, and you’ll see Bitcoin, that wayward soul, still in the throes of correction following its high, reminiscent of $124,517. It plummeted to a low of $107,270 before mustering a modest rally to these contemporary figures. There it lies, with a poignant structure-lower highs, lower lows-a stark tale of bearish dominance. And yet, the recent orchestration of candlesticks whispers of a base, forming just above $110,000, as if pleading for redemption. The eyes of resistance gleam near $114,000, and a clear passage above this threshold could herald short-term bullish prospects. A dance past $112,500, backed by larger volumes, would beckon the first song of an upside reversal, with a safety net placed snugly below $109,000.

Upon the 4-hour ledger, a glimmer sparks in our coal-hearted Bitcoin, emerging partially triumphant after rebounding at $107,483. A dainty range bound with bounds between $111,500 and $113,400, where a double peak formation long since signaled resistance, now signals a chance. Scalpers-those swift of finger and nimble with risk-may gambol into this dance at $111,500 or higher clearance above $113,400. Should bullish favor hold steady and volumes swell, a reaching for $114,000 might yet be on the cards. But keen should they remain, guarding against the siren calls of mimicry lurking below the $110,000 mark-a pivotal lighthouse for this timeframe.

The 1-hour scroll sketches an image of Bitcoin, finding fleeting sanctuary at $110,021 before rallying back to $111,369, only to rest within a consolidation phase. The microstructure of markets-transient and fragile-paints a miniature trend of modest ascent, albeit on waning volumes, akin to the sunset of optimism mirrored in summer’s end. Visions of a nifty entry near $110,800-$111,000 bond to a bullish candlestick’s promise; should breakouts above $111,400 announce themselves, they may unfurl a sprint toward $112,000. Yet any retreat breaching the sacred boundary of $110,000 may shatter these promises, rendering them naught but moonlit fantasies.

The oscillatory readings appear like jazz musicians varied in their percussion-some upbeat, some morose. The Relative Strength Index (RSI) intones a 46, Stochastic hums a 44, and the Commodity Channel Index (CCI) murmurs at −28-all standing singular in indecision. The Average Directional Index (ADX), poor simpleton, lingers low at 17, echoing the ills of a strong trend’s absence. The Awesome oscillator and Momentum indicator voice woeful antiphons of bearish concerns, whilst the Moving Average Convergence Divergence (MACD) touts a bullish narrative at −1,344-a cryptic divergence demanding cautious inter-pretation.

The scribes of moving averages pen tales divergent. The 10-period exponential moving average (EMA) and the simple moving average (SMA) stalk bullish paths, whereas their extended relatives on the 20-, 30-, and 50-period journeys fixate on bearish thrusts. A notable star shines, the 100-period EMA at $110,754, alongside the broader bearish context with the 200-period EMA solemnly at $104,521 and the 200-period SMA at a stoic $101,760. Yet until the Bitcoin dares to scale above the $113,000-$114,000 bastions of resistance, a chorus of strong confirmations will remain unwritten. Traders thus dwell in the provisional strategies of ranges or swift scalping. One must harbor caution, for macroeconomic spectres-like inflation reports or ETF bulletins-may initiate tempests within.

Bull Outlook:

Should Bitcoin forge a path through the arduous climb of $113,000-$114,000, breath garnered from considerable volumes, then abrupt favor may shift to the bullish horizon. Thus leading the chariot to revisit summits near $120,000. The base forming above $110,000 reflects a fortified beginning for a fleeting ascent, dependent on prevailing market sentiment.

Bear Outlook:

Without a forceful ascent past the surrounding watchtowers of $113,000, Bitcoin remains exposed, vulnerable to fresh torrents of bearish force. A fracture beneath the $110,000 bulwark could call forth a descent toward the $107,000 refuge, sustaining the broader drift downward and muting any bullish dreams for the cycle.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-09-07 19:36