Last week, the grand stage of US-listed spot Bitcoin exchange-traded funds (ETFs) witnessed a dramatic act, with net outflows exceeding a staggering $120 million. 🎭

Ah, but fear not! This figure, while echoing the cautious whispers of investors, also hints at a flicker of hope—a slight improvement from the previous week’s more dramatic exits, suggesting a timid resurgence of bullish sentiment. 🐂💪

BTC ETF Outflows Chill After the June 5 Meltdown

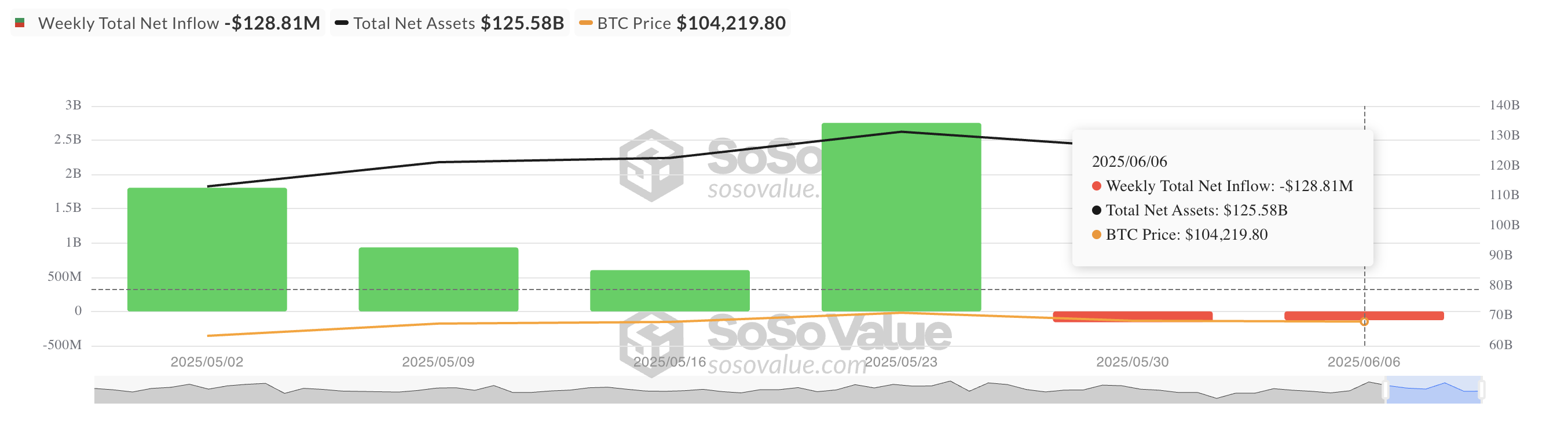

According to the wise sages at SosoValue, net outflows from spot BTC ETFs totaled $129 million between June 2 and June 6. This moderation in capital flight suggests that while some institutional investors are still clutching their pearls, others might be loosening their grip and embracing a more risk-on attitude. 😅

On June 5, the market experienced a dramatic plunge, with BTC’s price hitting an intraday low of $100,372. The resulting outflow was a staggering $278.44 million that day—talk about a bad hair day for the market! 💇♂️

Yet, the fact that outflows lessened the following day hints at a growing resilience in the market, despite BTC’s rather uninspiring price performance. Who knew crypto could be so dramatic? 🎬

Bitcoin Futures Turn Bearish, Options Stay Bullish

As of today, BTC has graced us with a mild 0.13% price decline, trading at $105,488. The coin seems to have resumed its sideways waltz, reflecting the ongoing uncertainty in the broader crypto ballroom. 💃🕺

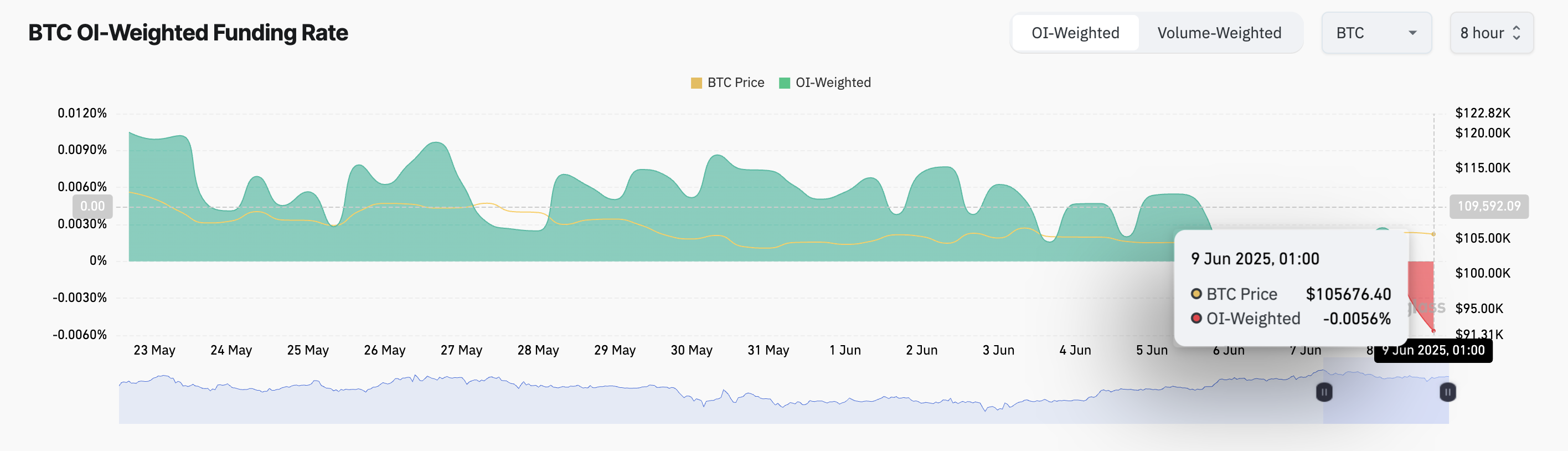

Meanwhile, the funding rate across major perpetual futures markets has turned negative, indicating that more traders are betting on further downside in the short term. As of this writing, it stands at a thrilling -0.0056%. 📉

The funding rate is like a periodic payment between traders in perpetual futures contracts, ensuring the contract price aligns with the spot price. When it’s negative, it’s a sign that traders are clamoring for short positions—because who doesn’t love a good bear market? 🐻

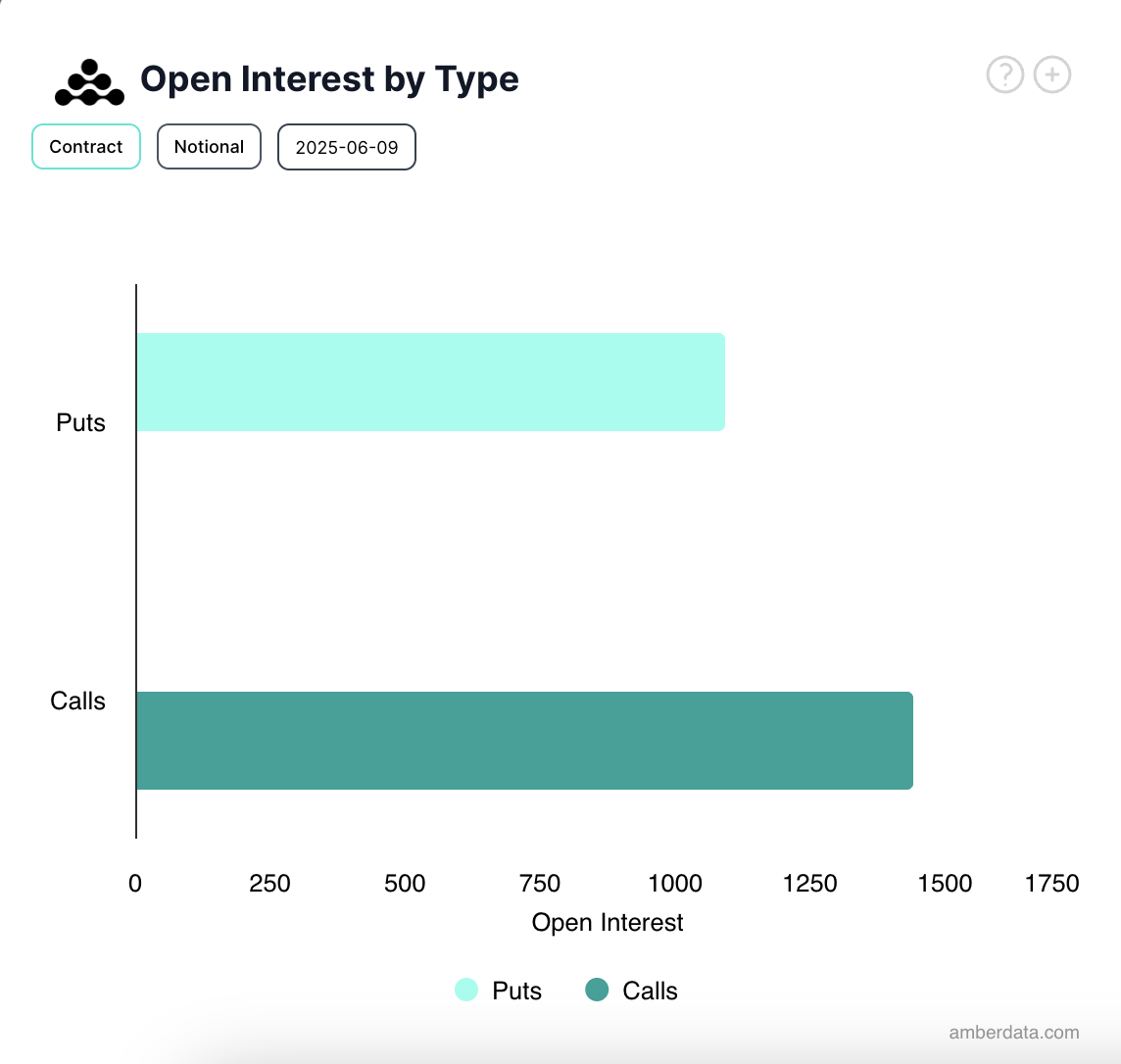

However, BTC options data offers a glimmer of hope. According to Deribit’s data, BTC options traders are still showing strong demand for call options. This points to a flicker of optimism among the more sophisticated market participants, even as short-term indicators remain as mixed as a fruit salad. 🍉🍊

In summary, while BTC ETF weekly flows remain in the red, the deceleration in outflows and a rise in bullish derivatives positioning suggest that market participants might just be bracing for a potential turnaround. Or maybe they’re just waiting for the next big drama to unfold! 🎭

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-06-09 10:06