So, Bitcoin‘s playing it cool, opening on Sept. 17 at $116,276. But hold up, with a market cap of $2.31 trillion and trading volume at $43.10 billion, it’s basically the kid everyone’s staring at in class. The price? Oh, it’s hopping between $114,866 and $117,292. You know, casual tension, some bullish vibes mixed with a sprinkle of selling pressure at those oh-so-high levels. Classic Bitcoin.

Bitcoin

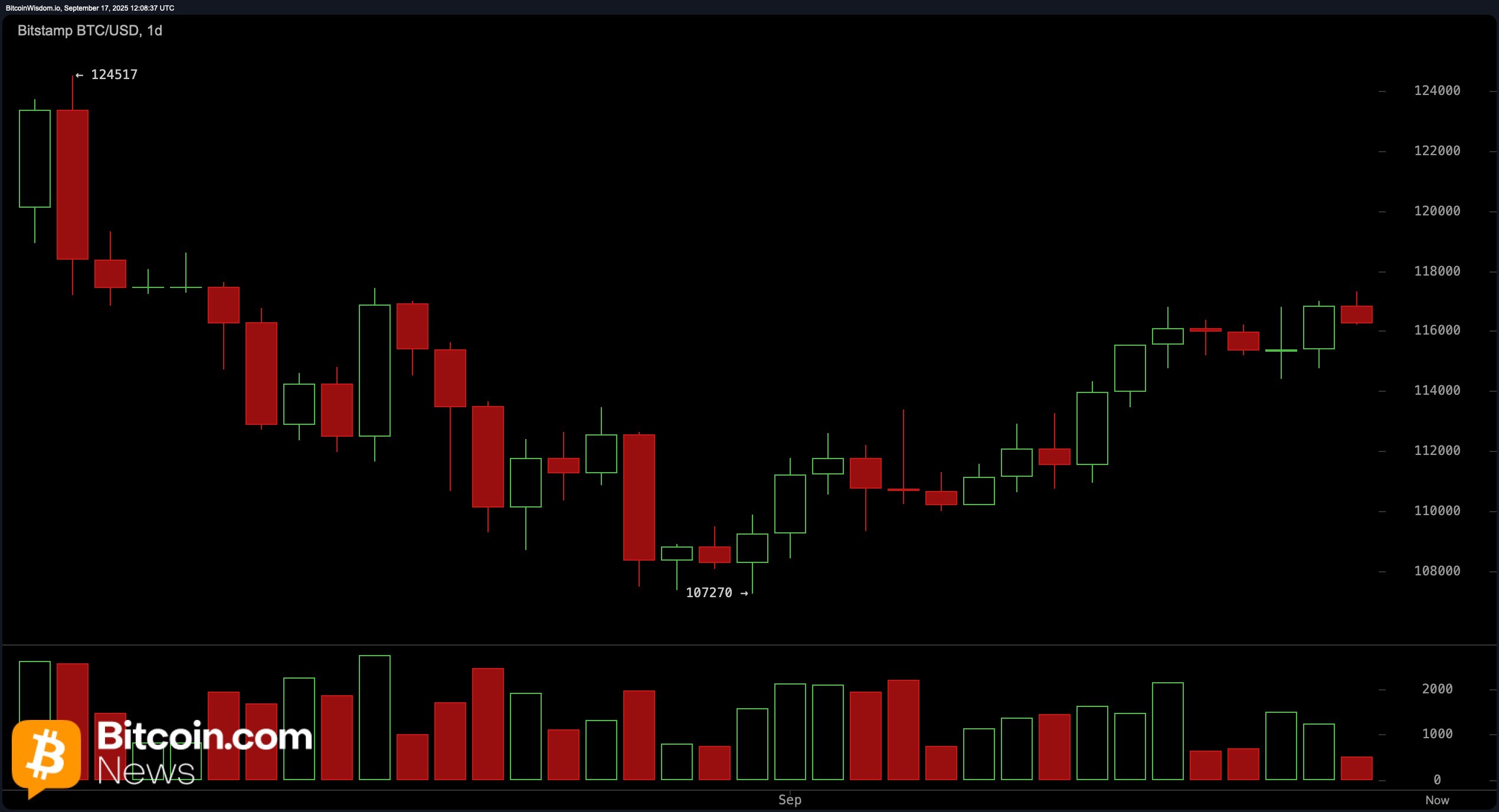

On the daily chart, Bitcoin’s been chilling just below the $117,500 resistance zone after recovering from a sad little low of $107,270. And I mean, it looked all hopeful and positive, but then, boom, the volume dips. So, yeah, the excitement’s kinda fading. Big mood. 😅

Now, there’s this key support near the $112,000 to $114,000 zone. A dip into that range could be like a lifeline for some traders, maybe even sparking some fresh buying action. Oh, and if Bitcoin breaks that $117,500 ceiling? It better do it with volume, or else it’s just a nice idea.

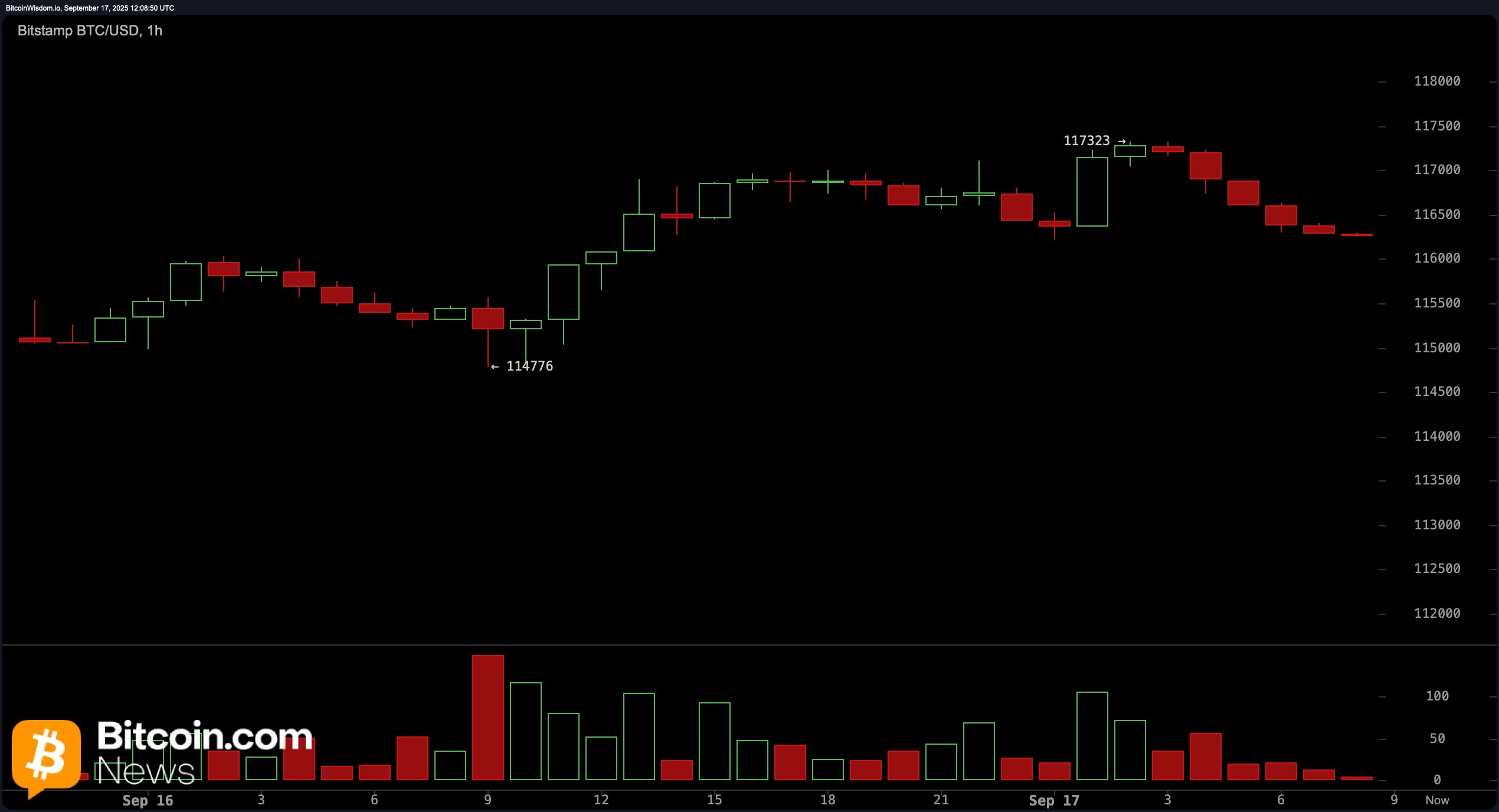

Let’s zoom in to the 4-hour chart for a second. A little bit of a buzzkill here-Bitcoin’s recent rally from $114,137 to $117,323 just got hit with a bearish engulfing candle. Oh, and did I mention the red volume spike? Classic sign of resistance building up like a wall. So, maybe a correction is in the cards. For now, the $115,200 to $115,500 zone looks like a potential bounce zone if the bulls decide to wake up and play.

Okay, switching to the 1-hour chart. Can we just talk about how Bitcoin’s rising structure totally broke down? 😬 Lower highs everywhere, people! And the support near $115,800 to $116,000? Looks kinda fragile, to be honest. There’s a minor chance for a quick long trade if we get a bullish reversal pattern, but that’s gonna need some action, like a hammer candle with volume. And don’t even think about holding out for big profits unless the volume kicks up.

Let’s talk indicators, shall we? Oscillators are throwing up their hands like, “I don’t know, you figure it out.” The RSI’s chilling at 58 (neutral, yay). But the Stochastic oscillator is sitting at 89 (also neutral-yawn). CCI’s at 115, momentum’s at 5,114-both flashing a “hey, maybe slow down” signal. ADX at 18? Meh, no trend strength. But, good news! The MACD’s holding steady at 763, so there’s still a chance for a bullish move. Just… not yet. 🧐

As for moving averages, they’re still waving the “uptrend” flag. The 10-period EMA is at $114,950, and the 10-period SMA is at $114,906. All the major EMAs and SMAs from 20 to 200 periods are aligned like a happy little army of optimism. But, if $115,500 doesn’t hold, don’t be surprised if we see a retest of $114,000 or even lower. Drama alert!

Bull Verdict:

Despite the fading hype, Bitcoin is technically still propped up by those moving averages and the bullish MACD signal. If it can hold above the $115,200-$115,500 range and volume actually does something, maybe we’ll see a breakout above $117,500. Fingers crossed, okay? 🤞

Bear Verdict:

Short-term signals are looking a bit like a dark cloud. There’s selling pressure, a bearish engulfing candle, and oscillators flashing “nope.” If $115,500 caves, Bitcoin might just revisit $114,000 or lower, and that recent rally could end up being a sad, distant memory.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-09-17 16:08