- Bitcoin’s dominance is holding strong, but it’s starting to look like a tired king clinging to its throne. A breakout above $90k? Unlikely, unless pigs start flying. 🐷

- Is the crypto kingdom about to witness a liquidity rebellion, with altcoins stealing the crown? 👑

The cryptocurrency market is buzzing with whispers of an altseason, as if the stars themselves are aligning. History, that old gossip, suggests that when Bitcoin takes a breather, altcoins throw a party. 🎉

In 2017 and 2021, altcoins surged like over-caffeinated traders after Bitcoin peaked and decided to nap. Now, alts are reclaiming their territories, while Bitcoin dominance faces resistance like a stubborn mule. 🐴

Could Q2 be the stage for the most explosive altseason yet? The odds are stacking up like a Jenga tower on the verge of collapse. 🎲

The Case for the Altcoin Uprising

Bitcoin dominance (BTC.D) has climbed to 62.40%, a level not seen since the days when people still thought NFTs were a good idea. 😬

But with the RSI nearing overbought territory, history whispers that a pullback might be on the horizon. If Bitcoin dominance peaks, it could be the signal for altcoins to shine – just like in 2021, when BTC.D dropped to 40% and the altcoin market surged to a record $1.50 trillion. Not bad for a bunch of underdogs. 🐕

That rally happened during a post-election economic shift, rising inflation, and pandemic-driven policies. Sound familiar? It’s like déjà vu, but with more memes. 🐸

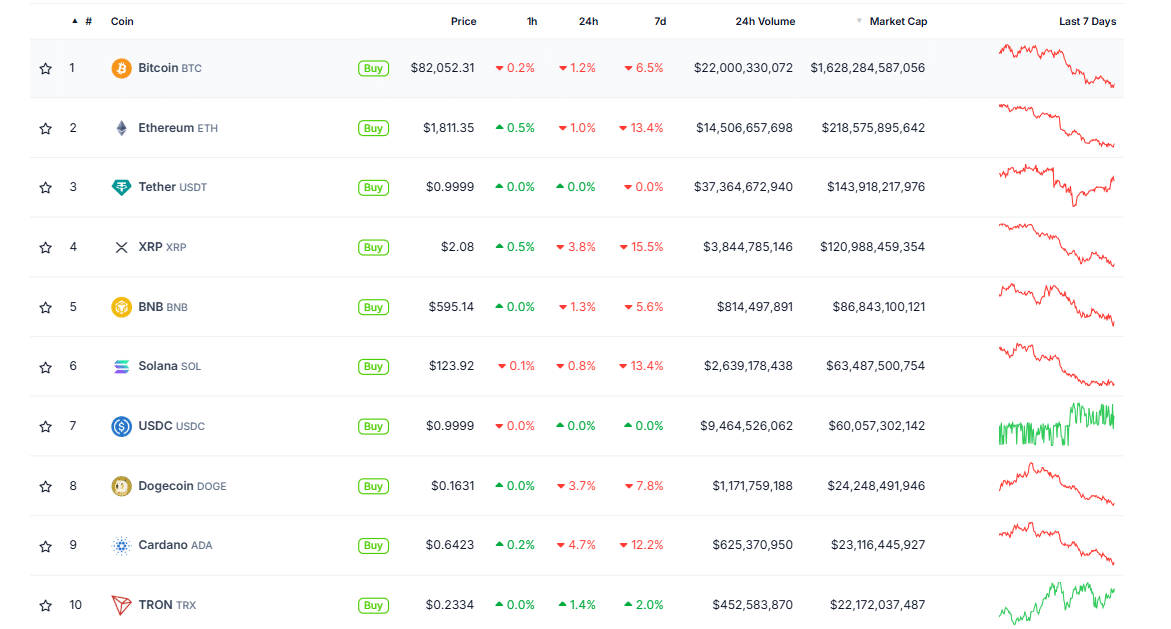

Currently, the altcoin market cap is under $1 trillion, with the RSI hinting at a bottom. This could mean a breakout is on the horizon, with altcoins hovering around a critical $900 billion support level. But for a true altseason, Bitcoin dominance must decline. Right now, BTC.D is at a three-year high, while altcoins are taking double-digit hits. Ouch. 💥

If Bitcoin Steps Aside

Bitcoin dominance is the key signal of whether investors are moving into altcoins. But in this cycle, Ethereum (ETH) and Solana (SOL) have already lost strength against BTC, breaking multi-year support. It’s like watching two heavyweight boxers get knocked out in the first round. 🥊

The impact is clear. ETH and SOL are down over 13% this week, while Bitcoin has only dropped 6%. Mid-cap alts? They’ve been hit even harder, like a piñata at a kid’s birthday party. 🎪

Still, some analysts remain bullish, predicting the biggest altseason yet. They point to macro factors and Bitcoin’s consolidation as the perfect setup. It’s like waiting for the perfect storm, but with more charts and less rain. 🌪️

The market is currently split between three BTC scenarios: A slow bleed to $50k–$60k, a multi-month range between $70k–$90k with choppy alt moves, or a breakout above $90k, which seems less likely without a macro shift. It’s like choosing between bad, worse, and “are you kidding me?” 🤷♂️

The most likely outcome? Bitcoin ranges, giving altcoins time to consolidate and set up for a strong move. With many already down 80–90% from their highs, a full recovery might not take years – just the right conditions for a rotation. It’s like watching a phoenix rise from the ashes, but with more volatility. 🦅

If this plays out in the coming months, Bitcoin dominance could see a 2021-style breakdown, with both technicals and macro trends aligning. And if that happens, altcoins might finally get the explosive season they’ve been waiting for. 🎆

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-03-31 22:19