Markets

What to know:

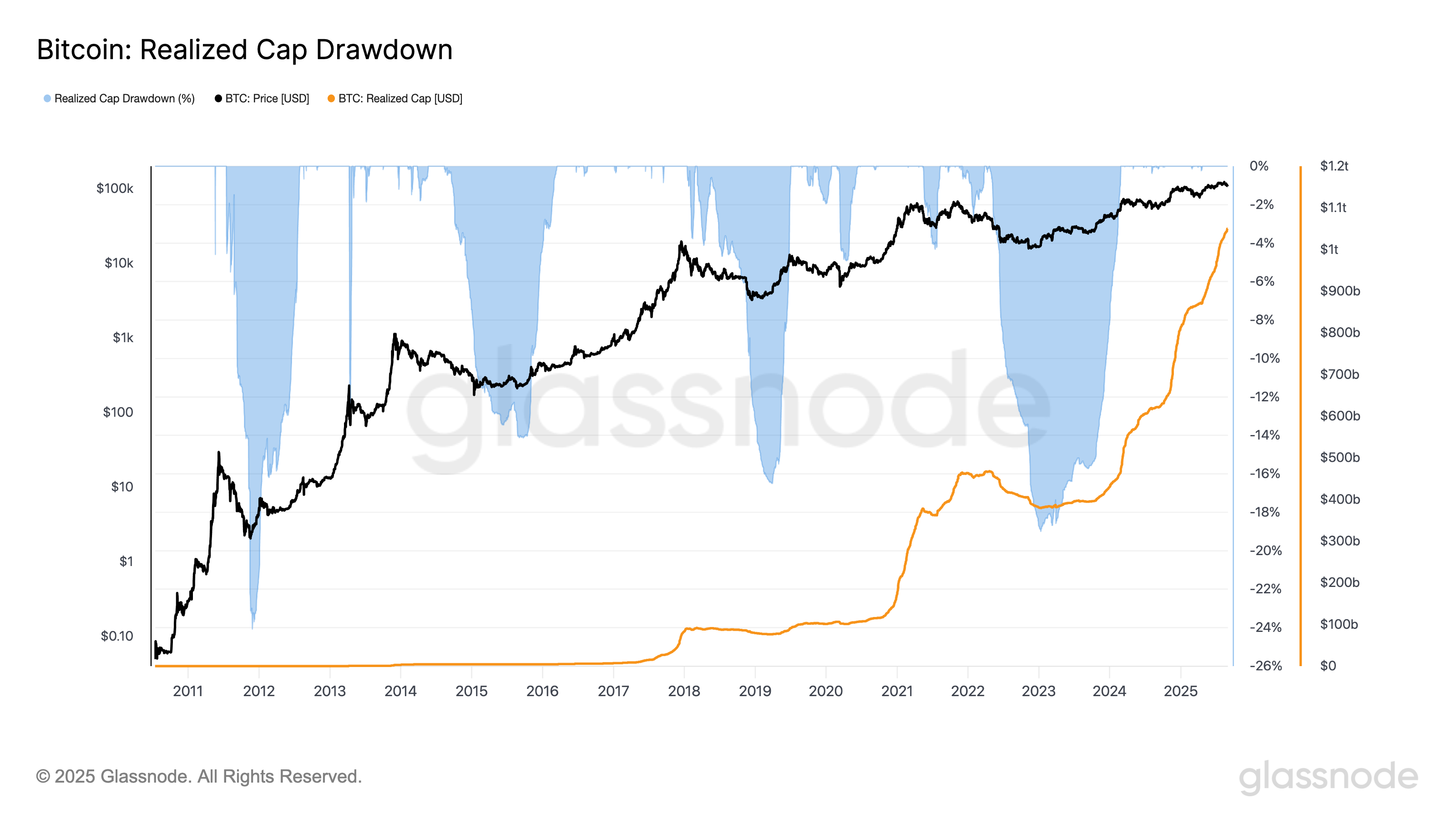

- Bitcoin‘s realized cap-basically counting only coins that actually moved-has marched past $1 trillion like a drunken dwarf at a feast, now comfortably lounging at $1.05 trillion.

- This marvelous rise happens even as the market cap, that fickle beast, is sulking and dropping thanks to spot price shenanigans.

- It’s a bit like checking how many people really *believe* in Bitcoin, rather than just pretending during awkward family dinners.

Bitcoin’s (BTC) realized capitalization is the financial equivalent of a cautious wizard: it only counts coins at the price they last changed hands, refusing to be fooled by flash-in-the-pan spot prices. Somehow, even as the spot price has decided to take a nap (dropping roughly 12%), the realized cap keeps climbing like a particularly stubborn troll scaling a cliff-now at a record-breaking $1.05 trillion.

Why? Well, unlike market cap, which prices every coin as if it’s fresh off the stage at a price gala, realized cap only updates when actual movement happens on-chain-coins get spent, prices reset, no illusions allowed. It’s a bit like only believing gossip when you’ve actually seen someone whisper it.

This model treats dormant coins, long-term holders, and those “lost forever in the great digital abyss” as unlikely heroes stabilizing the market. They stop the whole thing from crashing like a novice wizard’s first spell gone wrong, making realized cap a truer reflection of how deeply investors have stuck their necks out on the blockchain battlefield.

Historically, realized cap has taken bigger tumbles than a drunk goblin on slippery cobblestones. The brutal bear markets of 2014-15 and 2018 chopped it down by as much as 20%, and 2022 didn’t hold back either, with an 18% nosedive. Chaos, carnage, and a lot of gnashing of metaphorical teeth ensued.

But this time? Despite a double-digit price sniffle, realized cap’s actually rising-like a phoenix with a particular fondness for stubbornness. It’s proof the market isn’t just surviving the volatility-it’s doing so with the gruff resilience of a dwarven miner who’s seen worse and ignores all sensible warnings. 🪓💰

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- M7 Pass Event Guide: All you need to know

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

2025-09-01 17:13