Ah, the fickle nature of fortune! Behold, the mighty Bitcoin, once soaring like an eagle, now clings to its perch at $69,383, a mere shadow of its former glory. With a market capitalization of $1.38 trillion and a trading volume of $45.37 billion, it struts about, yet its intraday dance between $67,098 and $70,434 betrays a soul in turmoil, still reeling from a precipitous fall. A fall, I say, as dramatic as a nobleman’s downfall in a Russian novel.

Bitcoin Chart Outlook

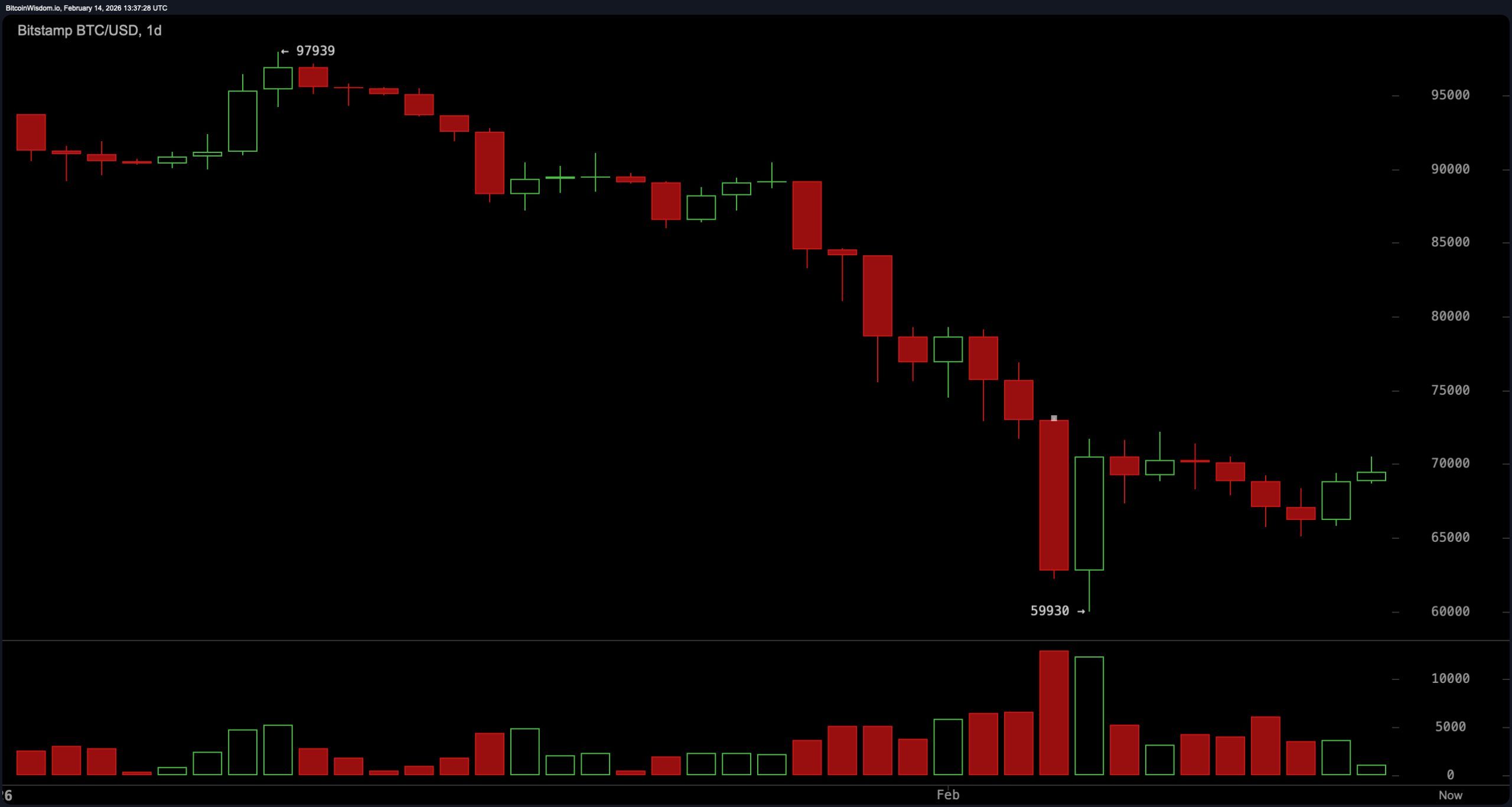

From the lofty heights of $97,900, our digital protagonist has tumbled, a staggering 30% decline, to the mid-$65,000s. It now attempts to steady itself, like a drunken peasant after a night of vodka. Yet, the higher-timeframe charts whisper tales of heavy distribution, a market still digesting its excesses. Volatility, that fickle mistress, has cooled, but the burden of proof hangs heavy, like a peasant’s yoke.

On the daily chart, the corrective structure remains intact, a waterfall sequence that culminated in a Feb. 12 breakdown on volume exceeding 10,000 units-double the prior average, a clear sign of distribution. Now, it hovers near $65,000, aligning with the 38.2% Fibonacci retracement level, a mathematical fancy that traders cling to like a superstitious peasant to his icons. Resistance layers await at $70,000 and $75,000, while the formation resembles a descending triangle, a trap from which Bitcoin struggles to escape. Unless $72,000 is reclaimed with expanding volume, the daily bias remains downward, a relentless march to who knows where.

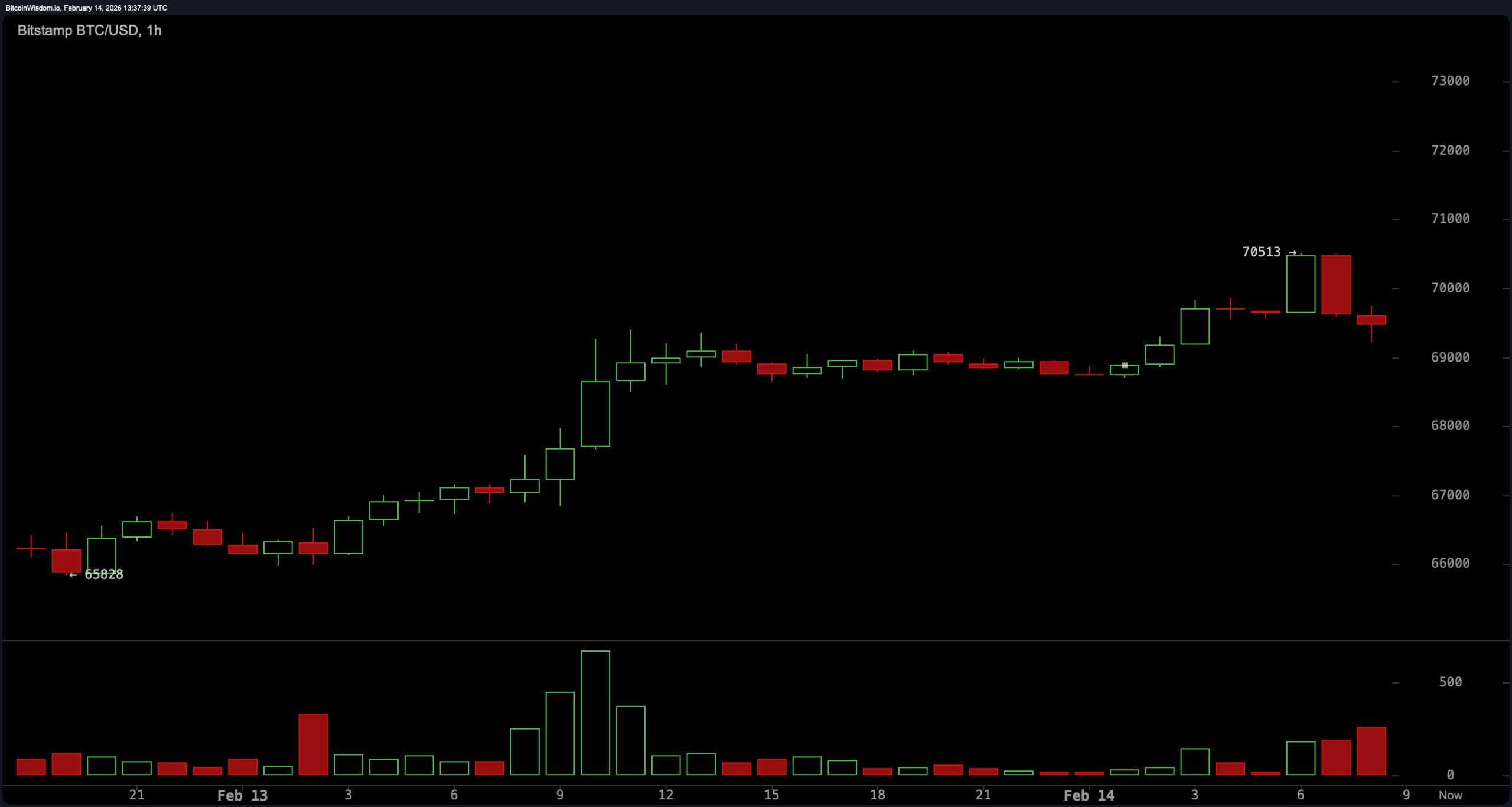

The 4-hour chart, a closer inspection, reveals a 9.5% decline from $72,174 to $65,800, followed by a tight compression between $65,800 and $66,500. Consecutive red marubozu candles and a shooting star near $69,500 preceded the fall, a harbinger of doom. Volume expanded during the Feb. 12-13 decline, signaling capitulation, yet subsequent rebounds have been feeble, on sub-500 unit volume, a lack of conviction as palpable as a peasant’s hunger. Support holds at $65,000-$65,800, while resistance looms at $67,000 and $70,000, with price pressing against the lower boundary of a descending channel, a trap from which escape seems improbable.

On the 1-hour timeframe, volatility has been as inconsistent as a nobleman’s mood. Bitcoin rebounded sharply from $65,628 to $70,513, only to form a double-top near $68,000 and retreat toward $66,000. Upper wicks near $70,500 marked exhaustion, and late-session declines printed on diminishing volume below 100 units. Price remains beneath the daily VWAP near $67,500, and wedge compression signals an approaching directional expansion. Failed breakout attempts reinforce resistance, keeping the short-term structure as fragile as a peasant’s hope.

Oscillators, those technical oracles, reflect stabilization but fall short of confirming a reversal. The RSI at 37 is neutral, rebounding from oversold territory without vigor. The Stochastic at 37 mirrors this neutrality, while the CCI at negative 54 indicates subdued momentum. The ADX at 55 confirms a strong prevailing trend-downward, of course. The Awesome Oscillator at negative 14,028 and the MACD at negative 5,371 reflect bearish momentum, though Momentum at negative 3,555 hints at possible short-term relief, a fleeting glimmer of hope in this sea of despair.

Moving averages (MAs), those steadfast sentinels, remain stacked in bearish alignment. The EMA and SMA structures show price trading beneath nearly every major trend gauge, a configuration that caps rallies and reinforces overhead pressure. The EMA (10-day) at $70,055, the SMA (10-day) at $68,326, and so on, all stand as barriers to Bitcoin’s ascent, a series of hurdles it seems unable to clear.

In practical terms, Bitcoin remains beneath short-, intermediate-, and long-term averages, a prisoner of its own making. The EMA (200) at $94,360 and the SMA (200) at $100,806 loom like distant castles, unattainable dreams in this bearish landscape.

Bull Verdict:

If $65,000-$65,800 holds and price reclaims $67,000 with expanding volume, short-term momentum could build toward $70,000 and potentially challenge $72,000. Oversold recovery signals and contracting downside volume suggest a relief rally remains possible, a brief respite from the gloom.

Bear Verdict:

As long as Bitcoin trades below $70,000 and remains under the majority of key moving averages, the broader corrective trend persists. A decisive break below $65,000 would expose downside risk toward $60,000, keeping the structural bias firmly in favor of continuation, a relentless march into the abyss.

FAQ ❓

- What is Bitcoin’s price on Feb. 14, 2026? Bitcoin trades at $69,383 with a 24-hour range between $67,098 and $70,434. A pittance, compared to its former glory.

- Is Bitcoin in a bullish or bearish trend right now? Bitcoin remains in a short-term corrective trend, a prisoner of its own making, below key resistance levels and major moving averages.

- What are the key support and resistance levels for Bitcoin? Immediate support at $65,000-$65,800, resistance at $67,000, $70,000, and $75,000. A series of hurdles, indeed.

- What do Bitcoin’s technical indicators signal? Oscillators show neutral-to-bearish momentum, with the MACD and multiple EMAs indicating continued downside pressure. A grim prognosis, to be sure.

Read More

- Gold Rate Forecast

- Star Wars Fans Should Have “Total Faith” In Tradition-Breaking 2027 Movie, Says Star

- Christopher Nolan’s Highest-Grossing Movies, Ranked by Box Office Earnings

- KAS PREDICTION. KAS cryptocurrency

- Jessie Buckley unveils new blonde bombshell look for latest shoot with W Magazine as she reveals Hamnet role has made her ‘braver’

- Country star Thomas Rhett welcomes FIFTH child with wife Lauren and reveals newborn’s VERY unique name

- eFootball 2026 is bringing the v5.3.1 update: What to expect and what’s coming

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Marshals Episode 1 Ending Explained: Why Kayce Kills [SPOILER]

- Decoding Life’s Patterns: How AI Learns Protein Sequences

2026-02-14 18:07