Ah, the fickle dance of the digital ruble! Bitcoin, that elusive phantom of the financial world, has once again tumbled from its lofty perch, shedding the $90K crown like a jester’s hat in a gale. The prime cryptocurrency, once hailed as the future of wealth, now lies prostrate at $89,185, a pitiful sight for the bulls who dared to dream. Even the whispers of rate cuts, those sweet nothings murmured by the financial soothsayers, could not stem the tide of despair.

Bitcoin Stumbles: The Bears Feast on the Fallen 🍖🐻

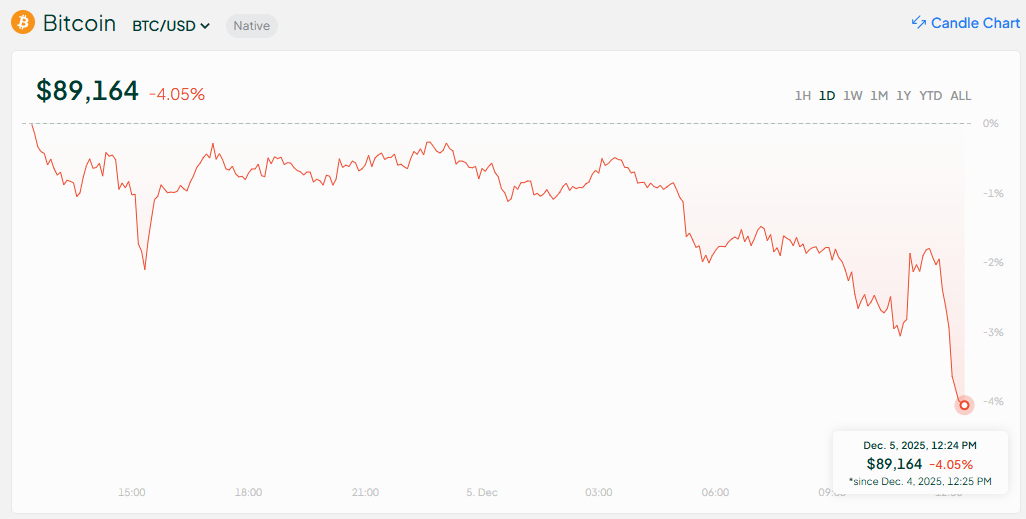

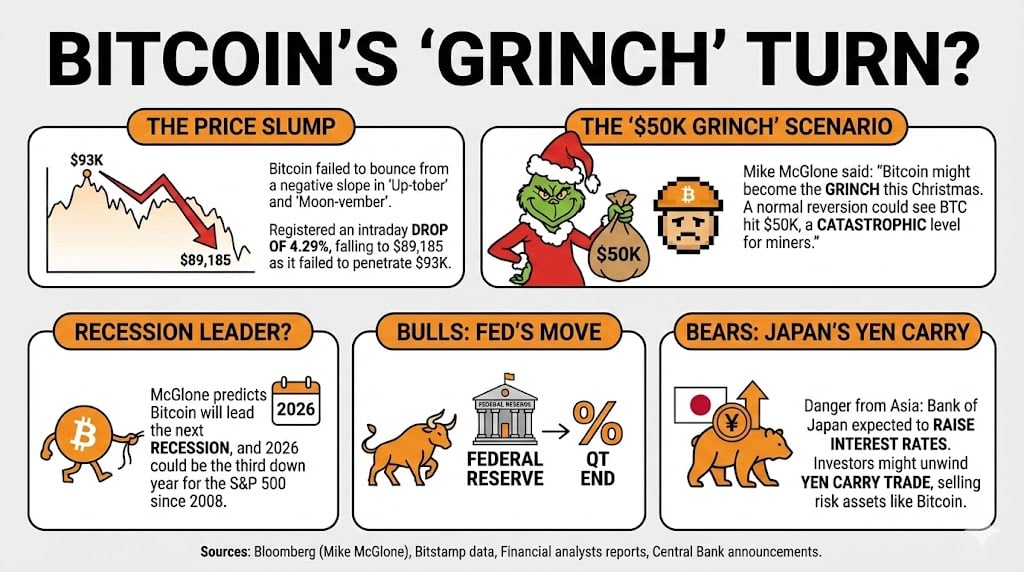

Alas, Bitcoin, that once-mighty titan, now crawls like a wounded beast, failing to rebound from its autumnal slump. “Up-tober” and “Moon-vember”? More like “Down-tober” and “Gloom-vember,” for the currency that promised the moon delivered only mud. A 4.29% intraday drop? A mere trifle, you say? Nay, it is the harbinger of doom, the crack in the dam that threatens to unleash a flood of liquidations.

BTC, once the darling of the digital realm, now struggles to breach the $93K barrier, falling instead to $89,185 on Bitstamp. The analysts, those modern-day Cassandras, cackle with glee, proclaiming that the worst is yet to come. “Room for the downside,” they mutter, their eyes gleaming with malicious delight.

Bloomberg’s Mike McGlone, that modern-day Nostradamus, declares that Bitcoin shall be the Grinch of this Christmas 🎄. On the digital squares of social media, he proclaims that a “normal reversion” might drag Bitcoin back to $50K, a level so catastrophic it would make the mining companies weep into their ASICs. The ecosystem, once a lush garden, may soon be a barren wasteland. And yet, McGlone is not done; he foretells that Bitcoin will lead the next recession, and that 2026 will be the third down year for the S&P 500 since 2008. Joy to the world!

Ah, but let us not forget the record prices of yesteryear, when Bitcoin soared like Icarus, only to plummet into the sea of bearish sentiment. A liquidity crisis, they call it, where even the smallest positions wield the power of titans, sending the market into convulsions.

Yet, the battle rages on, a grotesque ballet of bulls and bears. The Federal Reserve, that grand puppeteer, hints at cutting interest rates, while the end of quantitative tightening beckons like a siren’s call. But beware, for danger lurks in the East. The Bank of Japan, that enigmatic sphinx, may raise its rates, prompting investors to unwind their yen carry trades, selling Bitcoin like yesterday’s news to cover their loans in the land of the rising sun. 🌅

FAQ

What recent trend is Bitcoin experiencing?

Bitcoin has registered an intraday drop of 4.29%, failing to rebound from a negative slope during the ironically named “Up-tober” and “Moon-vember.” 😢What price level did Bitcoin struggle to reach?

BTC failed to break the $93K level, falling to as low as $89,185 on Bitstamp, a tragicomic spectacle for the ages. 🎭What are analysts predicting for Bitcoin’s future?

Mike McGlone, the modern Cassandra, suggests Bitcoin could drop to $50K, a level so dire it would make mining companies weep into their ASICs. 😭What external factors could impact Bitcoin prices?

Interest rate changes, particularly from the Bank of Japan, could worsen Bitcoin’s plight as investors sell risk assets to cover loans in the land of sushi and samurais. 🍣🗾

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-12-05 20:54