Let’s talk about the crypto market’s latest party crasher: the bears. They’ve arrived in full force, dragging Bitcoin down below $91K like a toddler determined to ruin your perfectly made bed. Sellers are doing their best interpretive dance, trying to lure the price into a support range that used to be a safe zone but now feels like a haunted house. The real drama? Derivatives haven’t cooled off yet. It’s like everyone’s still wearing last summer’s sunscreen-burns happen when you least expect it.

Bitcoin Price Today: BTC Retests $91K as Bears Defend $98K Resistance

The BTC price has been on a seven-day bearish streak, which is about as fun as a root canal with a side of existential dread. It’s currently flirting with $90,865, down 2.6%, because apparently, the bulls forgot to pack their confidence. The chart looks like a rejected dating profile-every candlestick says “no thanks.” But hey, maybe this rebound is just the token’s way of saying, “I’m fine, really, why do you ask?”

Looking at that chart, you’d think Bitcoin’s been on a keto diet. It rebounded from $80K like a spring, only to start trading within the lower bands, where it’s clearly running out of steam. Right now, it’s testing the 50-day MA at $90,430, which used to be a fortress but now feels more like a leaky dam. And if it dips below that? Well, the demand zone between $86,400 and $86,700 is waving hello with a neon sign that reads, “Your worst nightmare awaits.”

A daily close below the 50-day MA would be like getting a D- on a pop quiz you didn’t study for. The correction could head straight for the old lows, where Bitcoin will probably throw a pity party and invite Ethereum to crash it.

Why Bitcoin’s Selloff Doesn’t Look Like Capitulation Yet

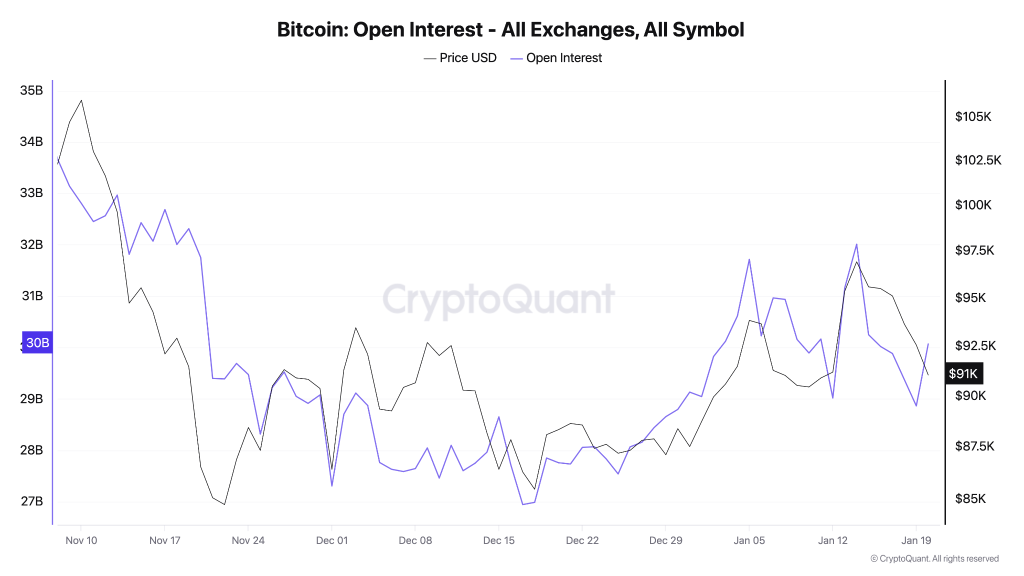

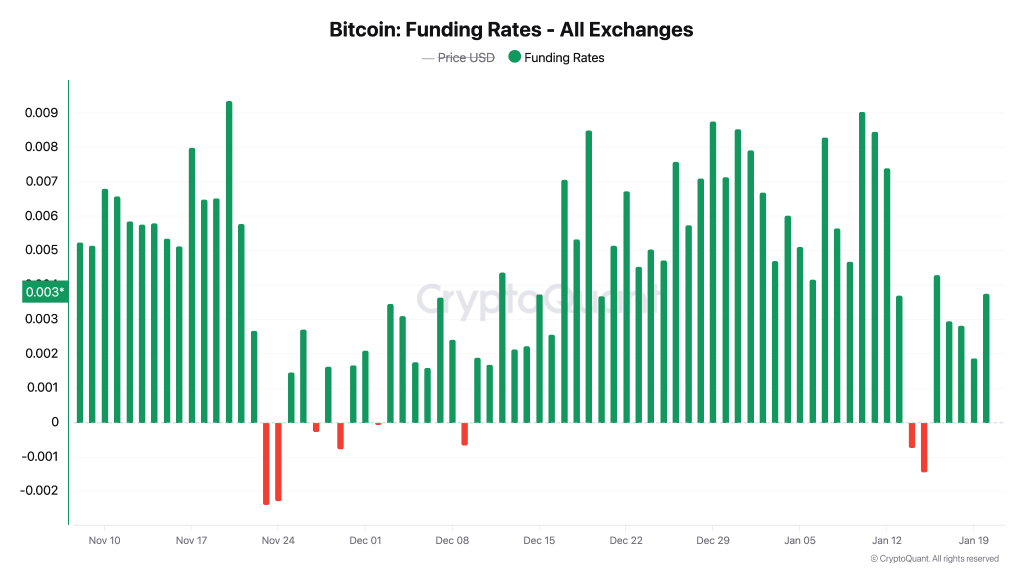

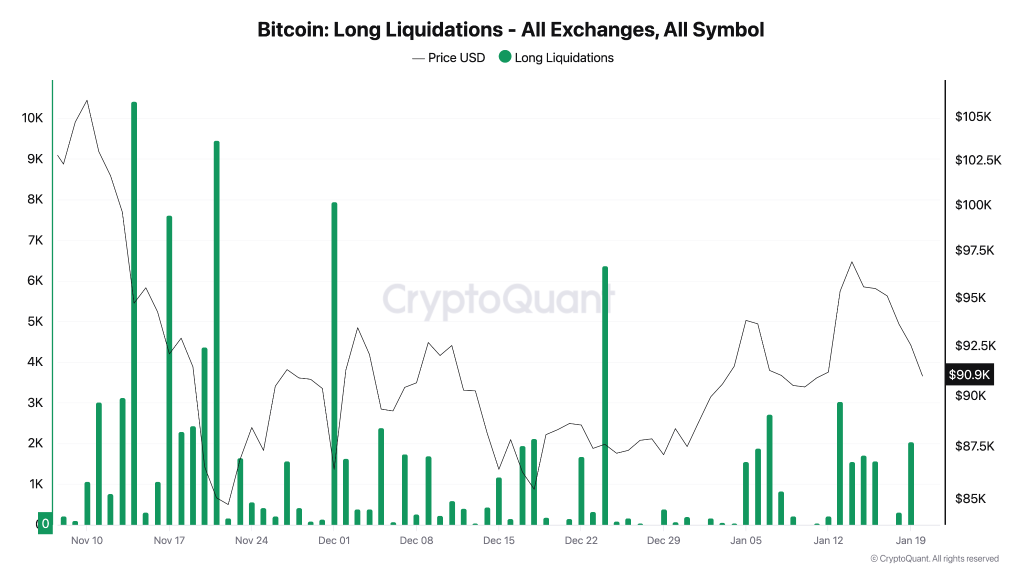

Bitcoin is sliding again, but the derivatives data suggests we’re not at the “I give up” stage just yet. Open interest is rising while the price falls, which is like adding fuel to a fire that’s already burning your couch. Funding remains slightly positive, and long liquidations are still small enough to fit in a teacup. This isn’t panic; it’s more like a midlife crisis where everyone’s pretending they’re not stressed.

Rising Open Interest During a BTC Dip = New Leverage Entering

When open interest goes up during a price drop, it’s like watching people jump into a pool that’s slowly filling with Jell-O. Traders are opening new positions into the decline, which means volatility is still lurking like a raccoon in your trash can. Leverage hasn’t fully reset, so the market is basically a loaded gun waiting for someone to pull the trigger.

Positive Funding (0.003) Suggests Longs Still Leaning In

Funding staying positive while prices fall is like your ex still liking your Instagram posts after you broke up. It means the market is slightly long-skewed, and the bears haven’t fully taken over. In a true washout, funding would flip to negative faster than your Netflix queue after a weekend binge. But no, we’re just here, politely pretending the problem isn’t real.

Long Liquidations (~2K) Are Too Small for a “Flush” Bottom

Recent long liquidations are about as exciting as a spreadsheet error. Most are between $1K-$3K, which is cute but nowhere near the massive spikes we saw earlier. If this were a proper flush, we’d be seeing liquidations big enough to make headlines in the crypto tabloids. Instead, it’s more like a gentle sigh from the market, saying, “Not today, Satan.”

The charts suggest Bitcoin is dropping, but leverage hasn’t cleared. It’s like your car’s check-engine light blinking while you’re stuck in traffic-annoying, but not quite a breakdown. The current support test is dangerous because the market might need a sharper shakeout to fully reset. Or, as I like to call it, “the part where everyone starts crying in the comments section.”

Bitcoin at a Key Support, But Leverage Signals Raise Downside Risk

Bitcoin is approaching the $90K-$88K support zone like a person walking into a room full of strangers. It failed to break through $98K resistance, which is now more of a “do not pass go” sign. The demand band could spark a bounce, but the Price vs OI data says this selloff isn’t capitulation yet. Rising open interest, positive funding, and tiny long liquidations mean leverage is still in play. If support holds, BTC might reclaim $98K-$100.6K and head toward $110.7K. If not? Well, the market might need a deeper flush before it stops acting like it’s in a rom-com and starts behaving like a horror movie.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- World Eternal Online promo codes and how to use them (September 2025)

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2026-01-20 17:47