Bitcoin, that most capricious of digital aristocrats, has once again summoned its entourage of hysteria and smoke, testing the $110,000 median with the grace of a penguin on roller skates. After a weekend of such volatility that even the Higgs boson might have yawned in disdain, the bulls lumber about like Shetland ponies with delusions of grandeur, squabbling over crumbs of recovery. The wider market, ever the prude, remains preoccupied with questions of whether this price tag could hold-or if a fresh wave of sellers will descend like vultures at a garden party. 🦴

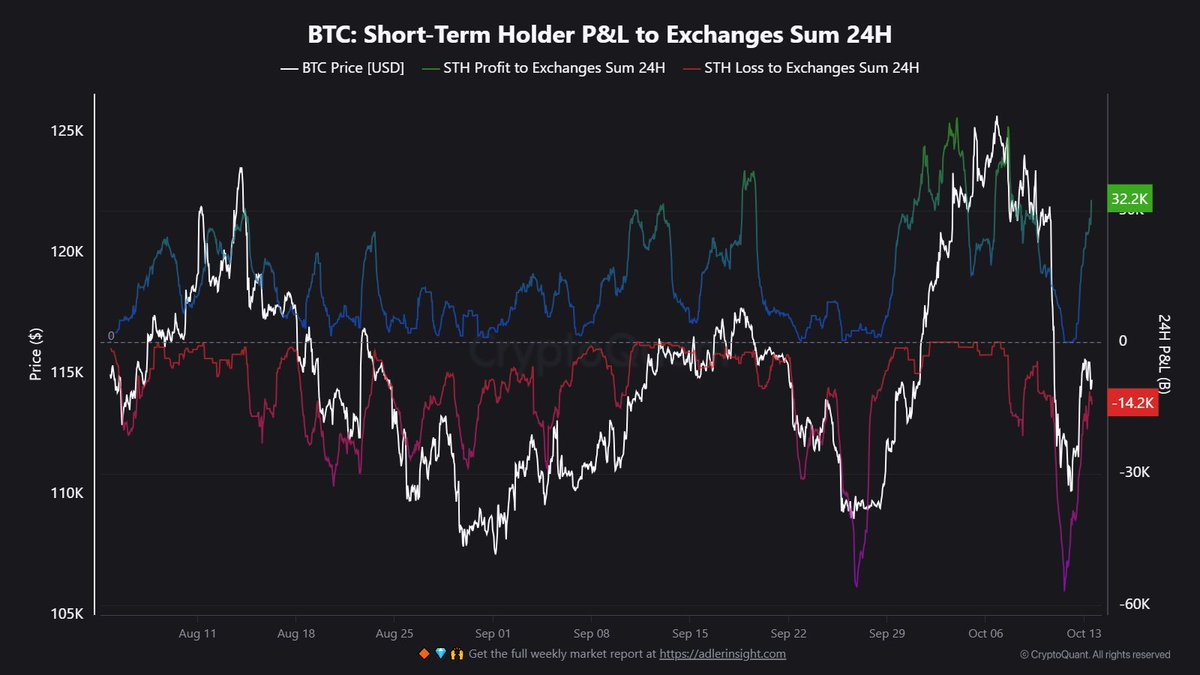

Amid the mayhem, some analysts, presumably with more hair and fewer existential crises, whisper of resilience if Bitcoin can cling to this ignoble support zone. According to the estimable Maartunn (or perhaps a sock puppet in his likeness), on-chain activity reveals a grand reshuffling of mutual funds with the subtlety of a drunken tango. Over 46,524 BTC, a quantity sufficient to buy a small Pacific atoll and a lifetime supply of Tesla Semi depreciation, has been spirited to exchanges by Short-Term Holders. One wonders if they’ve mistaken their Bitcoin for Monopoly money. 💸

Such behavior, Maartunn insists-or tweets, for all we know-is but a prelude to the market’s long-awaited “reset,” a phase wherein profit-taking and panic coalesce like bitter ex-lovers at a wedding. If this range holds, fortune’s pendulum may swing toward stabilization (or another plunge, but let’s pretend optimism is fashionable). The coming days, as ever, teeter between hope and despair, with Bitcoin playing the tragic hero. 🎭

Maartunn, or the ghost of Buffett with a Twitter ban, suggests this “rebalancing phase” is par for the course, a grand purge of leverage and human folly. One might call it the crypto equivalent of fumigating a moth-eaten wardrobe. Such cleansing, he claims (with the solemnity of a tax auditor), sets the stage for a “short-term or mid-term bottom”-a relief wall indeed, should one brave enough to lean on it. The market’s selling pressure, he insists, is being absorbed by “stronger hands”-i.e., those with better JPEGs in their NFT portfolios. 🖼️

The coming days shall decide if Bitcoin’s prostration near $110-112k is a prelude to virtue or vice. Bulls who prevail might claim it as the floor, a foundation upon which investors (read: the gullible) might rebuild faith. Should the price falter anew, however, the party of liquidations shall resume with the vigor of a toddler learning addition. 🎤

At $110,800, Bitcoin teeters like a latter-day Icarus, testing its wings near a support zone that smells faintly of desperation. Those pesky moving averages, like a grumpy professor, have barred reentry from the $117.5k plateau, a ceiling since September. Now the coin clings below 50- and 100-day averages, while the 200-day MA loiters near $111k like a stubborn uncle at a funeral. Should this line give way, a deeper correction might beckon-$107-108k, a place where accumulation once masqueraded as strategy. 🏹

If Bitcoin survives this kamikaze dance, a rebound toward $115k might follow, where resisters wait like nitro-buffed bouncers at a bear market speakeasy. For now, the chart resembles a beleaguered Victorian missus, torn between societal expectations and the siren call of folly. Bulls must muster the verve of a Gallup poll to reclaim ground-failing which, another consolidation phase looms, all the romance of a salad lecture. 🥗

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

2025-10-15 06:13