Ah, Bitcoin-dancing the jitterbug between $87,477 and $90,317 on Dec 17. Traders? Ruthlessly brave or just really good at pretending? 💃💸

Bitcoin Derivatives Show It’s Just Hot Air and Tight Shorts

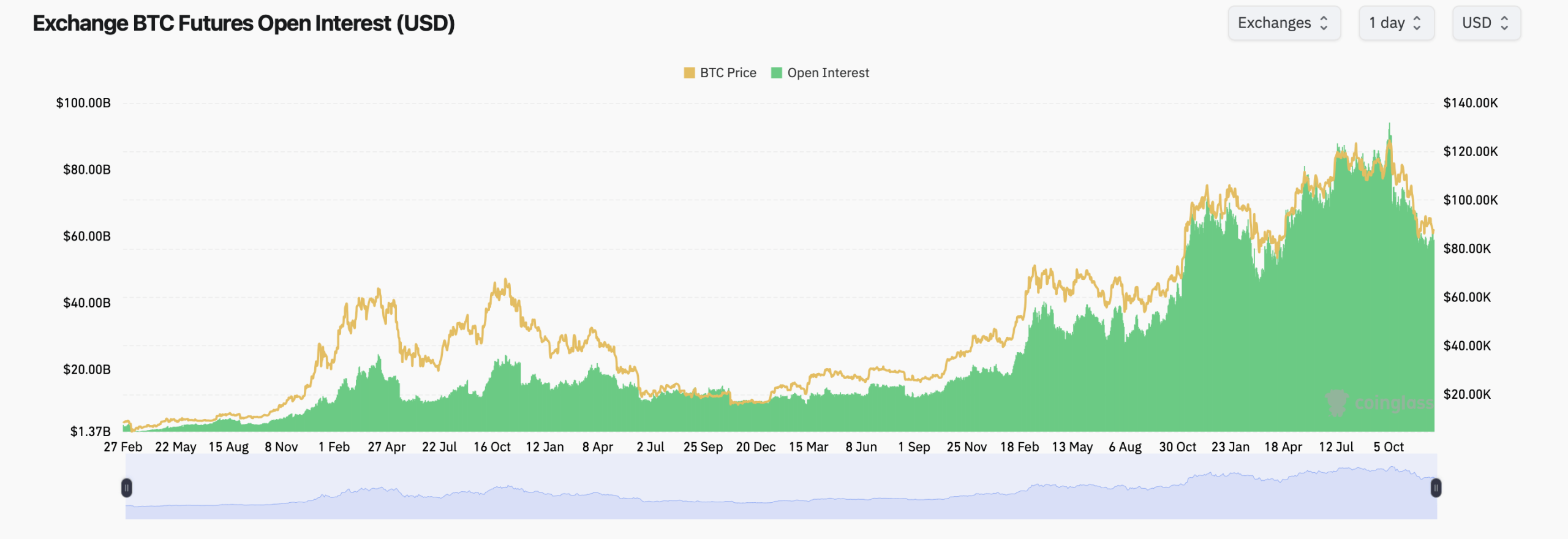

According to coinglass.com (who knew they kept track of this stuff?), the futures open interest (OI) is still sky-high at around $58.97 billion. That’s like, a trillion dollars in crypto play money. Despite recent price lullabies, traders are still in the game, clinging to their leverage like it’s grandma’s heirloom. In Bitcoin-terms, that’s roughly 673,770 BTC, still bouncing above normal levels and hinting that folks are involved-maybe not all in, but enough to keep the party going.

Looking closer, CME is king with about 126,030 BTC in futures-nearly 19% of the whole shebang-meaning the big guns, the institutions, are still swaggering. Binance isn’t far behind with 122,520 BTC, because why not share the love? Meanwhile, Bybit, Gate, and MEXC are just hanging out in the middle, like that friend who’s not the life of the party but shows up anyway. 🎉

OKX has slightly upped its game, but Kucoin and BingX have taken a step back-probably tired of all the adrenaline. It’s like a market that’s adjusting, not running for the hills. Futures are barely shifting, just a tactical ‘let’s see what happens’ kind of move. The OI-to-volume ratio is still high-stickiness abounds-as traders wait for that big signal to jump or stay grounded.

Nansen Says Many Investors Are Still Bullish in 2026-Or Just Stubborn

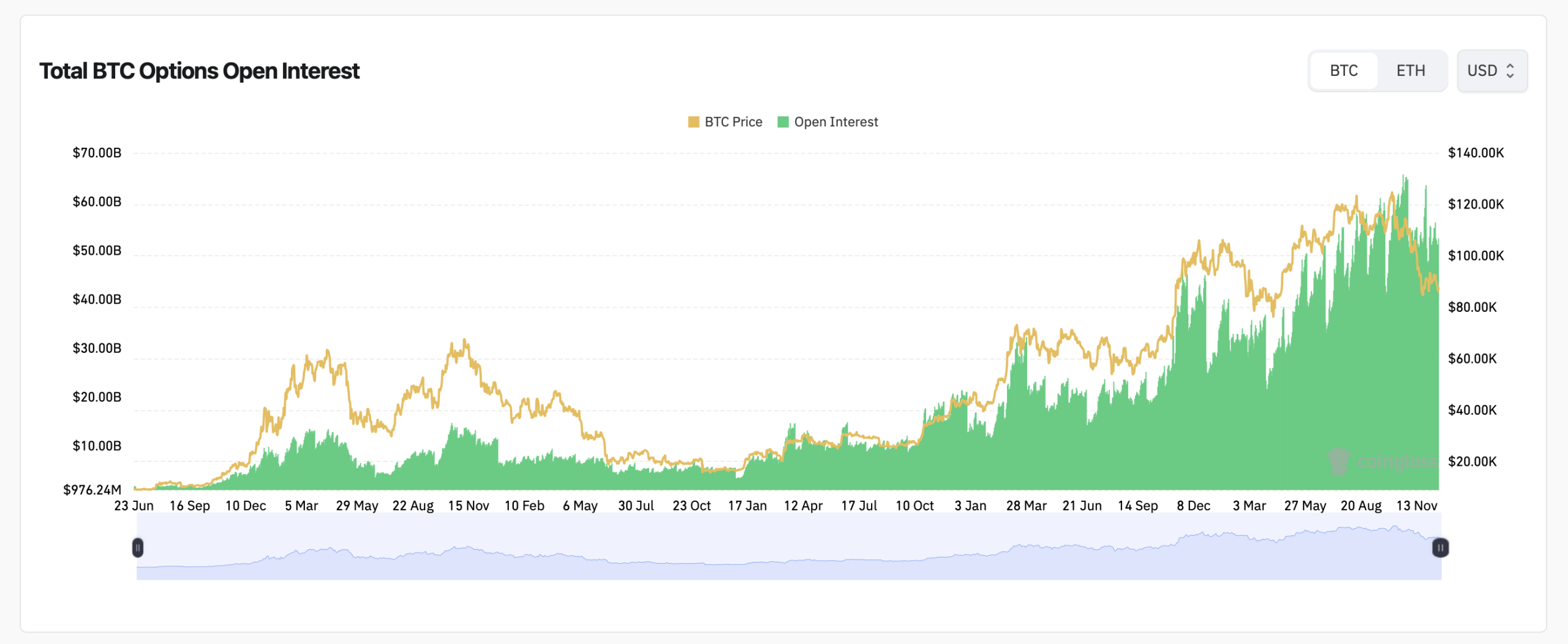

On the option front, it’s a different story. There, people are cautious but not throwing in the towel. According to coinglass.com, options open interest has grown along with the price over the long haul, but in the short term? Defensive posturing. About 64% of open interest is in calls (the ‘come on up’ bets), yet recent volume leans a tad more toward puts-more hedging, less doom. 🙃

The big strikes are around $100,000, $106,000, and $112,000, way above current prices-making everyone think, ‘Huh, maybe it’ll go higher, but not today.’ On the downside, puts are lurking at $85K and $80K-your typical ‘don’t let the price slip too far or else’ levels. Max pain? Well, it’s cozy in the high-$80K zone, which suggests that Bitcoin might just moby-dick around there until the expiry date. ⏳

According to max pain data, the market wants to stay in the $80-90K range for now, maybe just sulking or plotting its next move. Not exactly the rocket ride some dreamed of, more like a fancy cruise with a lot of shore visits.

And yes, the smartest folks, like Aurelie Barthere from Nansen, say: “Short-term? Caution. Long-term? Still bullish. But don’t get ahead of yourselves. The odds of hitting $91K in January? Less than 34%. But by March 2026? Over 50% for $105K or more.” So, maybe HODL because the market’s flip-flopping like a fish on a hook. 🐟

“Prices might dip into Q1 2026, thanks to AI stocks drawing some sympathy, but bounce back in Q2 with fiscal boosts and a dovish Fed,” she adds.

In plain English: derivatives are playing it cool-no panic, just a lot of cautious finger-crossing. Futures? Staying planted. Options? Hedging. Max pain? Sticking around. Leverage? Still lurking, just not doing cartwheels yet. Watch this space. 😉

FAQ ⚠️

- What does high bitcoin futures open interest mean?

Traders are holding onto their leverage, not throwing in the towel. - Why are options leaning defensive?

People are hedging against a dip, not declaring outright bearish war. - Where’s the max pain level?

Around the upper-$80,000s for late December-because nobody wants to lose money… too much. - What’s the 2026 outlook?

Caution now, but a likely bull run above $105K by March. Basically, the market’s just playing hard to get.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

2025-12-17 19:44