Bitcoin has made a slow and steady recovery after taking a dive to $100,424 on June 5. While the relief is welcome, the coin seems to be stubbornly resisting any attempts to surpass the $105,000 mark. A hard nut to crack, indeed.

Yet, on-chain data whispers a different story—BTC might be on the cusp of a breakout, with liquidity accumulating just above the $105,000 threshold. If only it could hear the whispers of the data gods. 🙄

BTC Gearing Up for a $105,000 Breakthrough—Or Not?

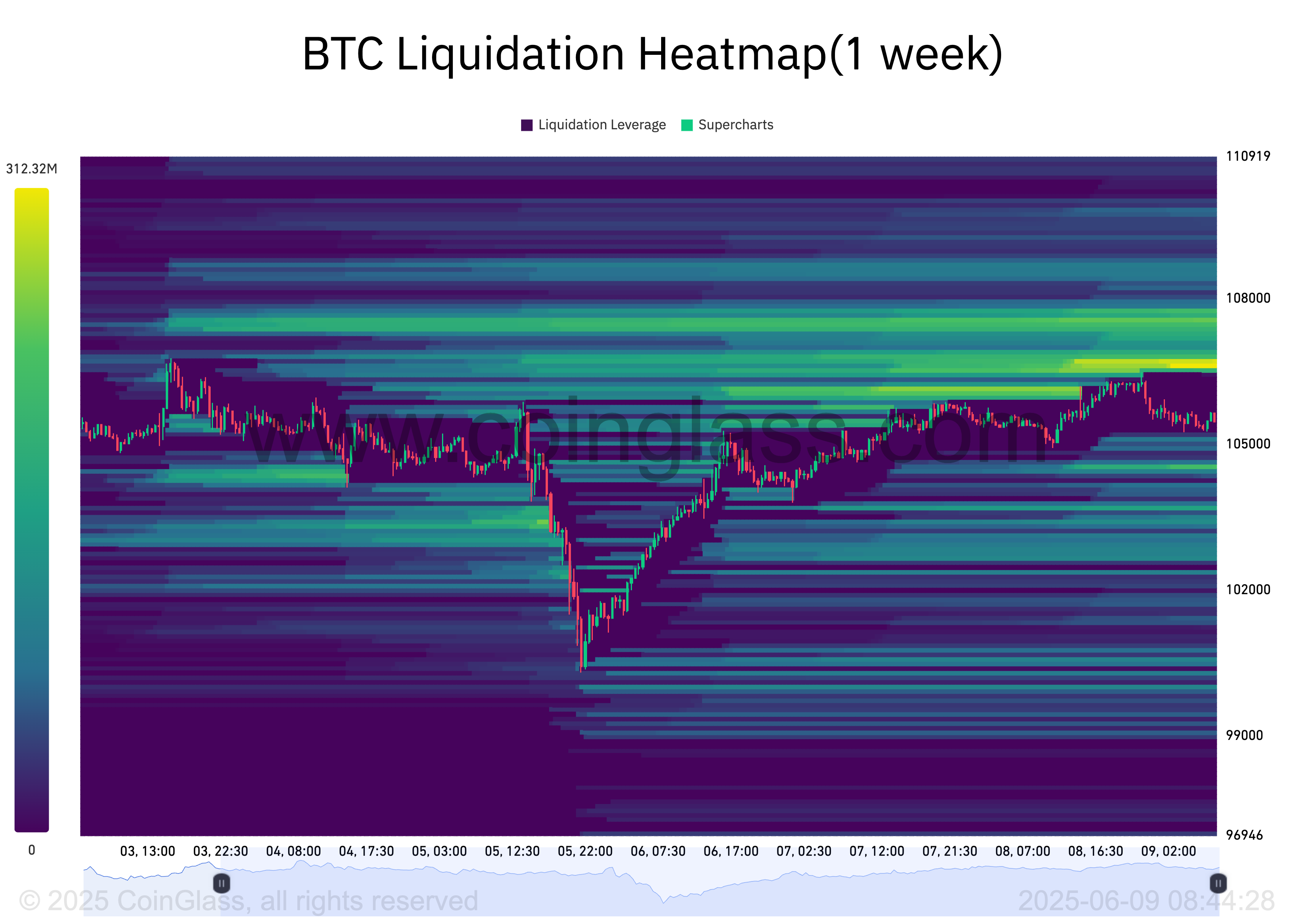

The liquidation heatmap reveals a juicy liquidity cluster around $106,736. This magnetic zone usually pulls in buyers like a moth to a flame, making the prospect of breaking $105,000 look increasingly likely. Hold onto your hats. 😎

Liquidation heatmaps aren’t just pretty pictures—they highlight areas where traders might lose their shirts (or just their margin). The brighter zones (hello, yellow) point to potential liquidation hotspots, meaning the market’s already eyeing these regions to wreak havoc. Or to make a fortune. Depends on your side of the trade. 💸

The concentration of liquidity around $106,736 hints at serious buying interest. BTC might be poised to break through the $105,000 resistance, flirting with a rally towards the $106,000 zone. As long as it doesn’t get distracted by shiny things on the way. 🤷♂️

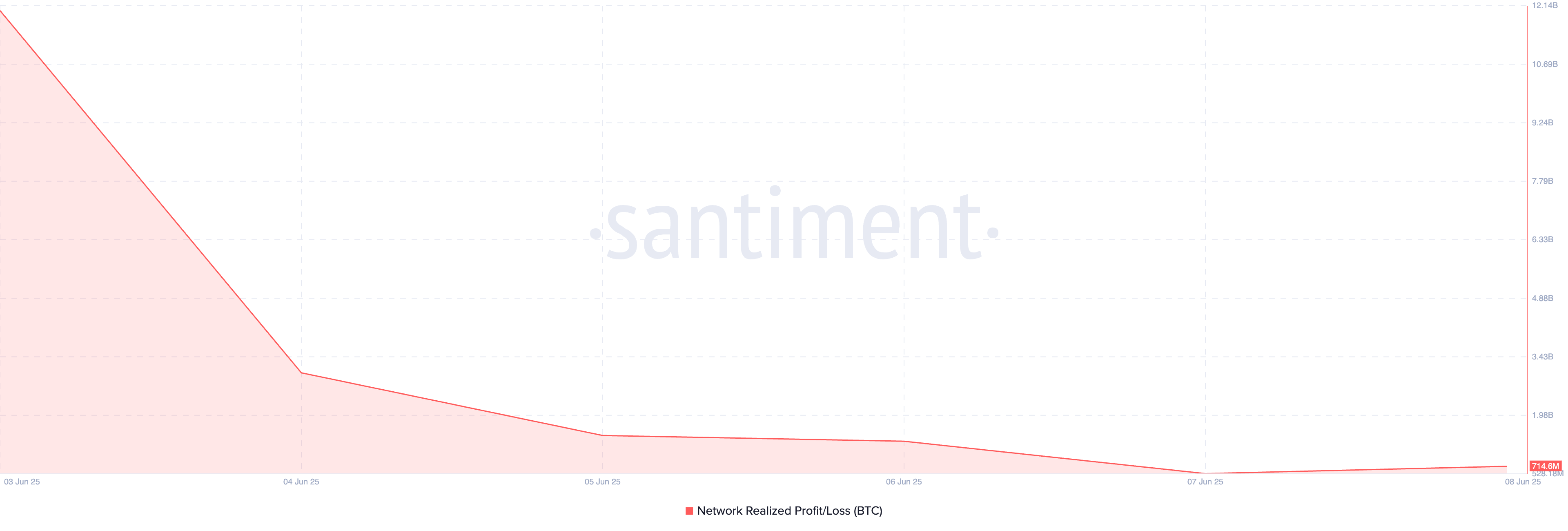

And here’s a little cherry on top—the Network Realized Profit/Loss (NPL) for BTC has plummeted by over 90% since June 4, sitting at a cool 715 million. Low selling pressure means less panic selling, and potentially more room for price growth. If only investors could stop checking their portfolios every five minutes…🙄

The NPL is basically a measure of when traders are in or out of profit—and when it drops, traders are less likely to sell at a loss. This behavior tightens supply, possibly pushing BTC’s price up. If only the market worked like that every day. 🤔

Bitcoin’s Fate Hangs Between $106,000 Breakout and $103,000 Pullback

Right now, BTC is sitting comfortably (well, maybe uncomfortably) at $105,630, just below the resistance at $106,548. If new demand enters the market, we could see it break above and make its way toward the $106,736 liquidity zone. Or, it could just sit there and make us all wait. Patience is overrated anyway. 😅

If it clears that level, we’re looking at a potential move to $109,310. But hey, nothing’s guaranteed—Bitcoin is nothing if not full of surprises. 🤡

On the flip side, if the selloffs pick up speed, BTC could stay range-bound or take a dip toward $103,938. Time will tell. It always does.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-06-09 13:40