In the vast and tumultuous realm of the crypto markets, a drama unfolds, not unlike the grand tragedies of old, where the once-proud altcoins, those rebellious offspring of innovation, now find themselves in a state of abject retreat. Since the fateful year of 2024, their fortunes have waned, their spirits broken by the relentless march of time and the fickle nature of investor sentiment. The euphoria of 2021, a distant memory, has given way to a sobering reality, where only the strongest-or perhaps the most fortunate-survive.

Behold, the CryptoQuant sages have spoken, their analysis a beacon in the darkness, revealing the flight of capital from the altcoin wilderness to the fortified walls of Bitcoin. At $65,000, Bitcoin stands as a bastion of stability, a refuge for the weary traveler in a land beset by uncertainty. Here, whales and long-term holders gather, their strategic accumulation a testament to the enduring appeal of the firstborn of the crypto world. Altcoins, once the darlings of speculation, are now but shadows of their former selves, their volumes halved, their allure dimmed.

History, that implacable judge, repeats itself with cruel irony. In times of turmoil, the masses flee to the safety of Bitcoin, leaving altcoins to wither on the vine. Binance, the great marketplace of this digital realm, bears witness to this exodus. As Bitcoin reclaimed its throne above $60,000, the shift was palpable, a silent acknowledgment that in the face of uncertainty, only the king remains trustworthy.

The King’s Dominance: A Tale of Waning Altcoin Fortunes

The corrective phase, a period of reckoning, has laid bare the fragility of the altcoin domain. On February 7, Bitcoin’s trading volumes on Binance ascended to 36.8% of the total, a crown it has since retained. This dominance is not mere happenstance but a reflection of the market’s yearning for stability and liquidity in turbulent times. Altcoins, once the embodiment of risk and reward, now languish, their share of the market dwindling to a mere 33.6% by February 13, a precipitous fall from their November heights of 59.2%.

This pattern, a recurring motif in the crypto saga, echoes the corrective phases of April 2025, August 2024, and the bear cycle’s twilight in late 2022. Bitcoin, ever the stalwart, emerges as the liquidity anchor, the safe haven in a storm of volatility. Yet, one cannot help but marvel at the irony: the very asset that was once derided as a speculative bubble now stands as the bulwark against the whims of the market.

The Altcoin Lament: A Market in Chains

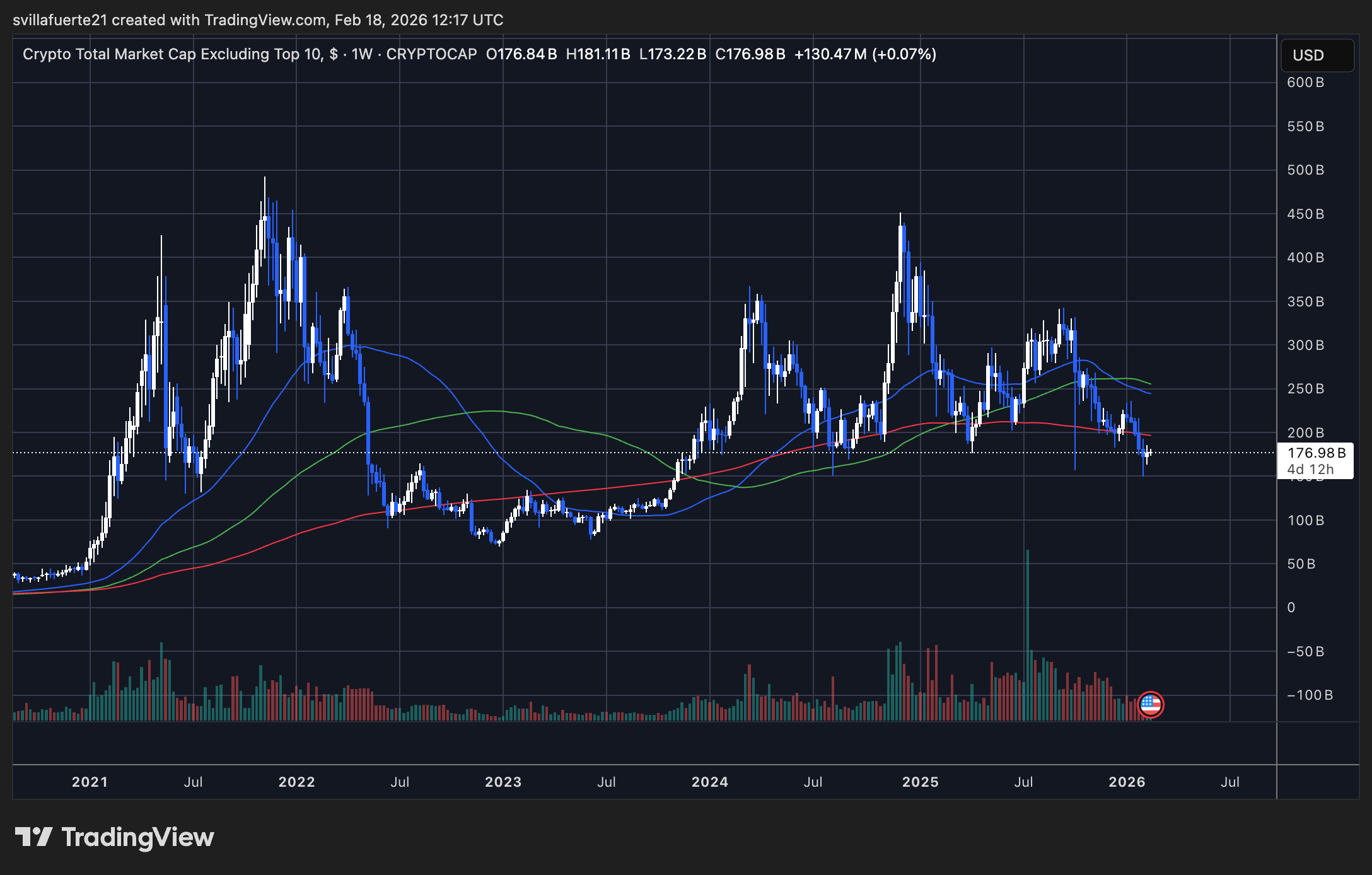

The total market capitalization of the altcoin realm, excluding the top 10, paints a picture of despair. Peaking near the 2025 highs, it has since entered a corrective phase, languishing in the $170-180 billion range. This tentative support, a fragile lifeline, offers little solace, for the absence of a robust rebound signals a risk appetite as subdued as a winter’s eve. The technicals, those cold and unyielding arbiters of fate, show the altcoin market trading below key moving averages, a clear sign that the sellers hold sway.

Volume dynamics, the pulse of the market, tell a tale of distribution rather than accumulation. While short-term stabilization may offer a fleeting respite, the absence of sustained inflows leaves the altcoin market in a state of structural constraint. History, ever the sage, suggests that such configurations often presage prolonged consolidation, a purgatory of sorts, where only the most patient-or perhaps the most deluded-remain.

And so, the crypto saga continues, a grand drama of rise and fall, of hope and despair. Bitcoin, the king, reigns supreme, while the altcoins, those once-proud rebels, are left to ponder their fate. In this digital realm, as in life, the only constant is change, and the only certainty is uncertainty. Yet, in the midst of it all, one cannot help but find humor in the irony of it all: the very asset that was once dismissed as a fad has become the sanctuary of the crypto world. Oh, the whims of fortune!

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Overwatch Domina counters

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- 1xBet declared bankrupt in Dutch court

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Gold Rate Forecast

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- Clash of Clans March 2026 update is bringing a new Hero, Village Helper, major changes to Gold Pass, and more

2026-02-19 10:16