Ah, the capricious whims of Bitcoin! Like a wayward son who returns home with tales of riches, it now finds itself entangled in a web of losses reminiscent of the infamous Luna debacle, albeit at a price that could make one weep-$67,000, not the paltry $19,000 of yore.

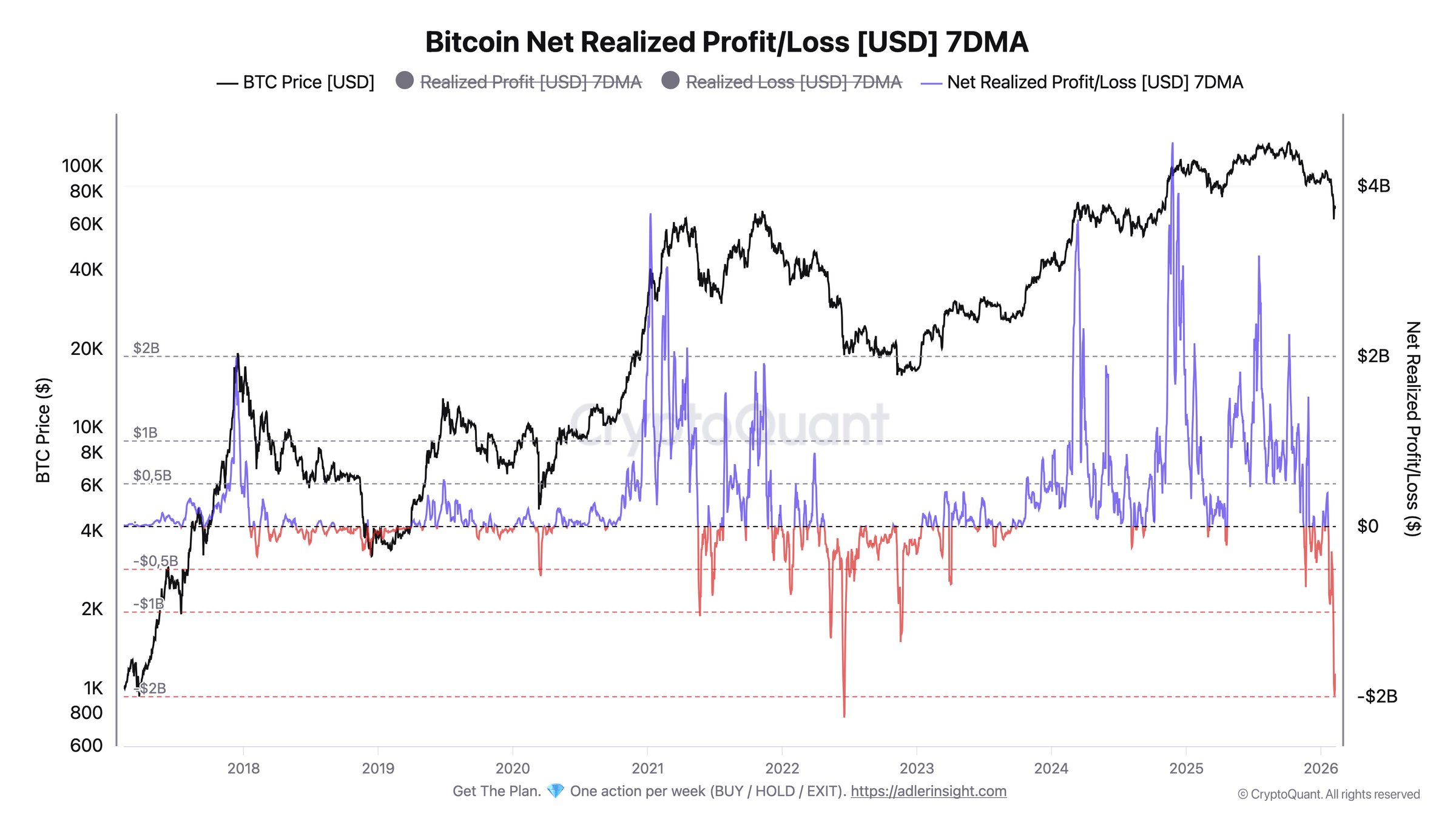

Our astute analyst, Axel Adler Jr., reports with a flourish that Bitcoin’s Net Realized Profit/Loss has plunged into the abyss of negativity, reaching a disheartening -$1.99 billion on February 7th, before showing a hint of improvement to a mere -$1.73 billion by the 10th. Truly a remarkable feat, placing our beleaguered Bitcoin among the most grievously loss-laden periods ever recorded. One might even say it rivals a tragic opera, where the only thing left to lose is one’s sanity.

Adler cleverly points out that this is not just a passing storm; no, dear reader, it is a relentless tempest. For five consecutive days, Net Realized Profit/Loss has wallowed beneath the cursed threshold of -$1.7 billion, creating a veritable cluster of seller pressure. It is as if the market itself is staging an elaborate performance of capitulation, rather than a simple gasp of shock.

In Adler’s ingeniously simple terms, realized losses have taken center stage, dominating profits like a diva at an opera. The market, it seems, is wading through the murky waters of supply owned by those unfortunate souls compelled to sell at a loss, all while clutching their pearls.

“The depth and duration of this current negative regime,” he muses, “could indicate a mass exodus of participants who once danced with delight at higher prices.” How poetic! The true harbinger of change, he insists, would be the moment when Net Realized Profit/Loss triumphantly ascends back above zero, signalling a transition from loss to profit dominance. Until then, the specter of seller pressure looms large.

The Bitcoin Tragedy: Losses to Rival the Great Luna Crash

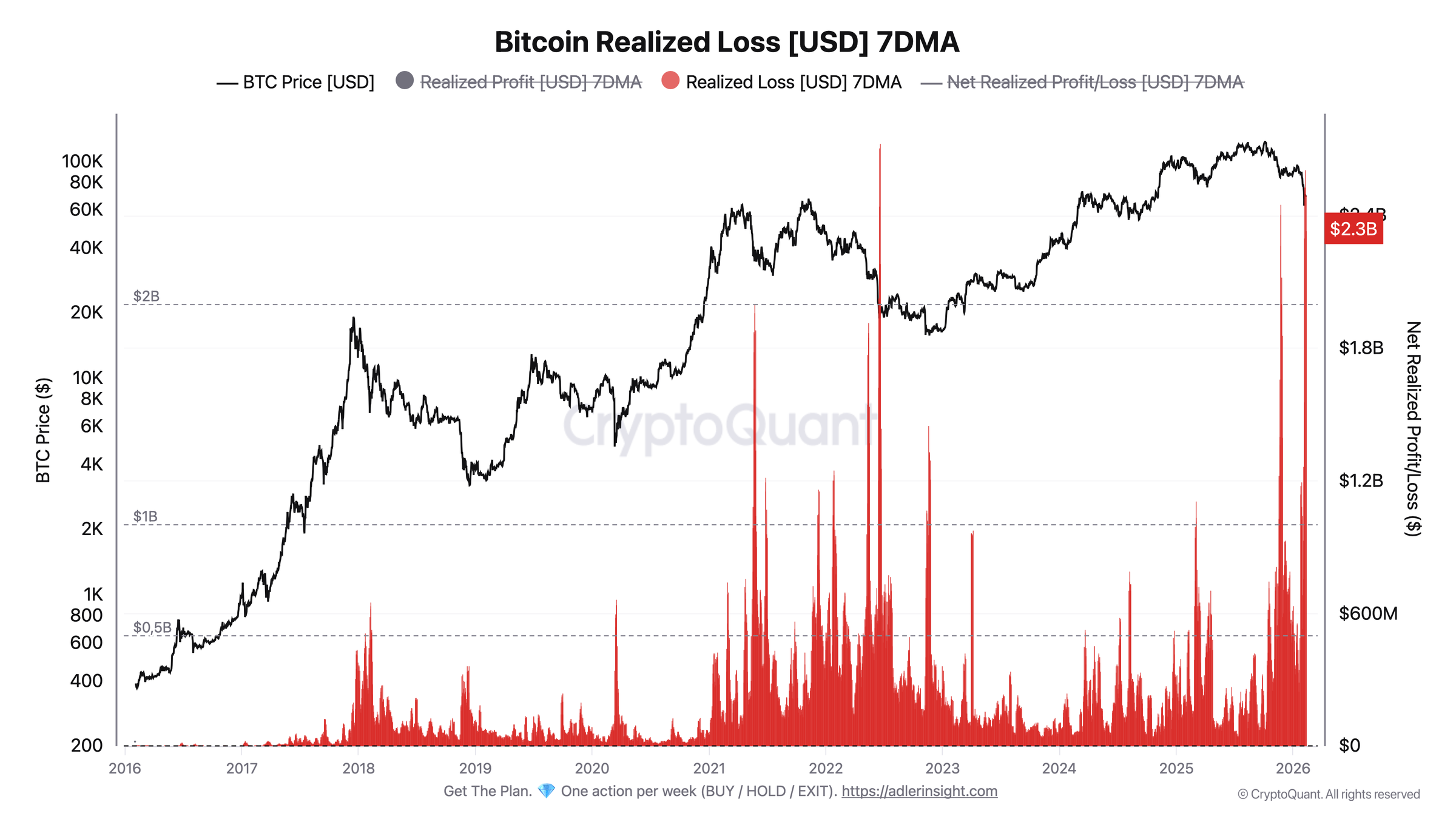

Behold the accompanying chart, for it reveals a tale of woe: Bitcoin Realized Loss (7DMA) soaring to approximately $2.3 billion on February 7th and stubbornly hovering around this level through the 10th. Adler dubs this one of the highest smoothed levels ever recorded-indeed, a tragedy worthy of Shakespeare himself!

He adds with a wink that the 7-day smoothing merely understates the real-time panic. The heights of despair witnessed in 2022 were so profound that single-day losses far eclipsed any weekly averages. Just on February 5th, we witnessed a staggering realized loss of $6.05 billion-an impressive feat, if one can call financial ruin impressive.

Yet, let us not forget the setting: in 2022, such losses were observed at the humble price of $19,000. This time, however, our dear Bitcoin is shedding tears around the much loftier price of $67,000-a context that Adler suggests resembles a cleansing of latecomers rather than a cataclysmic failure of the entire ecosystem.

“Then, the loss at $2.7 billion was akin to a small tempest,” he quips. “Now, comparable volumes are manifesting at a princely $67,000, suggesting a mere flushing out of overzealous buyers, rather than a fundamental catastrophe.” How delightfully optimistic!

Adler lays forth two critical markers: first, a consistent rise of Net Realized Profit/Loss back above zero for multiple weeks, heralding a shift from loss to profit. Second, a dip of Realized Loss below $1 billion, which would indicate that the wave of forced selling is receding. Simple as pie, one might say, though the market’s recipe often includes a dash of chaos.

However, caution is warranted; as Adler warns, should the market’s “cleansing stress” evolve into something more dire, we may find ourselves on the precipice of full-blown capitulation-not due to minor losses, but because the storm may lengthen and intensify.

As we linger in this dramatic landscape, Adler’s assertion remains: Bitcoin is generating signals of Luna-like proportions, yet without the structural calamity that accompanied it. A curious tale indeed, where the magnitude is similar, but the narrative diverges.

And as the clock ticks on, BTC trades at $67,924-a number that, like a fine wine, may age well or sour with time.

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Gold Rate Forecast

- Star Wars Fans Should Have “Total Faith” In Tradition-Breaking 2027 Movie, Says Star

- KAS PREDICTION. KAS cryptocurrency

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Christopher Nolan’s Highest-Grossing Movies, Ranked by Box Office Earnings

- Jujutsu Kaisen Season 3 Episode 8 Release Date, Time, Where to Watch

- Jason Statham’s Action Movie Flop Becomes Instant Netflix Hit In The United States

- Jessie Buckley unveils new blonde bombshell look for latest shoot with W Magazine as she reveals Hamnet role has made her ‘braver’

- How to watch Marty Supreme right now – is Marty Supreme streaming?

2026-02-12 11:20