Ah, the ever-dramatic Bitcoin Open Interest, which has recently taken a nosedive that would make even the most seasoned acrobat blush. One can only wonder what this might portend, as history has a way of repeating itself—often with a rather sardonic twist. 🤔

Bitcoin Open Interest Has Dropped 17% In Last Week

According to the illustrious CryptoQuant analyst Maartunn, in a post that surely sent ripples through the digital ether, the 7-day change in Open Interest has plummeted with all the grace of a lead balloon. The “Open Interest,” for those unacquainted, is a rather fancy term for the total number of Bitcoin positions still hanging around on derivatives exchanges, like unwanted guests at a dinner party.

When this metric rises, it’s a sign that investors are throwing caution to the wind and opening fresh positions, often with more leverage than a circus performer on a tightrope. Naturally, this leads to a delightful increase in volatility—because who doesn’t love a little chaos in their financial life?

Conversely, when the indicator descends, it suggests that derivatives holders are either voluntarily closing their positions or being unceremoniously liquidated by their platforms. Such a trend might lead to a more tranquil price action, which is about as exciting as watching paint dry. 🎨

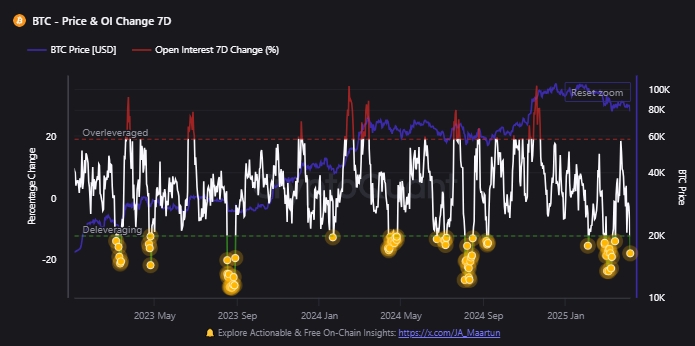

Now, feast your eyes on the chart shared by our dear analyst, which illustrates the 7-day change in Bitcoin Open Interest over the past couple of years:

As one can see, the 7-day average has recently plunged into the negative abyss, suggesting that a veritable host of positions have vanished from the market faster than a magician’s rabbit. 🐇

Specifically, this indicator has suffered a staggering 17.8% decline, coinciding with Bitcoin’s recent volatility that has triggered a veritable bloodbath of liquidations. It’s almost poetic, really.

In the chart, Maartunn has highlighted instances of similar deleveraging over the past two years, which, amusingly enough, often coincided with Bitcoin hitting rock bottom. Perhaps this latest crash is merely a prelude to another buying opportunity, or perhaps it’s just the universe’s way of keeping us on our toes.

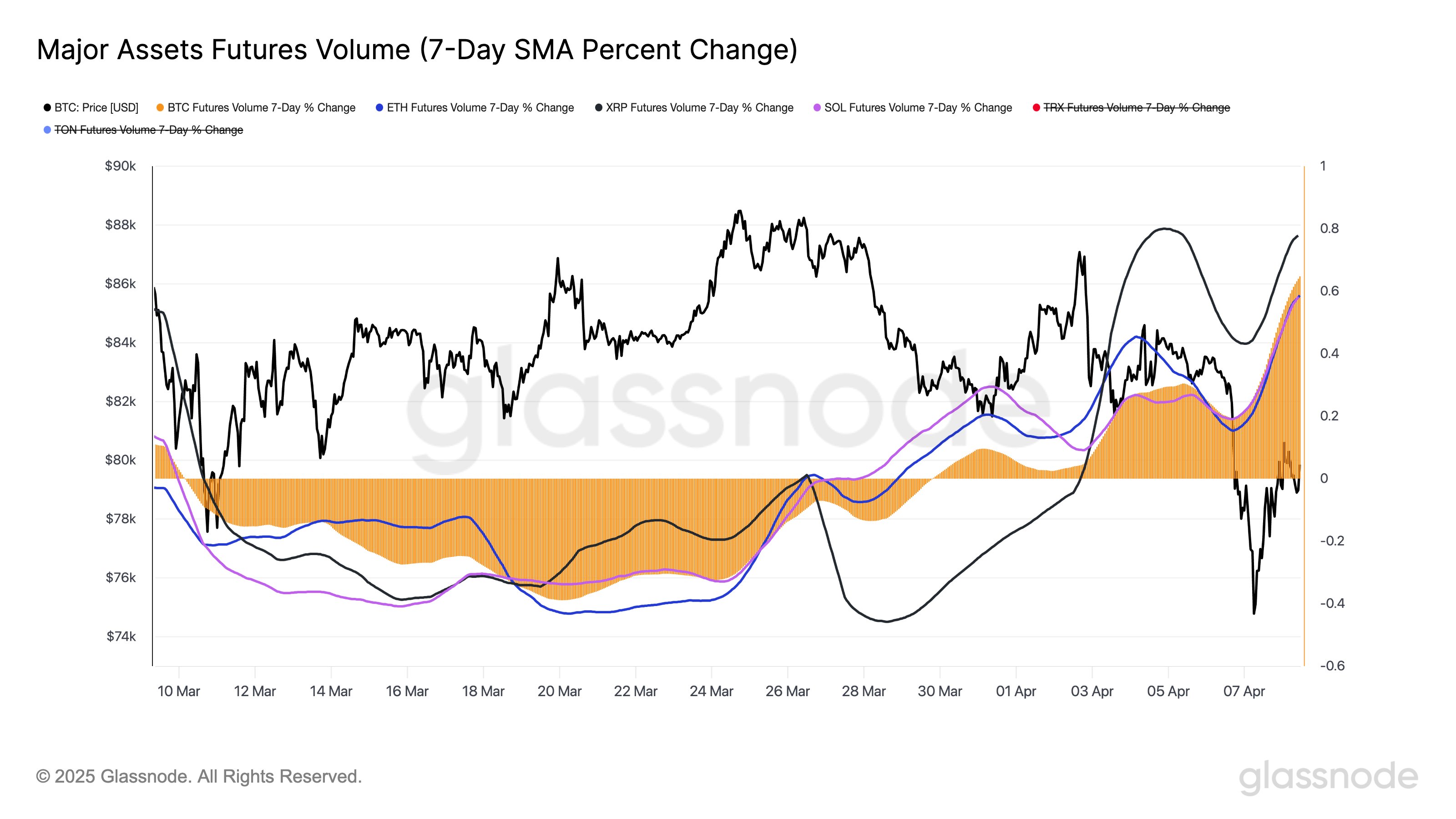

Speaking of the futures market, the analytics firm Glassnode has shared a delightful post on X, detailing how the futures volume has recently changed for major digital assets. Spoiler alert: it’s not all doom and gloom!

From the chart, it’s clear that futures volume for Bitcoin, Ethereum, XRP, and Solana was on a downward spiral last month, but recently, it has reversed course. It’s like watching a soap opera—just when you think it’s over, the plot thickens!

In the past week, volume on derivatives exchanges has surged for BTC, ETH, XRP, and SOL by 64%, 58%, 78%, and 58%, respectively. This significant uptick suggests a return of speculative interest, which is as welcome as a surprise party—if you like surprises, that is.

BTC Price

As of this very moment, Bitcoin is trading at a rather respectable $77,900, up nearly 5% in the past day. Who knew that a little drama could be so profitable?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-04-09 17:14