Oh, what a thrilling spectacle we have here! Bitcoin, that ever-dramatic cryptocurrency, is just days away from printing another “death cross.” Yes, the 50-day moving average will dip beneath the 200-day, and analysts are already sharpening their keyboards to talk doom and gloom. But wait! Don’t let the name fool you, for as the insightful Kevin (aka Kev Capital TA) would argue, this so-called “death cross” is more like an overdramatic, somewhat poorly-scripted soap opera that we just can’t stop watching. 💀📉

In a video released on November 12, titled “BTC Daily Death Cross – How It Works And What To Expect,” Kevin enlightens us with a revelation: every single death cross this cycle has happened near the end of corrective phases. In simpler terms: it’s not the beginning of an apocalypse, it’s just the final stretch of a bumpy ride. He gives us a warning, “Don’t buy into the posts screaming, ‘Oh my god, death cross on the daily, we’re going down 80%!’” Because, spoiler alert, that’s not how these things play out. It’s like the warning signs that show up after the train has already passed the station.

What The Bitcoin Death Cross Means

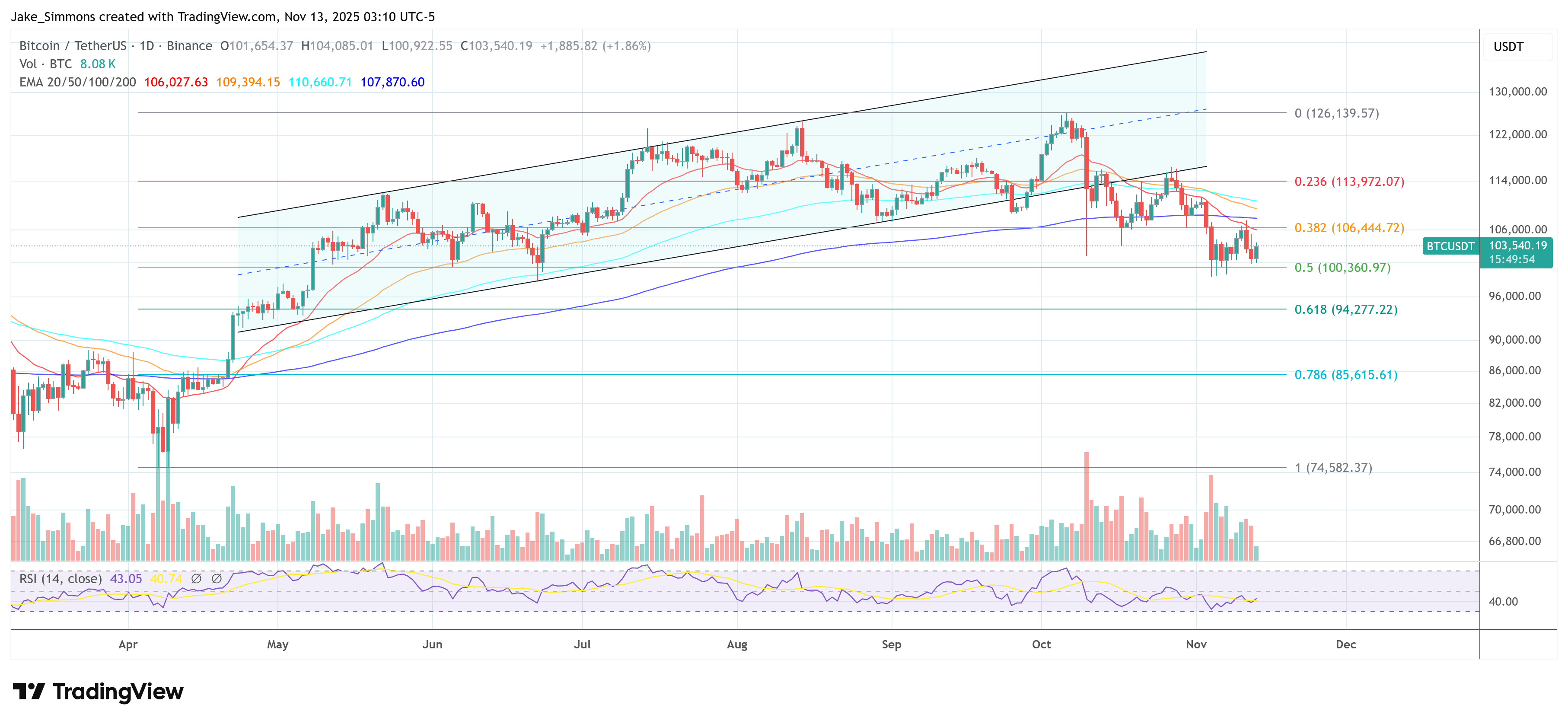

Kevin breaks it down for us with all the precision of a seasoned historian. Apparently, the market this time around hasn’t been behaving like those glorious 2017 or 2020-2021 periods, where Bitcoin just blasted off to the moon and ignored all moving averages like they were speed bumps. Oh no, this cycle is a different beast entirely. We’ve had long pauses of 114 to 174 days, where prices ground sideways, down, and then – tada! – back up again. Each of these pauses caused the 50-day moving average to dip just enough for a “death cross.” But don’t worry, this usually happens near the tail end of these corrective phases. 📊🕰

Kevin reminisces about the three previous crosses, and oh, what a journey it’s been. In 2023, after Bitcoin got tossed around like a ragdoll in the post-$30k range, the death cross actually marked the end of the correction. Bitcoin chopped around for a while, then rocketed from $25k to $73k like it had just found a magic potion. Altcoins went berserk, jumping anywhere from 5x to 10x. A good time, no? 😎🚀

Then came 2024, with its mid-cycle top in March, followed by the grueling year-long grind into the US election. A single “16% candle on one day” just skewered the lows right before the cross, and the cross itself arrived after the damage was done. The result? A two-month chop followed by a Q4 recovery fueled by the excitement of the election and a Fed policy shift. Bitcoin eventually sailed to around $110k. 💵💫

2025? Oh, the market was cleaner than a freshly waxed floor. The death cross marked the bottom of the correction, and the recovery was immediate. Yet Kevin sums up the year with a dose of reality: “2025 has been a year of reclamation rather than expansion.” In short, we barely made a new all-time high, and the sentiment? Let’s just say it could use a pick-me-up. 😓📉

The catch here is that these moving averages are like that one friend who always arrives fashionably late to the party. The move that causes the death cross has already happened by the time the averages cross each other. Kevin lays it out: “When a death cross happens, almost 100% of the time you’ll see a retrace back up to the moving averages.” The key question is, will Bitcoin bounce and reclaim them with authority, or will it just pathetically hover below? 🧐📈

Now, here’s the all-important question: Can Bitcoin reclaim the $106.8k level on weekly closes? If it does, it’s got a shot at making a new all-time high. If not, well… then it’s just another weak cycle in the books. Kevin points out that this isn’t some uncharted territory: “The four-year cycle just played out normally, and Bitcoin just had a really weak cycle,” with altcoins not exactly delivering the classic “alt season” performance. Ouch. 😬🛑

What Comes Next For BTC?

As if the situation wasn’t confusing enough, Kevin points out that there’s a bit of a debate about how we should measure the four-year cycle: from the bottom or from the halving. And if that’s not confusing enough, the whales – those grandmasters of the market – have been offloading Bitcoin like they’re cleaning out their closets. “Whales that have been holding since the Satoshi era are unloading their Bitcoin,” Kevin observes. But hey, Bitcoin is still hanging around at $105k, despite all that sell pressure. Go figure. 🐋💸

And let’s not forget the macro backdrop. With restrictive monetary policies sucking liquidity out of the system, Bitcoin’s been facing some serious competition from AI-driven equities that are riding high. Meanwhile, the Russell 2000 just broke out of its funk. So, yeah, crypto’s underperformance isn’t exactly a surprise. 🙄📉

Looking ahead, Kevin suggests we brace for a “clean market test.” The death cross is coming soon, and traders should prepare for a possible response toward the moving averages. The real drama will unfold depending on whether Bitcoin can clear the $106.8k level and convert it into support. If it does, we could be in for a new high. If not? Well, let’s just say it won’t be pretty. 😅💀

The grand punchline? Despite the name, the “death cross” has yet to kill Bitcoin. Four crosses in one cycle is unprecedented, and the last three have coincided with the end of corrective phases, not the beginning of a collapse. As Kevin puts it: “The death cross everyone fears has marked every bottom so far.” So don’t panic, folks, it’s just the same old song and dance. 🎶💁♂️

At press time, Bitcoin traded at $103,540. That’s right, we’re still here, people! 🙌💰

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-11-13 15:32