One must observe, with no small amount of amusement, that Bitcoin (BTC), that most capricious little digital cherub, presently finds itself propped above the formidable sum of $115,000 this fine Wednesday, the 17th of September. This stability comes in the wake of the United States Federal Reserve’s latest declaration-an act of great theatrical subtlety, one might say-wherein they reduced their rates by a modest 25 basis points, descending from 4.50% to a slightly less daunting 4.25%. Not quite the dramatic half-percentage drop that gossipmongers and market prophets anticipated, alas.

Such a half-hearted cut follows the rather alarming heat of consumer inflation figures recently revealed, leaving many a speculative trader quite unsure as to the Fed’s true intentions for the coming seasons-more akin to reading tea leaves than comprehending official documents.

US Federal Funds Rate Trends, 2025 | Source: TradingEconomics, September 17, 2025

One must commend the Federal Open Market Committee (FOMC) for their subtlety and caution, as expressed in their carefully worded statement, hinting at the perils of a labour market perhaps losing its usual vim, with a slight uptick in unemployment casting a shadow over the horizon. How delightfully suspenseful.

Nonetheless, the committee clings to the hope of further rate reductions to the tune of 50 basis points before the year concludes, though when these might transpire remains as mysterious as the true intentions of any heroine in a sudden plot twist.

Fed Decision Causes but a Teeny Ripple-Market Liquidations Remain Frozen Despite Gold’s Glittering Rise

Earlier this very week, the noble metal Gold took it upon itself to ascend to unprecedented heights-above $3,700, of all things-thus inspiring fears among some that mighty crypto liquidations might cascade forth should the Fed disappoint. Yet, the derivatives market, ever the pragmatist, suggests the calamity was little more than a vexing frown upon the day.

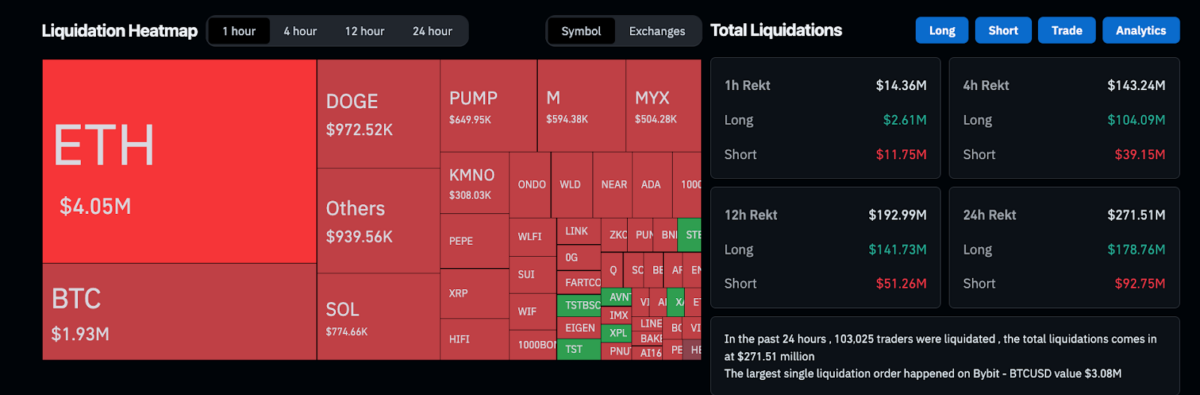

Crypto market liquidations, September 17, 2025 | Source: Coinglass

As reported by the venerable Coinglass, the sum of crypto market liquidations over twenty-four hours reached a tidy $267.44 million-divided rather sensibly into $178.64 million in longs and $88.81 million in shorts. Curiously, only $36.19 million of this grand total transpired in the hour succeeding the Fed’s proclamation, suggesting the market, much like your most composed governess, maintained its composure, abstaining from unseemly panic.

The Bulls of Bitcoin Stand Their Ground, As the Potential for a Short Squeeze Tantalizingly Looms at $118K

Now, let us turn our attention to the liquidation maps, which-if you will pardon the comparison-function much as the social gatherings of our most fashionable acquaintances, revealing where allegiances and rivalries lie. At first glance, the bears appear quite stout-hearted, with a formidable $3.3 billion in shorts overshadowing the $2.3 billion amassed by the longs.

However, upon closer inspection, one notes that over 35% of these longs flock near the price of $114,458, where a staggering $814 million sits poised, as if on a powder keg awaiting but a spark. With the day’s total liquidations but a humble $267 million, these positions seem destined to endure-suggesting a most promising setup for a spirited rebound should the bulls keep their nerve above $114,500.

Bitcoin Liquidation Maps as of September 17, 2025 | Source: Coinglass

Looking upwards, the shorts cluster stoutly around $118,000-a haunt where more than $1.8 billion might face ignominious liquidation. Absent any more daunting resistance, a triumphant surge beyond this threshold could ignite a short squeeze the likes of which would nudge Bitcoin’s price towards the august peak of $124,500 last seen in the fragrant month of August.

Unless trading volumes find some courage to swell, one supposes Bitcoin will repose between $114,000 and $118,000, much like a genteel lady at a ball, cautious yet hopeful, while the Fed’s murmurs of unemployment risks continue to hover like an expectant matron overseeing the proceedings.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- All Brawl Stars Brawliday Rewards For 2025

2025-09-18 03:45