It is with no small measure of astonishment that I must inform you, dear reader, that a most significant Bitcoin (BTC) on-chain metric has recently vacated the “buy” zone, thus indicating a rather alarming transition from the low-risk accumulation conditions we have so fondly embraced. Yet, fear not, for the market still exhibits traces of bullish strength, as if it were a gentleman attempting to maintain his composure at a ball despite a rather unfortunate wardrobe malfunction. 🎩😅

Bitcoin On-Chain Indicator Urges Caution

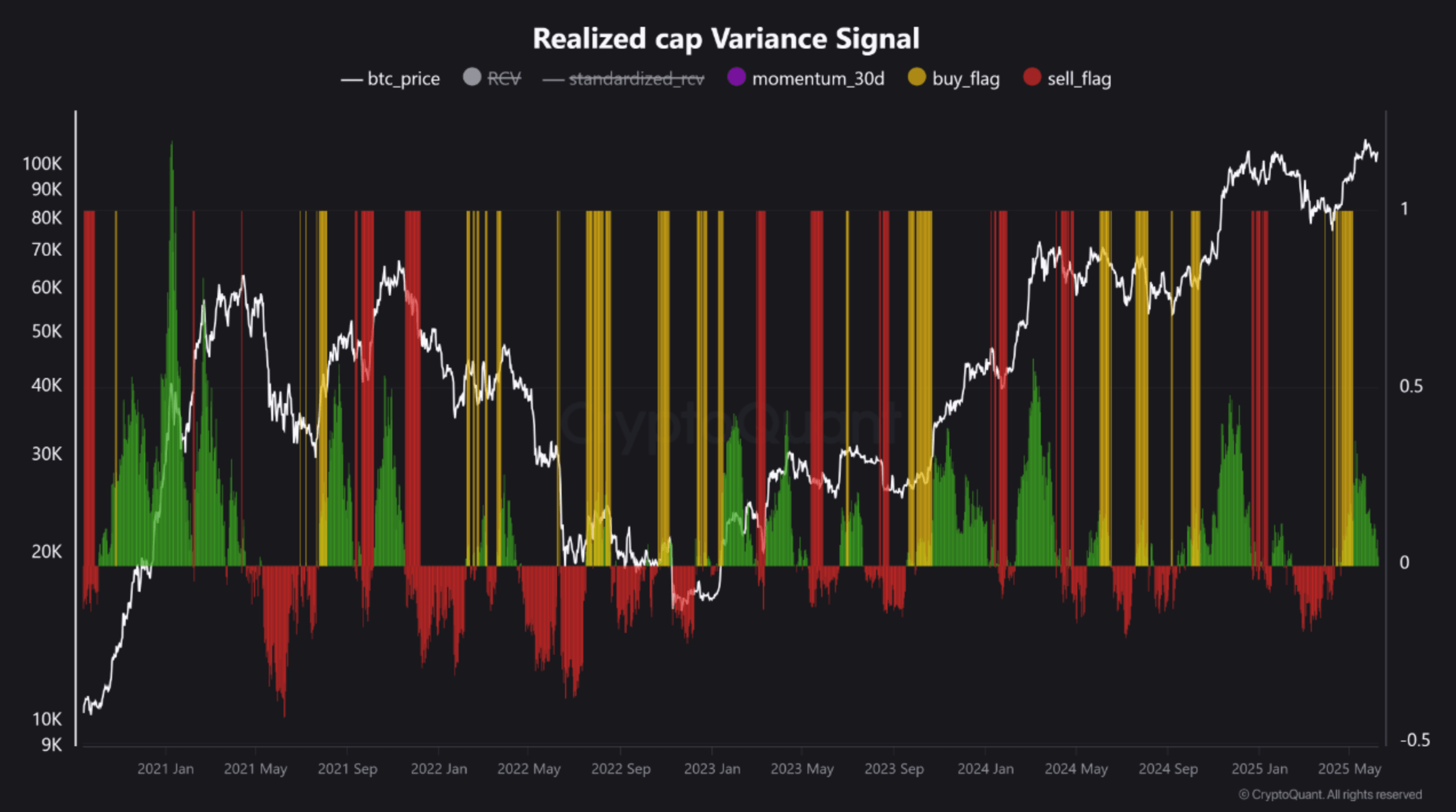

In a most enlightening post by the esteemed contributor Crazzyblockk on CryptoQuant Quicktake, it has been revealed that Bitcoin’s Realized Cap Variance (RCV) has taken its leave from the “buy” territory, thereby cautioning BTC holders of a potential price correction. One might say it is akin to a warning from a wise aunt about the perils of dancing too close to the edge of the ballroom floor.

For those unacquainted with the intricacies of this digital currency, allow me to elucidate: Bitcoin’s RCV measures the volatility of the asset’s realized capitalization over a period of sixty days, reflecting the changes in value of coins based on their last on-chain movement. A rising RCV, dear friends, suggests an increase in market activity and risk, while deeply negative values often align with those delightful low-risk accumulation zones we so cherish.

As illustrated in the following chart, the buy flags—those cheerful yellow beacons—have recently vanished, marking the end of a most favorable risk-reward window. However, the sell flags—marked in a rather alarming red—have yet to make their appearance, largely due to the sustained positive momentum of the past thirty days. One might liken this to a game of musical chairs, where the music has stopped, yet no one has yet taken their seat. 🎶🪑

Historical data suggests that buy flags typically emerge when the standardized RCV is deep in the negative territory, bolstered by an improving trend and upward momentum. Alas, such conditions are no longer present, leaving us to ponder the fate of our beloved Bitcoin.

Meanwhile, the RCV has entered the neutral-to-high-risk zone above 0.3, indicating that the broader Bitcoin market is heating up, much like a pot of water on the stove, and entering a less favorable phase for opening new long positions. Caution, dear traders, is the order of the day!

That said, the thirty-day price momentum remains in positive territory, suggesting that there is still a modicum of bullish energy left in the market. Bitcoin’s recovery over the weekend further supports this view, much like a dashing hero returning from a perilous adventure.

Moreover, a sell flag has yet to be confirmed. According to the astute Crazzyblockk, three conditions must be met for such a flag to be raised: RCV above 1, negative thirty-day momentum, and a declining RCV trend. None of these conditions have yet materialized, leaving us in a state of suspense akin to the final act of a riveting play.

We find ourselves in a risk-elevated phase, but not yet at the heights of extreme euphoria. The smart money accumulation zones are now but a memory. Traders are advised to avoid aggressive purchases, remain vigilant for trend reversals, and consider partial profit-taking should the RCV venture further into overheated territory.

Can Bitcoin Hit A New ATH?

At the time of this writing, BTC is trading a mere 3.5% below its latest all-time high (ATH) of $111,814, recorded on the 24th of May. Yet, some analysts, ever the cautious souls, warn that a sell-off may occur before BTC dares to attempt a new ATH. How very dramatic! 🎭

Notably, Bitcoin miner-to-exchange transfers have recently reached a historic high, indicating an increase in selling activity by miners—potentially adding downward pressure to BTC’s price. It seems our miners are not quite the loyal subjects we had hoped for!

Additionally, the venerable crypto analyst Titan of Crypto has noted that BTC may be forming a Head and Shoulders pattern on the daily chart, suggesting a possible pullback to $96,000. At present, BTC trades at $107,775, having risen 1.7% in the past twenty-four hours. A most curious turn of events indeed!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Wuthering Waves Mornye Build Guide

2025-06-10 08:54