As the mighty Bitcoin hovers near the lofty heights of $112,100, the whispers of analysts grow louder. They speak of a mystical line, one that determines the fate of the great cryptocurrency-its long-term moving average. A dance of cooling momentum and a gap, yes, a CME gap, that has opened like an untouched treasure chest. Ah, the drama unfolds.

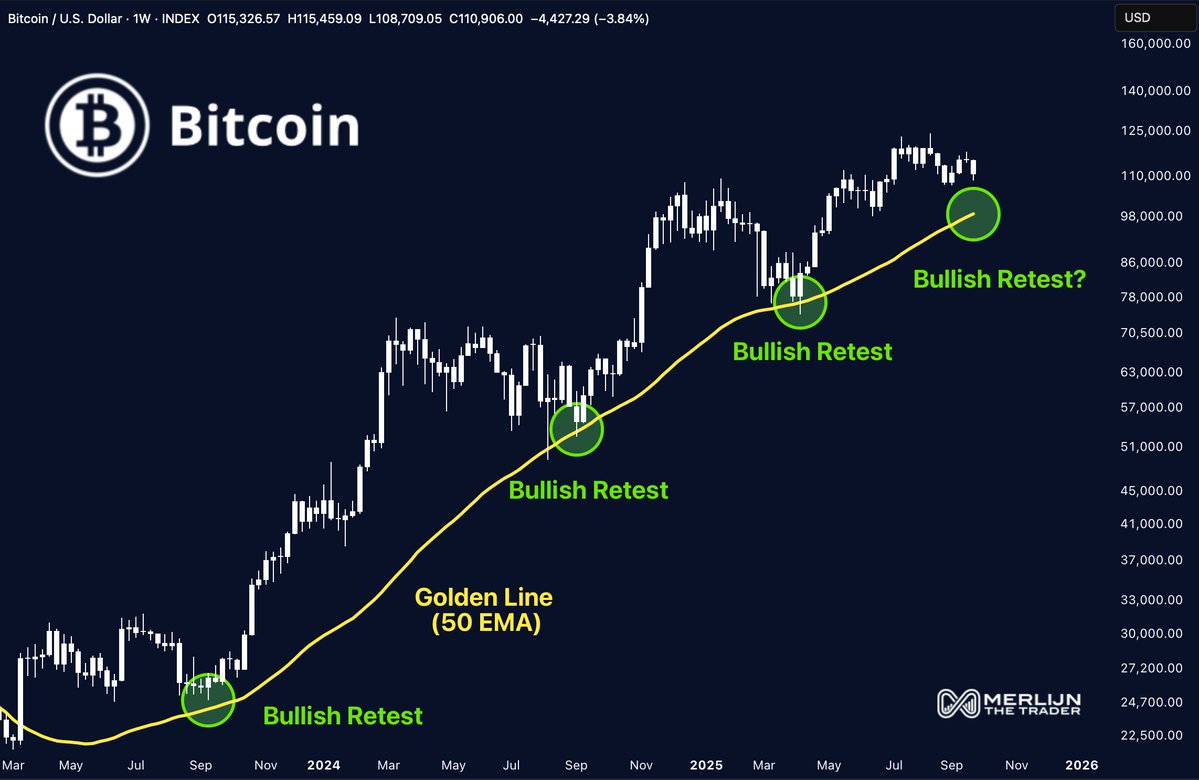

And now, dear reader, traders cast their gazes upon a seemingly magical threshold. A line that, like a wise elder, holds the power to guide them through the final quarter of 2025. Oh yes, this is the 50 EMA, that shimmering “Golden Line” that all are now watching with bated breath.

The 50 EMA: A “Cheat Code” or Just a Line in the Sand?

Merlijn The Trader, a name that surely strikes fear into the hearts of the uninitiated, boldly calls this 50-week exponential moving average the “cheat code” for Bitcoin. How very dramatic! His charts, it seems, are like sacred scrolls, showing the repeated retests of this level through 2023, 2024, and now, 2025. Each test, it seems, heralded what Merlijn describes as a “Bullish Retest,” after which the price rose like a phoenix to new highs. Truly, a saga for the ages.

But now, dear friends, Bitcoin approaches the 50 EMA once more, sitting just below $100,000. The great Merlijn himself declares:

“All bounces are vertical rallies. Every break is capitulation. Q4 survival or destruction depends on this line.”

Yes, this line-this humble line-might just be the fulcrum upon which the future of Bitcoin tilts. Will it hold? Will it break? Only time will tell, and traders, like the valiant knights they are, watch closely.

Momentum Cooling… Or Is It Just a Breeze?

Ah, but the winds of momentum are fickle, my friends. According to the wise sages at CryptoQuant, the 30-day momentum index has taken a turn towards the neutral-to-bearish side. How ominous! The buying strength, once so mighty, now fades like the last whispers of a summer breeze. More downside risk looms, and the traders tremble.

Bitcoin, ever the dramatic actor, recently dropped from $115,400 to a humble $108,600. This new level of $108,600 now stands as a support-oh, how the mighty have fallen! Resistance, meanwhile, lurks between $111,000 and $112,000. An ominous balance in the tale.

The CME Gap: A Gaping Mystery

Ah, and here we have the CME gap-a riddle wrapped in an enigma. Bitcoin CME futures opened with a gap between $110,500 and $111,300. A gap! Unfilled, like an unfinished symphony. The price later soared to $112,930, leaving the gap to haunt us. How mysterious! But analyst Daan Crypto Trades, with all the wisdom of a fortune-teller, notes that CME gaps often close swiftly, yet adds with a knowing smile:

“It has been quite a while since we did open with a gap like this.”

And so, the question lingers: Will Bitcoin close this gap? Daan Crypto believes it will remain untouched-at least, until BTC dips below $111K. And if that happens? Well, the gap could soon be closed, like the final curtain on a tragic play. If support holds, however, the gap may remain open, like an unresolved mystery that continues to linger in the air.

And so, Bitcoin remains trapped in a tight range. The 50 EMA, like a beacon in the fog, stands as the critical level for Q4. Will it rise like the sun after a storm, or fall into the abyss? One thing is certain-the fate of Bitcoin hangs on this simple line.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-09-29 19:36