Oh, how the mighty Bitcoin (BTC) has decided to play the game of patience, or perhaps it’s merely taking a leisurely stroll through the garden of indecision. In the past day, BTC has shown a remarkable talent for standing still, much like a statue in a particularly dull museum. After its recent attempt to scale the dizzying heights of $110,000, our dear cryptocurrency found itself politely rejected, and now it languishes within a descending consolidatory channel, leaving the bull market to ponder its fate with a furrowed brow and a sigh.

Amidst this atmosphere of uncertainty, the ever-astute market analyst, Ali Martinez, has emerged from the shadows to shed some light—or perhaps a spotlight—on two critical support levels that could very well determine the next act in this grand drama.

On-Chain Data Reveals Strong Bitcoin Support At $106,500 And $98,500

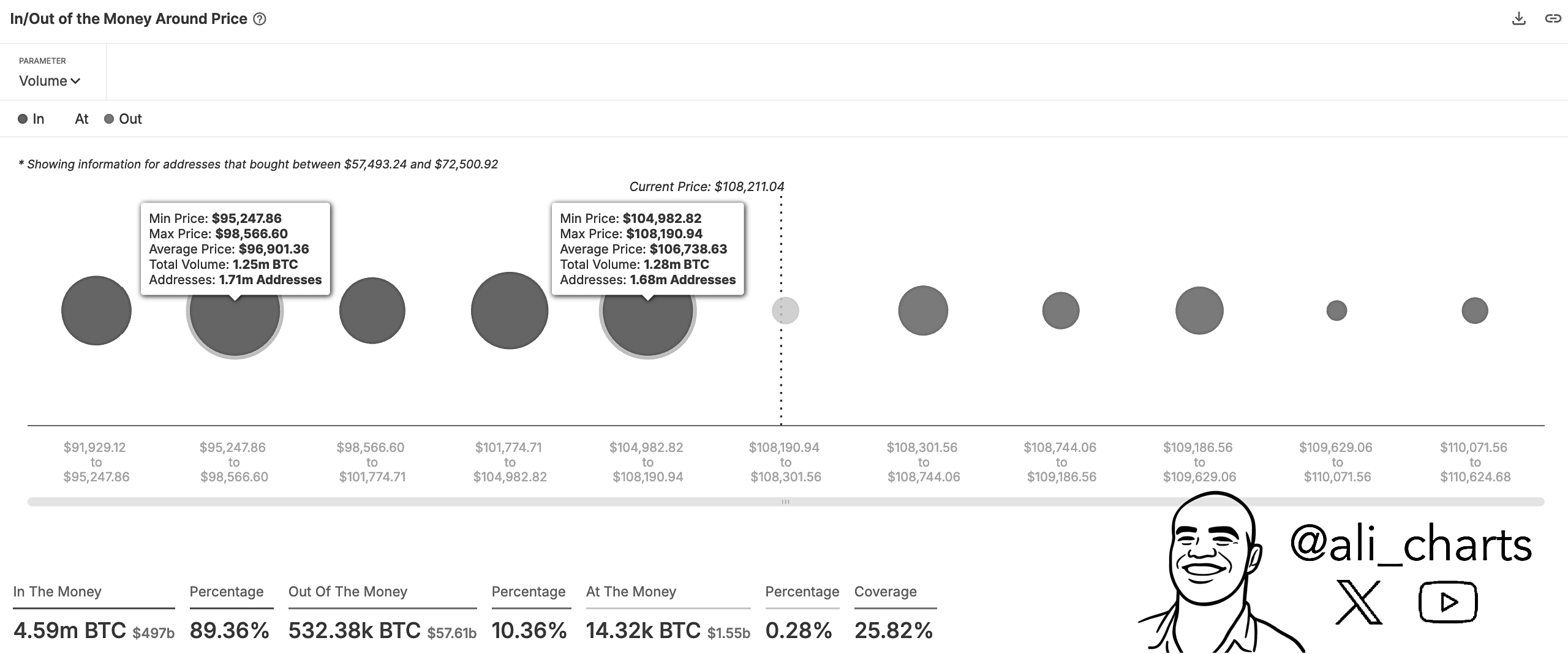

In a recent X post on July 5, Ali Martinez shared a piece of on-chain wisdom that could be as impactful as a well-placed quip at a dinner party. Using data from the In/Out Money Around Price (IOMAP) Chart from Sentora, Martinez reveals that major support zones have emerged, much like the ghost of Christmas past, to haunt the BTC market with their potential influence.

The IOMAP chart, a veritable treasure map for the discerning investor, analyzes Bitcoin wallet addresses and the average prices at which they acquired BTC, offering a glimpse into the psychological battlefields of buying and selling pressure. It tells us where holders are currently in profit—“in the money,” or at a loss—“out of the money.”

From this chart, it is clear that 1.68 million addresses bought 1.28 million BTC between $104,982 and $108,190, with an average acquisition price of $106,738. Such a concentration of buying activity is like a fortress, a bastion of support that could very well defend BTC from the hordes of bears. Thus, the $106,700 range stands as a formidable near-term support level, a line in the sand that BTC must not cross without a fight.

A second significant support level is identified in the $95,247 to $98,566 range, where 1.7 million addresses acquired 1.25 million BTC at an average price of $96,901. Should BTC falter above $106,000, this lower range would act as the next major cushion, a soft landing for the cryptocurrency should it decide to take a tumble. However, a decisive price close below $96,901 would be a clear sign that the bears are in control, and the market is ready to dance to a different tune.

Bitcoin Market Overview

According to the IOMAP chart, around 89.36% of all BTC addresses are “in the money,” a fact that would make any investor smile. This suggests that the majority of market participants are in profit, a bullish signal that could keep the selling pressure at bay. Meanwhile, only 10.36% of addresses are “out of the money,” a small enough number to prevent a widespread panic, unless, of course, BTC decides to break below these critical levels, in which case all bets are off.

At press time, the premier cryptocurrency continues to trade at $108,154, reflecting a modest 0.24% gain in the past day. However, its daily trading volume is down by 27.09%, valued at $31.04 billion, a reminder that even the most elegant of dances can sometimes be a bit less lively than one might hope.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-07-06 12:42