Ah, Bitcoin. Always a drama. Up one day, down the next. Like a fickle summer romance. Last week it strutted ahead by a respectable 4.0%. But is it all a mirage? A fleeting dream before the harsh dawn? 🧐

Whispers abound, you see, about the peak. The dreaded market top. A CryptoQuant fellow, name of Burak Kesmeci, has spotted signs. Four of them, no less. Ominous on-chain portents of a potential Bitcoin demise… or at least, a rather nasty correction. One never knows, does one?

Do these four cyclicals signal Bitcoin’s market top? Perhaps… perhaps not. Life is full of such uncertainties. 🤷♀️

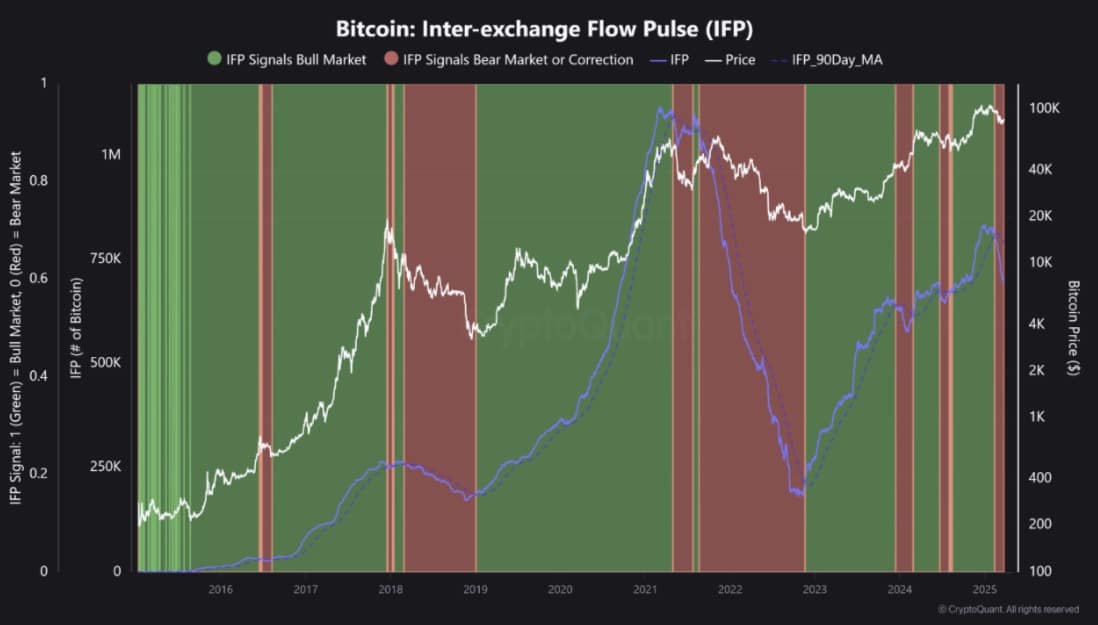

CryptoQuant, with a sigh, points to these harbingers of doom. Or, you know, just a temporary setback. First, the Inter-Exchange Flow Pulse (IFP). Apparently, it’s rather glum.

Currently languishing at 696k, well below the SMA90’s robust 794k. As long as it remains there, nestled below that SMA90 like a hibernating hedgehog, market corrections are, alas, probable.

Remember December ’23 to February ’24? The IFP sulked beneath the SMA90, and then… boom! Once it dared to cross above, Bitcoin soared to $73k. A lesson, perhaps? Or a coincidence? 🤔

Then there’s the CQ Bull & Bear Market Cycle Indicator. A gloomy Gus, signaling bearishness with gusto. It’s shown these weak, bearish patterns before, similar to now. Oh dear.

DMA365 at 0.18, DMA30 at a dismal -0.16. With DMA30 cowering below DMA365, it screams of bearish momentum! A bullish revival? Only when DMA30 bravely leaps above DMA365. Until then, we wait with bated breath. 😟

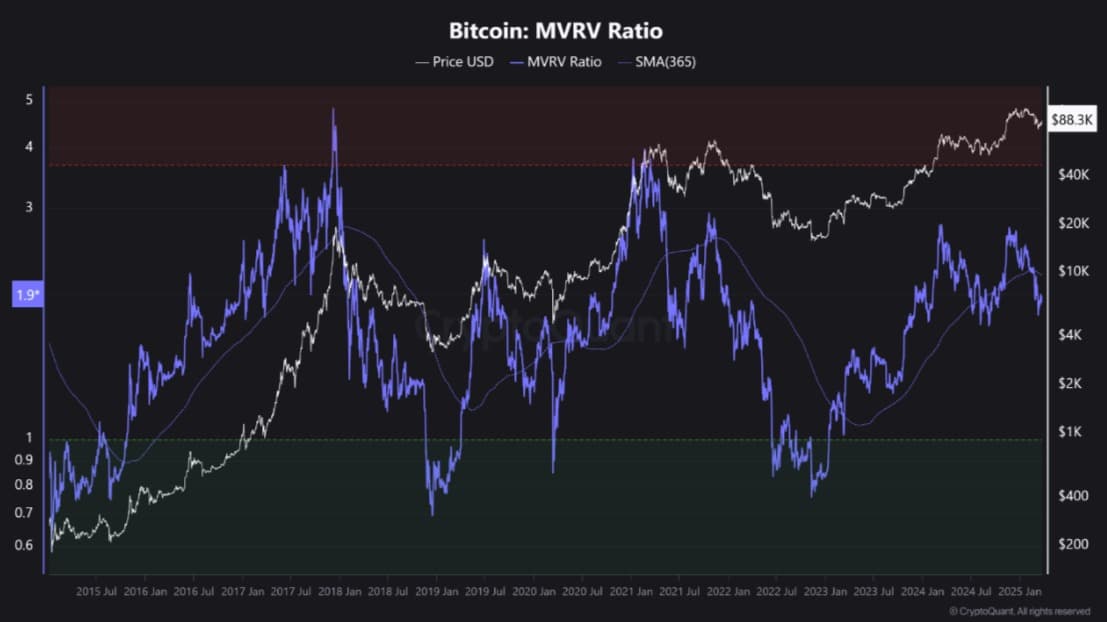

Thirdly, the MVRV Score. It stubbornly remains beneath its SMA365, implying the correction might just linger. Historically, under the SMA365, selling pressure mounts. Like a persistent houseguest. 😒

In this very bull cycle, Bitcoin last slipped below this support during that August 5, 2024, carry trade crisis. Remember that? Once the crisis sputtered out, the MVRV score crawled back above SMA365, signaling a recovery. A phoenix from the ashes, almost.

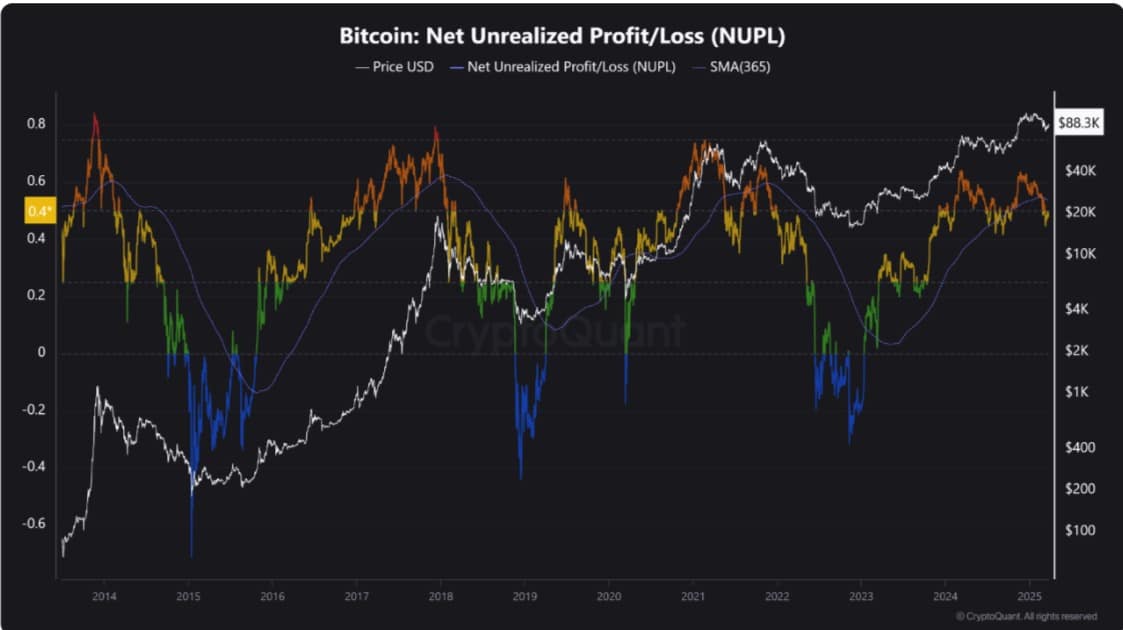

And finally, the NUPL. Below its SMA365. More bearishness! Alone, it can’t seal the bullish trend’s fate, but a recovery demands it clamber above that SMA365. A task, indeed.

Currently, NUPL at 0.49, SMA365 at 0.53. Unless it flips upward, more corrections loom. A rather tiresome cycle, wouldn’t you agree? 😩

So, these four metrics? They hint at turbulent times for Bitcoin. Short to mid-term, mind you. Not an overheated market, nor a cycle-top apocalypse. More like that August 5, 2024, carry trade crisis. Macroeconomic woes dragging Bitcoin down. A familiar story.

Trump’s tariffs, general unease… they weigh on indices and Bitcoin. A year ago, same dance. Pressures eased, Bitcoin recovered. A comforting thought, perhaps?

If history deigns to repeat itself, improved macroeconomics could nudge Bitcoin back up. One can only hope. 🙏

What BTC charts suggest, or, The glass half full.

CryptoQuant frets, but AMBCrypto sees some sunshine peeking through the clouds. The market top? Not quite yet, apparently. Some key players remain stubbornly bullish.

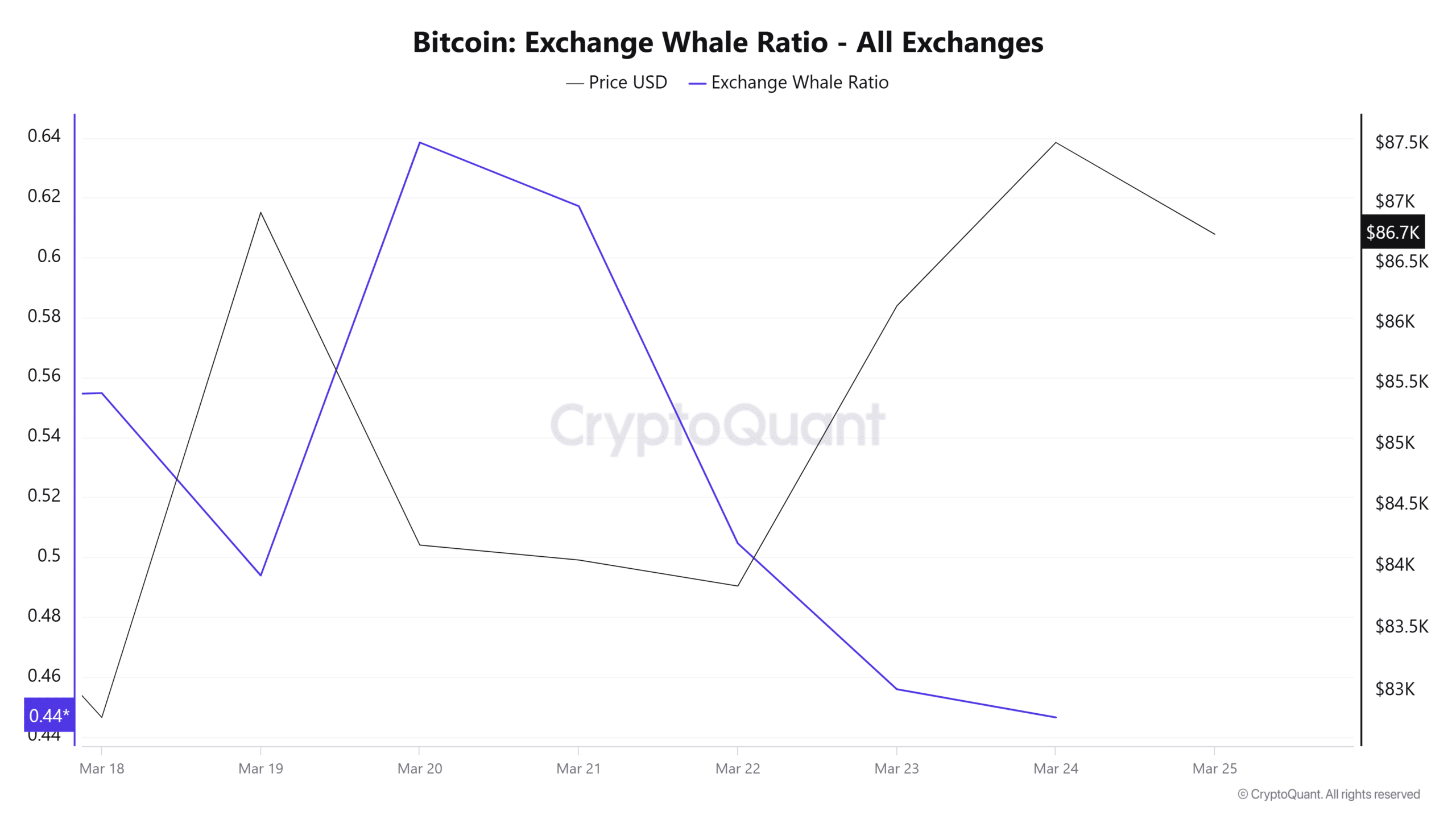

Whales, you see, those magnificent, deep-pocketed creatures, are holding steady. A declining Whale exchange ratio suggests they’re not rushing to sell. Optimism! They expect prices to rise further. Bless their cotton socks. 🥰

Optimism from whales. Reflecting high hopes, with these large entities expecting prices to continue their joyful ascent.

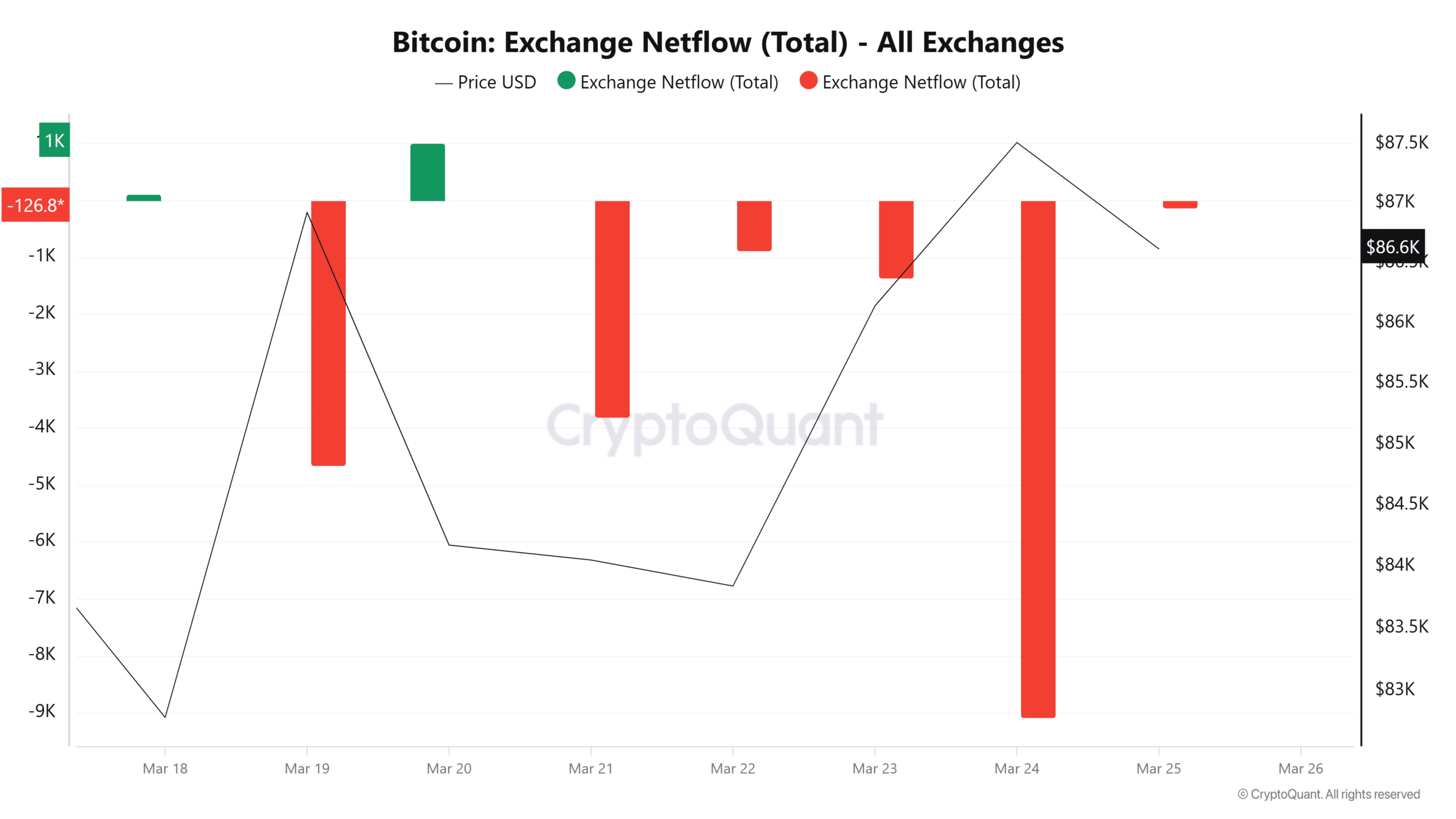

This trend resonates across market participants. Bitcoin’s exchange netflow has been stubbornly negative for five days straight. A streak!

Five days of negative netflow? Buyers are in control, accumulating addresses galore! If they suspected a market top, their behavior would be… different. More frantic, perhaps? More… desperate? 😬

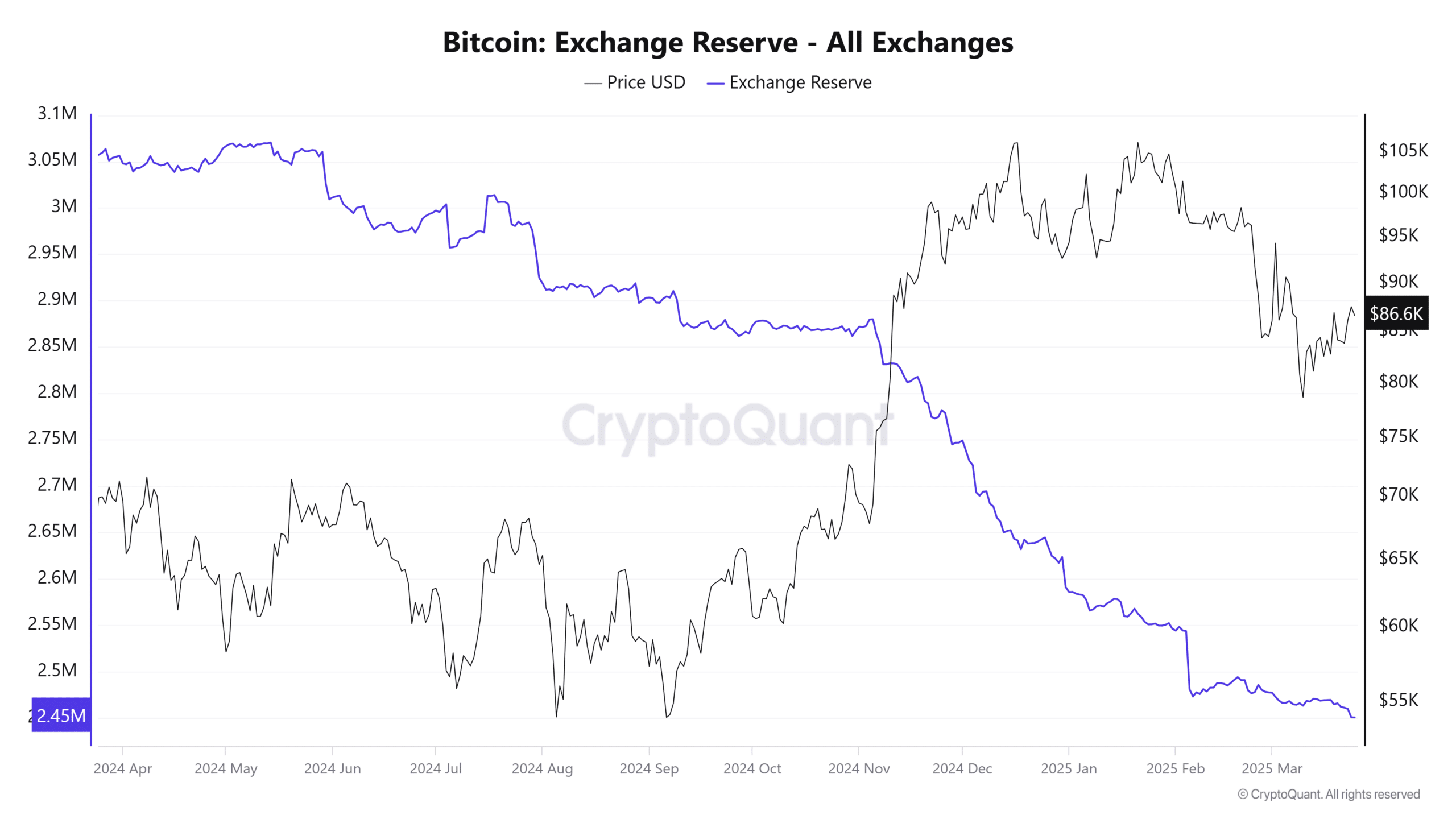

Outflows have caused Bitcoin’s exchange reserves to plummet to a yearly low. Fewer transfers into exchanges, as noted. As long as those inflows stay low, prices should bounce back when conditions improve. A waiting game, then.

In essence, indicators whisper of a potential end, but we’re not quite there. Room for growth remains! Whales and retail investors, united in bullishness. For now, at least. 🤞

If this sentiment holds, BTC might reclaim that $90k level. But if a correction strikes, we could tumble down to $85,222. Such is the nature of Bitcoin. A constant tightrope walk above a pit of potential despair… or boundless riches. Take your pick. 💰

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

2025-03-25 14:36