Bitcoin‘s Big Buzz: Will Shorts Collide with a Squeeze? 🚀

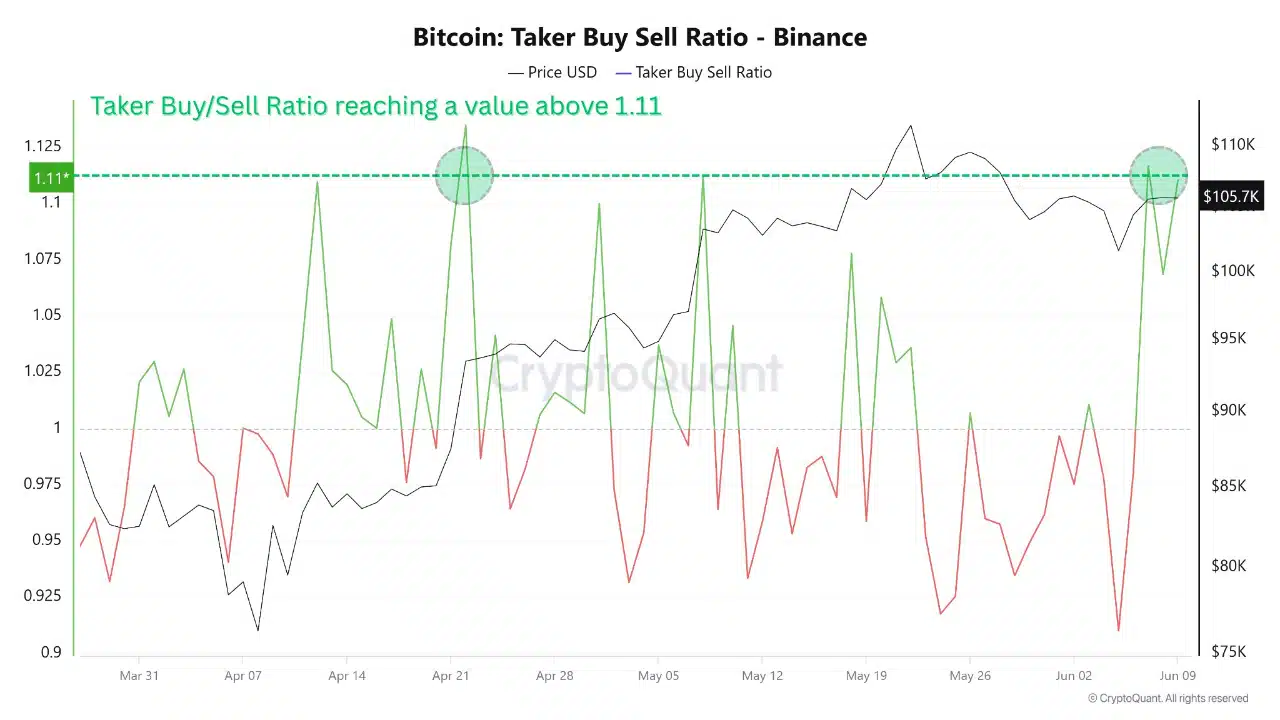

- Buy/Sell Ratio hit 1.1 as the UTXO bands confirmed profit holding among short-term holders — Looks like traders are finally realizing gains. Who knew?

- Long-term holder conviction climbed on the back of short bias, hinting at a potential short squeeze—because what could go wrong?

Bitcoin [BTC], that shiny digital gold, is catching everyone’s eye today. Its Taker Buy/Sell Ratio snuck past 1.1 while the price nipped up to a staggering $107,642. All this while daily gains tiptoed in at 1.84%—progress so bullish it might need a leash. People say the UTXO and long-term signals are flashing green. Well, about time.

The uptick in this Buy/Sell Ratio might suggest that aggressiveness is the new calm—buyers are boldly throwing their hats into the ring. And the UTXO bands reveal a funny thing: recent profiteers are stubbornly holding onto their gains. Seems like short-term traders are all zipped up and ready for another run up—not eager to cash out just yet. Typical, isn’t it? Hooray for hope, and maybe a bit of reckless optimism.

Together, these metrics whisper sweet nothings about confidence. Maybe another uptick is just around the corner—who wouldn’t want that? Market base, anyone? Yeah, we’re riding a bullish wave, and we might not even realize it yet.

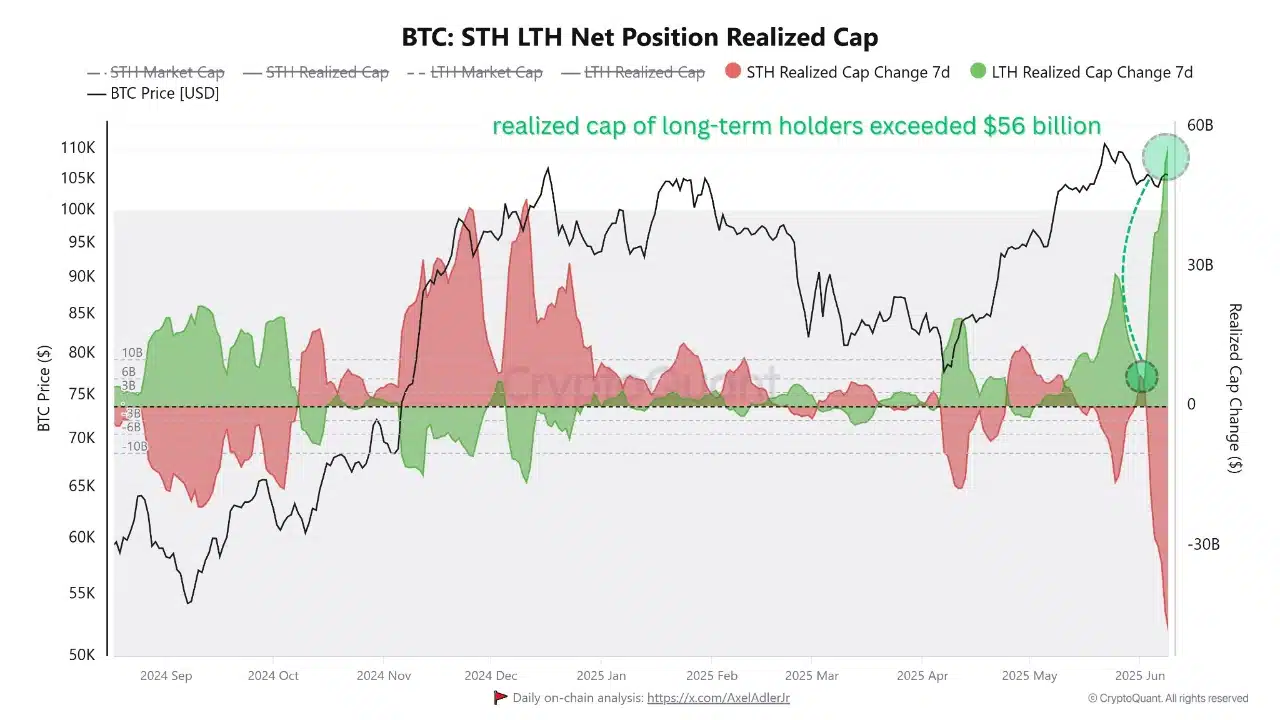

Are long-term holders setting the tone for the next surge? Or just sneaky hoarders?

The Realized Cap for long-term holders has now surpassed $56 billion—impressive, isn’t it? That’s a bunch of Bitcoin savvy folks convinced this thing isn’t going to zero. Coins older than 155 days are suddenly on the move—probably just to keep things interesting in their wallets. Not so quick to sell, these seasoned hoarders seem to be setting the stage for what’s next.

History suggests that when these old coins stay put, it’s usually a sign of things brewing—sort of like a pot about to boil over. You see, smart money resembles a cautious cat, locking away their stash, waiting for the right paw-step. The real scoop? They’re betting on a bullish party soon.

All signs point to a strong foundation underneath Bitcoin’s dance—an invisible support crowd whispering, “go up, go up.”

Is rising Coin Days Destroyed just routine or a red flag waving wildly? 🧐

Coin Days Destroyed (CDD)—fancy word for coins moving around—went up 3.83% to 291.4k. This means some old coins decided to visit exchanges again. Sounds scary, but it might just be a casual visit—nothing to panic over.

Maybe folks are just making routine moves, cashing out a bit, or rebalance their collections. No need to shout “bear!” just yet. Meanwhile, the big players—long-term holders and enthusiastic buyers—stay firm and bullish. As we speak, the narrative seems to favor accumulation over trashing the market.

Is low volatility the calm before the storm? Or just a bug in the system? ⚡

Bitcoin’s 30-day volatility has dipped to 21.68%—its lowest in nearly a month. Think of it like the quiet before the fireworks. Such calm often hints at a big blast just around the corner, for better or worse.

But hold on—when long-term holders are stacking chips and short-term signals are bullish, this lull could be the perfect launchpad for a rocket. Everyone’s just waiting for a spark while the market snoozes—don’t mistake silence for surrender.

Instead, this tranquility might be the edge needed for a grand upward leap. So, don’t yawn just yet; the market might just be catching its breath before a sprint.

Could that crowded short trade blow up in everyone’s face? Or is it just wishful thinking? 🤨

On Binance, over 60% of traders are betting against Bitcoin with short positions—a classic case of “Hey, I’ll bet it goes down!” But that’s actually a contrarian cheer. Heavy short interest means conditions are ripe for a squeeze—that’s financial chaos waiting to happen.

If buyers keep forcing the issue, those super short traders might suddenly find themselves underwater, flipping the narrative in a heartbeat. A modest rally could send them scrambling, liquidating a mountain of over-leverage in no time. It’s like poking a bear with a stick and hoping it naps.

Despite the small shuffle in coins, on-chain data speaks loudly—confidence is brewing. With a burst in taker buy volume, long-term conviction on the rise, and volatility on a diet, conditions seem perfect for an upward lift. Especially with shorts crowded tighter than a subway during rush hour.

If buyers keep the pedal down, Bitcoin might just give us that next big push—so hold onto your hats. 🧢💥

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-06-10 02:23