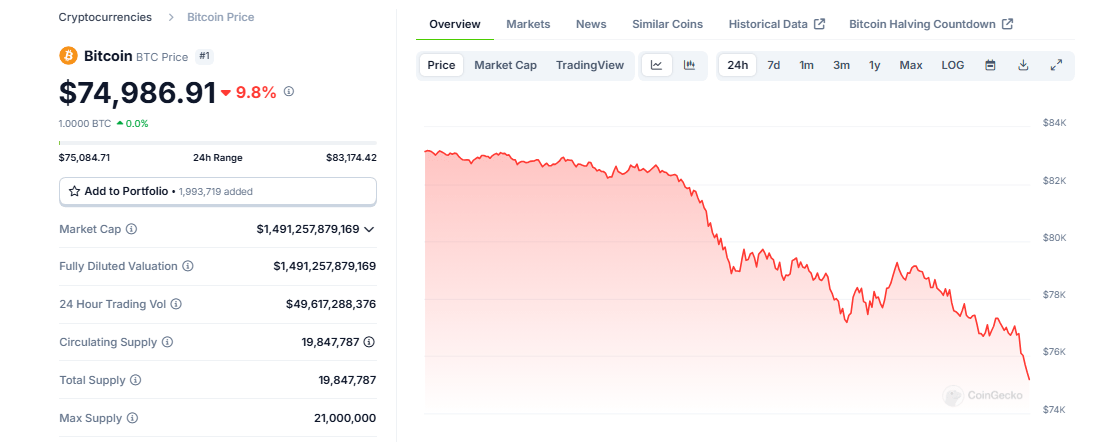

Once upon a rather peculiar Monday, our cheeky friend Bitcoin—ever the mischievous digital trickster—tumbled below the majestic mark of $75,000! Investors, their eyes as wide as saucers, watched in disbelief as it shed about 6% in a single day, as if it had lost a bit of its glitter. And the culprit? A quarrel between the mighty US and the stubborn dragon China that sent tremors throughout the enchanted markets. 🌀

US-China Trade War Unleashes a Whirlwind of Mayhem

Picture a grand tea party gone terribly awry: US President Trump, with his unconventional tariff recipes, stirred the pot so fiercely that Beijing couldn’t help but retort with equally explosive measures. Like a dreadful spell cast over Wall Street—the worst since the grim days of the COVID curse—the S&P 500, the Dow, and the Nasdaq all tumbled as if bewitched. It was a spectacle of chaos fit for a topsy-turvy story!

A rather cantankerous market pundit, Charles Gasparino, chirped on Twitter, “Monday is shaping up to be the ultimate pain day,” leaving us to wonder if anyone ever prepared for such a bally-kraut of a day. As predicted, Bitcoin now cavorts between $74,000 and $75,000—much lower than its splendid high from last week. 😏

Breaking: In a curious twist, one esteemed market sage confided, “Monday is shaping up to be the ultimate pain day.” Another added, “Some really nice buys out there particularly in financials.” Ah, the delightful chaos of disagreement in a market that loves its mischief!

— Charles Gasparino (@CGasparino) April 6, 2025

Ethereum And Altcoins Take a Hilarious Plummet

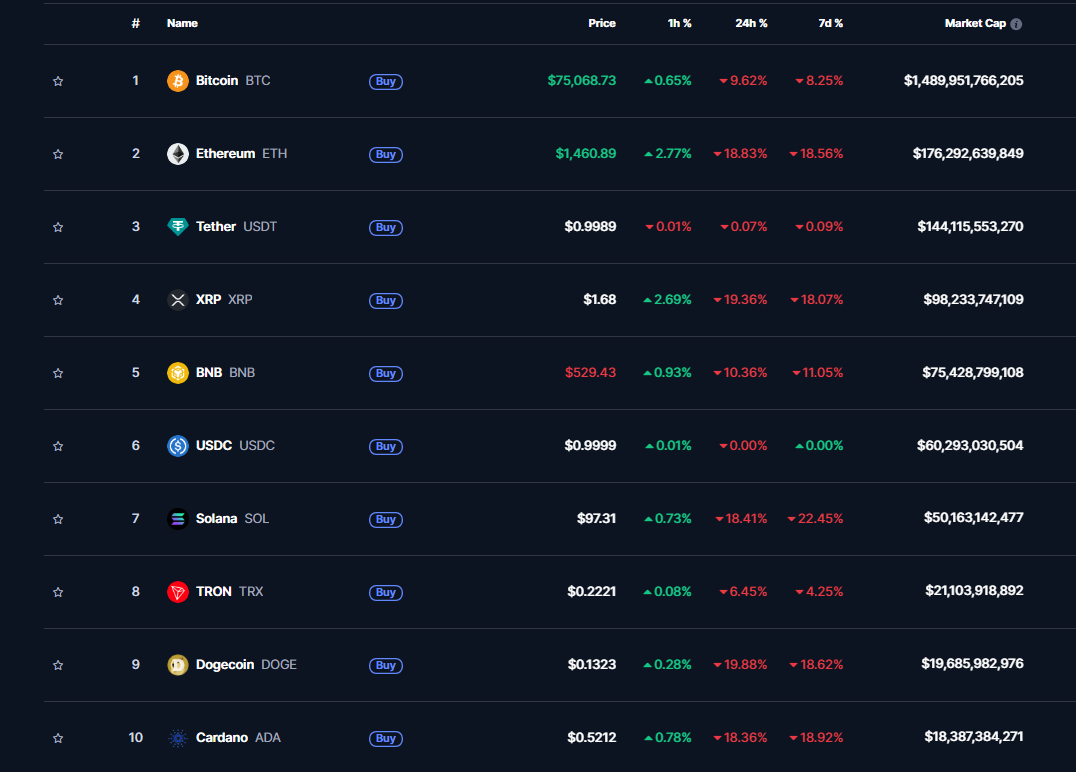

As Bitcoin performed its somersault, poor Ethereum and its ragtag band of altcoins fared even worse. Ethereum, the second in command of crypto mischief, dropped a staggering 13%—more than double that of Bitcoin’s slip! SOL, DOGE, ADA, XRP, and BNB all joined in a clumsy, slapstick tumble, each taking a nosedive faster than a character in a Roald Dahl fable. 🤡

Meanwhile, the entire enchanted crypto realm, boasting a wild market capitalization of $2.62 trillion, swirled in a delirious storm. Ironically, Bitcoin’s 24-hour trading volume skyrocketed to $26 billion—a madcap party where every goblin and wizard seemed to have shown up!

Investors Turn To Government Crypto Reserves For Potential Relief

In this bewildering circus, a tiny ray of hope glinted like a mischievous firefly. Edul Patel, the enigmatic CEO from Mudrex, whispered that US government agencies were about to reveal their secret crypto troves. “A huge confirmation might just spark a relief rally,” he quipped, leaving us to wonder if magic—or at least some government secrets—might save the day.

Alas, market moods remained as sour as a lemon squeezed by a cranky troll. The infamous Fear and Greed Index edged towards the dreaded realm of “Extreme Fear,” hinting that rather than wise investments, sheer panic had taken the helm. Meanwhile, Bitcoin now finds itself at a crossroads: reclaim the dazzling $80,000 summit or risk tumbling back to the infamous $74,000—a level many traders hope will act as a magical cushion to soften the fall.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-04-07 12:43