Pray, allow me to impart the latest tittle-tattle from the realm of Bitcoin, that most capricious of suitors. At the hour of my quill touching parchment, the said gentleman was circulating in the neighbourhood of $120,000, a modest elevation from yestereve and a full 10% above the week’s commencement. The assembly rooms of trade have been most lively, with a turnover of approximately $64.2 billion in the past day alone. All eyes are now fixed upon the $120,000 threshold, to discern whether it shall prove a steadfast supporter or a fickle acquaintance.

It is remarked upon with no small degree of interest that the present advancement bears a striking resemblance to a certain episode in mid-August, when a daily close above $120,000 precipitated a most agreeable bounce towards the all-time high of $124,000. The conduct of our protagonist at this juncture may well foretell his future intentions, though whether they be honourable remains to be seen. 🧐

A Mirror to August’s Merriment

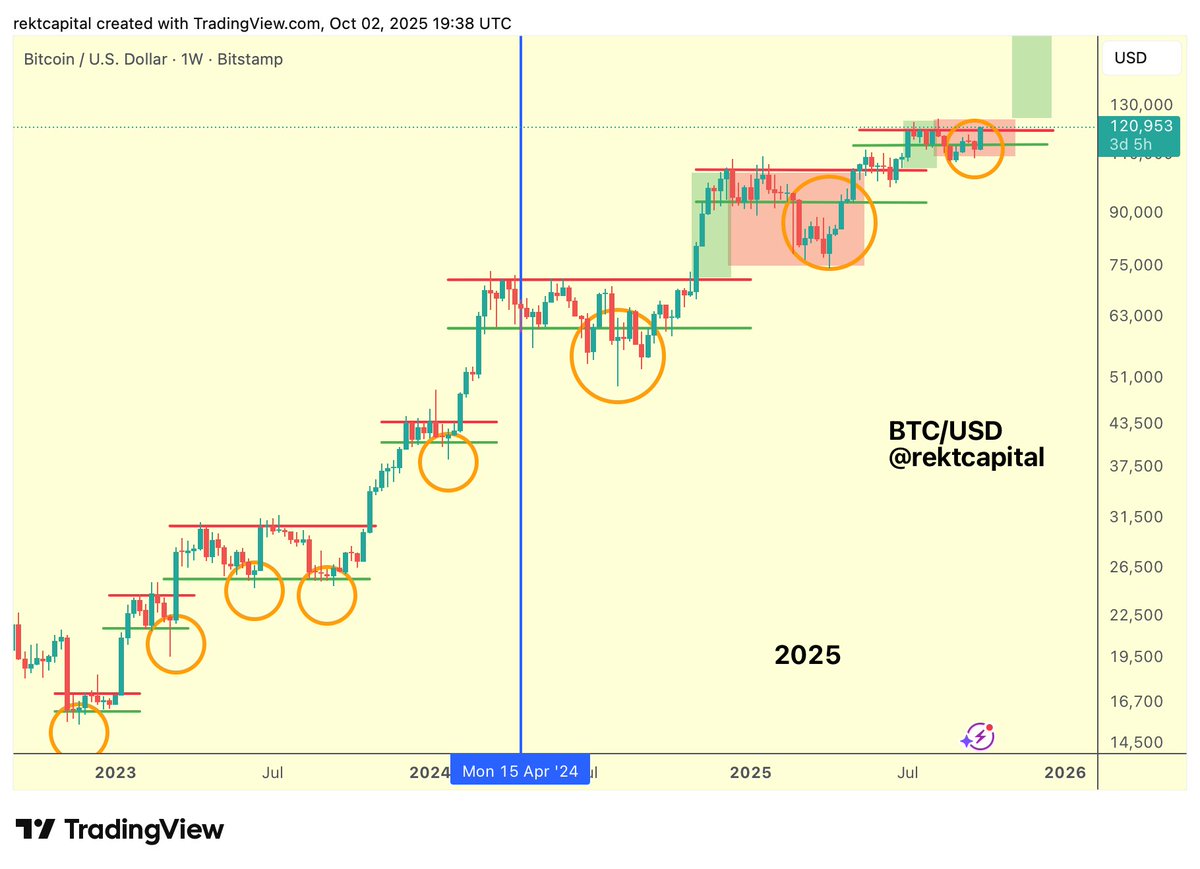

The astute observer, Rekt Capital, has noted that Bitcoin has achieved a daily close above the $120,000 mark, a feat not unlike that of August, when a similar close was followed by a retest of the level as support, and a subsequent ascent to $124,500. The charts, adorned with green circles, bear witness to these events, though one cannot help but wonder if history shall repeat itself, or if our hero has other plans. 📈

#BTC

Bitcoin has performed a Daily Close above ~$120k (black)

An identical Daily Close in mid-August (green circle) preceded a successful retest of $120k as new support before preceding upside into $123,400 (red)

Will the not-too-distant history repeat? $BTC #Crypto #Bitcoin

– Rekt Capital (@rektcapital) October 3, 2025

The current proceedings appear to echo this past setup. Should the level hold, the market may set its sights on $123,350 and beyond. However, should it falter, there are supports awaiting at $117,288 and $114,249, though one hopes such a retreat shall not be necessary. In a further observation, Rekt Capital notes that Bitcoin is also testing a 2.5-month downtrend line near $119,000, a challenge that may prove most telling. 🧭

On the weekly stage, the analyst speaks of the possibility of Bitcoin entering what is termed “Price Discovery Uptrend 3.” The long-term chart reveals a pattern that began in early 2023, wherein the price breaks out, retests resistance as support, and continues its ascent. This structure has repeated itself at various intervals, and Bitcoin now stands at $120,000, with a weekly close above this level potentially heralding a journey into uncharted territory. A green zone on the chart marks the potential area for this movement, though one must always be wary of unforeseen developments. 🌱

A Pause in the Dance? RSI Reaches Its Zenith

On the 4-hour chart, the observant Ted Pillows has noted that the RSI has reached 80.18, the highest level since July, placing Bitcoin in overbought conditions. Such instances, he remarks, often result in a correction or a period of sideways movement, a prospect that may dampen the spirits of the more enthusiastic dancers. 🕺

$BTC 4H RSI is now the most overbought since the July top.

Usually such instances result in a correction or sideways price action for some time.

– Ted (@TedPillows) October 2, 2025

This reading suggests a pause or consolidation phase after the recent rally from below $110,000, a development that may be greeted with mixed feelings by the assembled company. 🧘

A Bold Prediction: $203K by Year’s End?

Crypto Seth, ever the optimist, has presented a long-term chart showing Bitcoin within a growth channel. He recalls the final quarter rallies of previous cycles: 368% in 2017 and 83% in 2021. Based on this, he posits a 70% rise to around $203,530 by the end of 2025, a prospect that has set many a heart aflutter. The chart shows that the price remains well within the bounds of the channel, with no signs of a market top as yet. 🌟

2017: $BTC pumped 368% last 3 months of the bull market.

2021: 83%

2025: 70% from now to Dec sounds reasonable? Surely with all the ETFs and adoption it can give me another 70%????

– Crypto Seth (@seth_fin) October 2, 2025

The structure remains intact, and while one must always be cautious, the prospect of such a rise is enough to spark lively conversation at any gathering. 🥂

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-10-03 12:02