Ah, the glorious world of Bitcoin, where numbers dance like sugarplums in the heads of greedy goblins! 🧙♂️✨ After a jolly romp of bullish candles lighting up the charts like a fireworks display on New Year’s Eve, the poor old Bitcoin bulls have hit a brick wall-or should I say, a $94,000 brick wall. 🧱 Since December, they’ve been charging at this barrier like a herd of determined donkeys, but alas, success remains as elusive as a polite tax collector. 😏

Is the momentum fizzling out like a damp squib? Perhaps. But fear not, for the BTC price clings to its key support zone like a child to their favorite teddy bear. 🐻 The market, my dear readers, is at a crossroads-a critical decision phase, if you will. Sellers are perched above like vultures, while buyers lurk below, ready to pounce on any dips. It’s a game of chicken, and no one’s blinking yet. 🐔

Order Flow: A Tale of Aggressive Sell Walls and Timid Buyers 🛡️

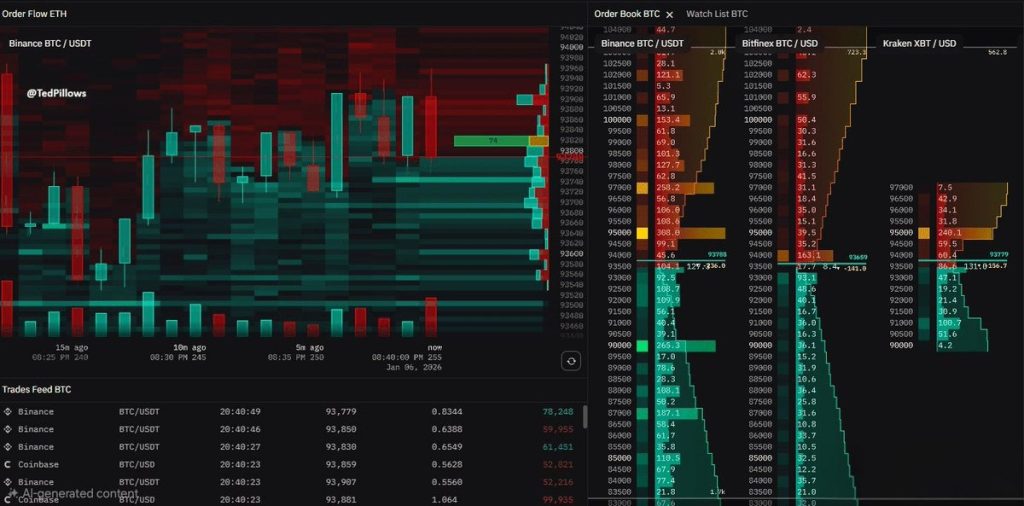

At the moment, Bitcoin is lounging around $92,000, having been repeatedly spanked by the $94,000 zone. Buyers are doing their best to prop up the price, but the order book tells a tale as grim as a dentist’s waiting room. 😬 Sellers are camped out like picnic-ruining ants between $94,500 and $96,000 on exchanges like Binance, Bitfinex, and Kraken. These sell walls are thicker than a slice of Aunt Sponge’s fruitcake, absorbing buy pressure like a sponge absorbs… well, fruitcake. 🍰

Just above $94,000, large sell orders loom like storm clouds, while cumulative asks spike near $95,000. No wonder upward moves stall faster than a three-legged racehorse. 🏇 Meanwhile, dip buyers are as reactive as a cat to a laser pointer, stepping in only when the price dips to $93,500-$93,800. This timid behavior keeps Bitcoin trapped in a range so tight, it’s like watching paint dry-but with more drama. 🎭

The liquidity distribution screams “compression phase” rather than a breakout. Below $92,000, the downside looks as thin as a supermodel’s patience, but buyers are holding the line like heroes in a bad action movie. 🦸♂️

Market structure, you ask? Here’s the scoop:

- Above $94K: Sellers reign supreme, cackling like villains. 👹

- Below $92K: Buyers tiptoe in, clutching their wallets. 🧢

- Between $92K and $94K: Choppy trading, as exciting as watching grass grow. 🌱

What’s Next for Bitcoin? 🧐

For Bitcoin to break free, it needs to gobble up those sell walls near $94,500-$95,000 like a kid devouring Halloween candy. 🍬 Without that, it’s stuck in a range-bound rut, facing rejection like a teenager at a school dance. 💔

The chart above shows Bitcoin breaking a symmetric triangle only to slam into resistance between $93,500 and $94,500. The RSI and OBV are throwing a bearish tantrum, and the CMF is sulking below 0. 📉 In short, the upswing is as supported as a house of cards in a hurricane. 🌪️ Expect Bitcoin to consolidate below resistance but defend the 50-day MA at $89,200 like a loyal guard dog. 🐶

The Bottom Line: Will Bitcoin Break Free or Stay in Limbo? 🤔

From a trading standpoint, Bitcoin is stuck below the $94,500-$95,000 supply zone, where sellers are as stubborn as a mule. 🦓 A break above this could send it soaring to $98,000 or even the magical $100,600. But if $92,000 gives way, it’s a slippery slope to $90,400 or $88,800. Until then, it’s a range-bound rollercoaster of high volatility-buckle up! 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

2026-01-06 22:07