- Bitcoin, the digital goldfish swimming in a sea of undervaluation, is doing its best impression of a yo-yo—plummeting down only to bounce back up with gusto.

- Will history repeat itself, or is Bitcoin just a big tease in today’s economy?

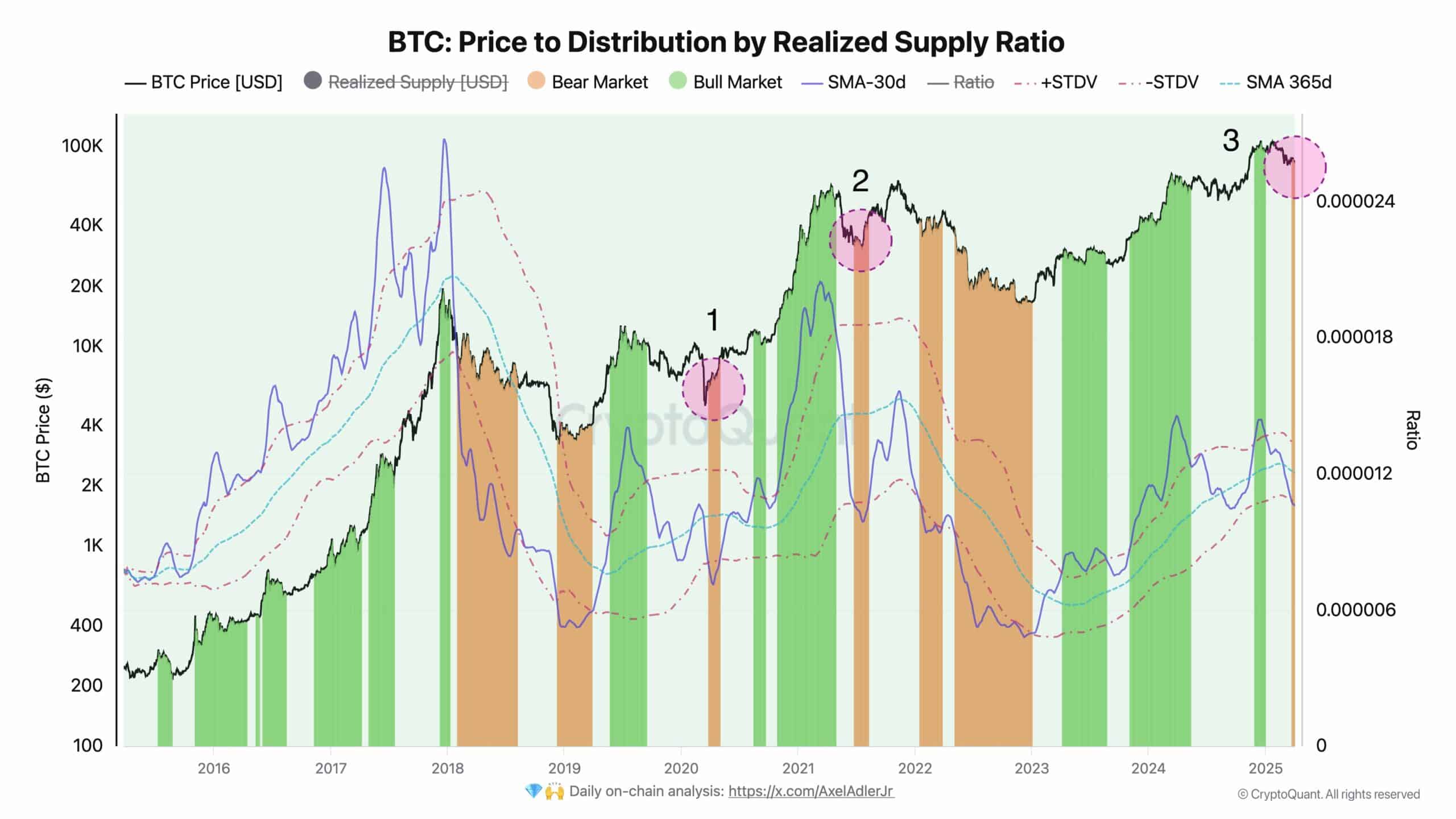

Picture this: Bitcoin [BTC], the cryptocurrency world’s favorite rollercoaster, is once again dipping into what we aficionados like to call the “undervaluation zone.” This is according to its30-day realized supply metric—a fancy term for how much Bitcoin is actually moving around versus playing hard to get.

Historically, these moments have been like the calm before the storm. Either everyone sells in a panic, or they buy in a frenzy, leading to a market movement that feels like trying to predict the weather with a coin flip. 🤷♂️

Realized supply is like a party guest list: when it’s high, the party’s popping; when it’s low, everyone’s either too cool to dance or has already passed out. Low realized supply suggests Bitcoin is being held tight by those who believe in it long-term or by addresses that are, frankly, napping.

The chart tells a tale of two corrections—during the COVID-19 scare and after China’s mining ban—both times Bitcoin’s realized supply dipped low, like a limbo dancer, signaling oversold conditions. Spoiler alert: it bounced back. And guess what? It’s happening again. 🎢

After a wild Q1 ride, with an11% drop that had us all holding our breath, Bitcoin’s realized supply is bottoming out. It’s like that moment in a horror movie when the silence is deafening, and you know something big is about to happen. Historically, this is when the brave (or the foolhardy) step in, hoping to catch the rebound.

Low Liquidity: Bitcoin’s Awkward Teen Phase?

When fewer coins are changing hands, it’s like Bitcoin is going through an awkward phase—more holders are adopting the “HODL” mantra, keeping their coins close and their trades infrequent. It’s the crypto equivalent of a trust fall.

In the grand scheme of things, this could mean Bitcoin is growing up, aiming to be the gold of the digital era. But for a bull run to happen, we need more than just hopeful HODLers; we need buyers to swoop in like superheroes.

While the “HODL” vibe is strong, reducing the liquidity influx, the market needs to soak up the sell-side pressure from those with weaker knees. It’s a delicate dance, balancing the scales of supply and demand, like juggling water balloons at a picnic.

The question remains: are the bulls ready to charge, or are they just window shopping?

Bitcoin’s Bullish Breakout: A Dream Deferred?

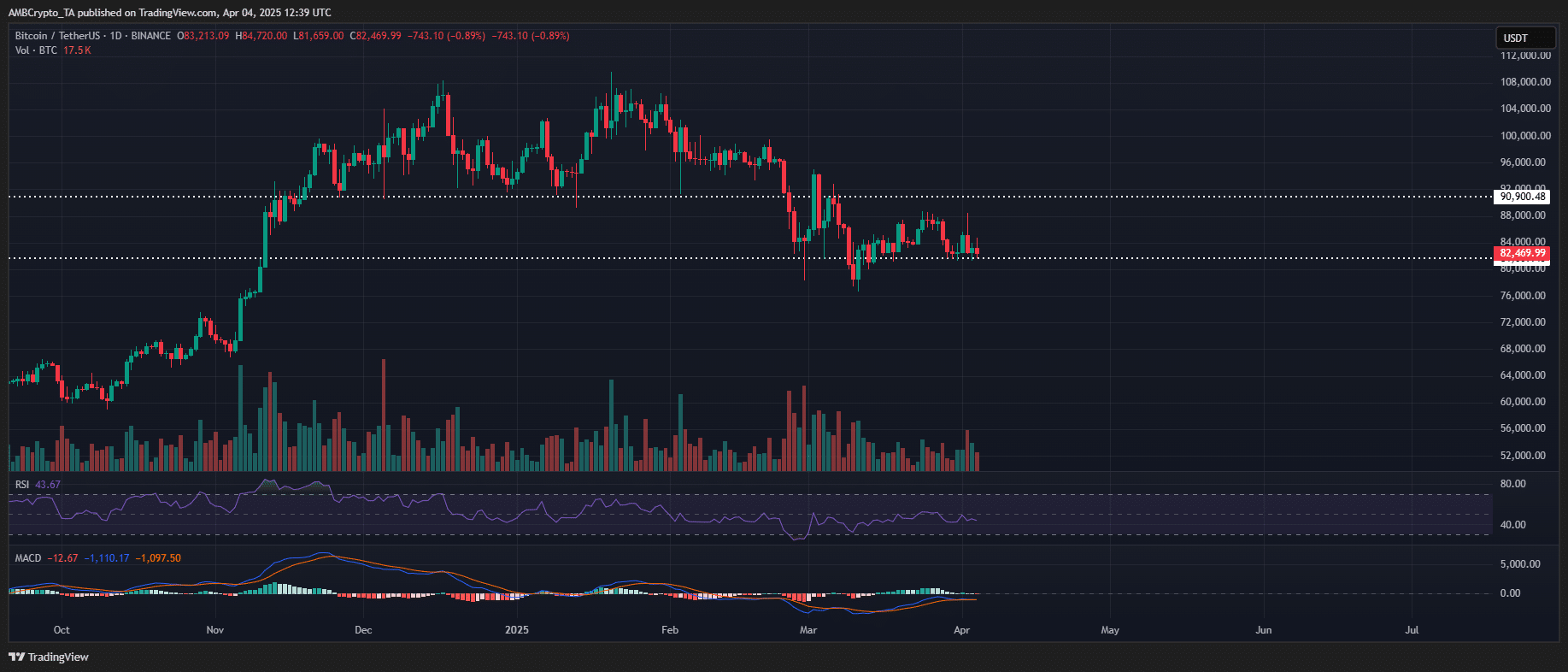

Despite Bitcoin holding its ground above $80k amidst economic turbulence, the shift to a bull market remains as elusive as a unicorn. Long-term holders recently parted with some coins, feeling the sting of tariff news, causing a brief wobble.

As we wade into Q2, the ghost of policies past continues to haunt retail sentiment. While institutional interest in undervalued Bitcoin sounds promising, and the “HODL” crew keeps the $80k support alive, retail participation is as lively as a sloth on a Sunday afternoon.

This lack of retail frenzy is the fly in the ointment, the kink in the hose, the reason why Bitcoin’s march to $90k this quarter looks about as likely as a snowstorm in July. Without a seismic shift in market dynamics or a sudden influx of retail love, Bitcoin’s breakout dreams might just have to wait.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-04-05 01:16