Ah, December-the month when cryptocurrencies behave as predictably as a cat in a room full of rocking chairs. Bitcoin, the stubborn prima donna of the financial opera, continues its theatrical decline, promising to waltz into the new year with a red glow rather than gold. But fear not! Recent revelations from the cryptic corridors of on-chain data suggest that all eyes should be fixed upon a certain mystical number-$82,000. Is it the holy grail or merely the latest illusion in this grand illusion? Only time will tell, or perhaps the market’s mood swings.

The Golden Number: $82,000-Where Market Giants Meet or Quarrel

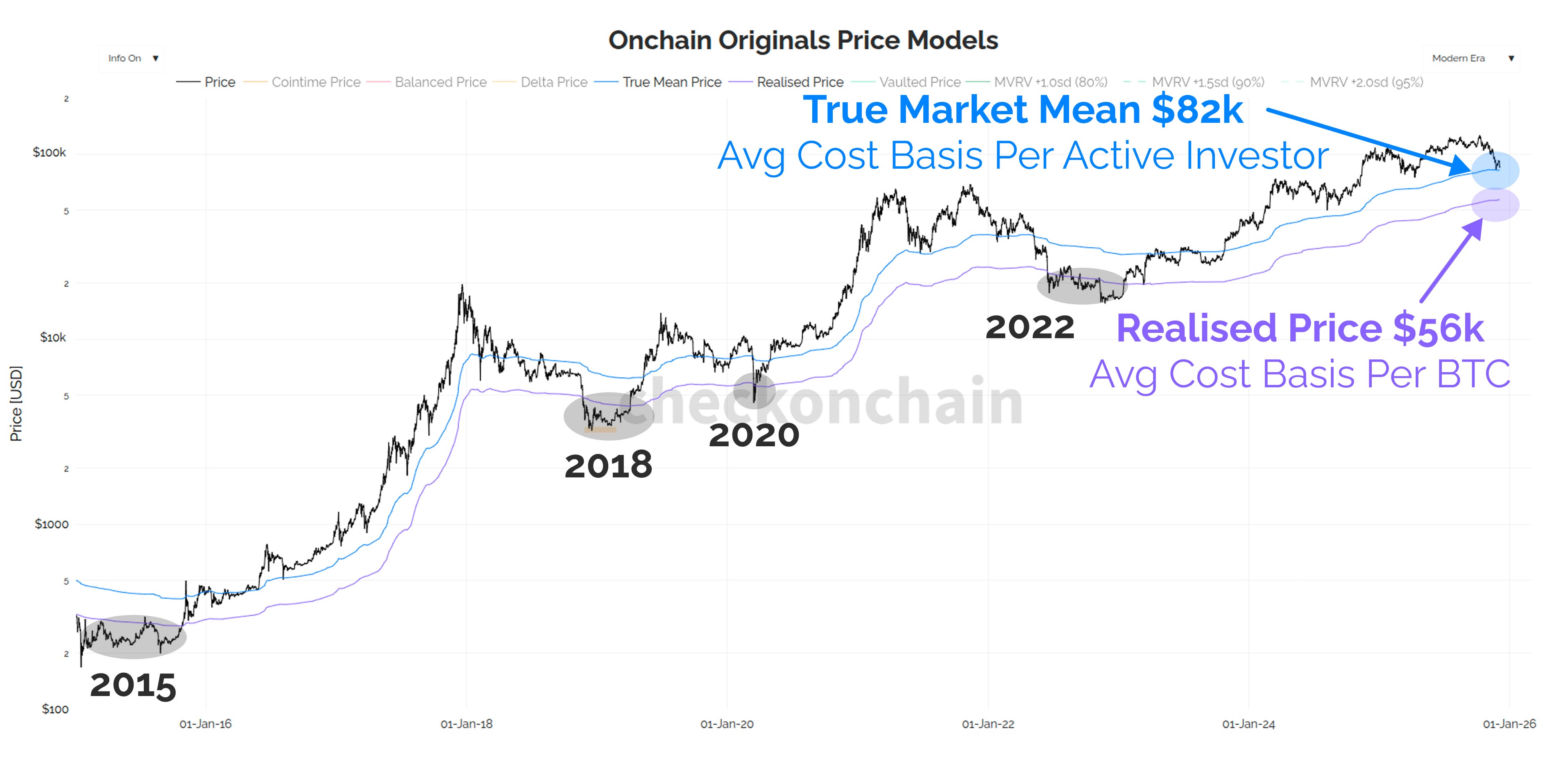

On a day when Twitter (or as some still insist, ‘X’) was ablaze, our dear analyst Burak Kesmeci announced that the fate of Bitcoin hinges upon the elusive $82,000 mark. Yes, dear reader, this is no ordinary number-it’s the convergence point of two legendary cost bases that have haunted and delighted investors alike. Like the meeting of two great empires, what happens here could determine whether Bitcoin rises like a phoenix or sinks into the abyss.

According to our statistician sage, the ETFs-those darling demand sources-carry an average cost of around $82,000. This figure, dear friends, is not just a number but a mirror reflecting the hopes, fears, and institutional ambitions riding on Bitcoin’s back. The more the market dances around this figure, the more we see the true state of its soul.

Not to be eclipsed, the wise crypt pundit also calls upon the True Market Mean-a fancy term for where the active investors bought their coins, excluding those mined yesterday or stashed in a secret vault. Interestingly, most of these funds found their way into Bitcoin at roughly $82,000, proving that even the most cynical market participants have their tipping point.

If $82,000 Falls-A Digital Apocalypse or Just a Slight Inconvenience?

When support levels break-oh, the melodrama!-investors start to panic, turning their Bitcoin into a lemming parade over the cliff. This, of course, inflates the bearish chorus, turning green candles into grave markers. The inevitable consequence? A relentless slide until the market’s lingering hope, the Realized Price, which currently lounges around $56,000, beckons the brave or the foolish to follow.

The terrifying forecast warns that should Bitcoin stumble beneath $82,000, it won’t just stop there-oh no! It might plummet a further 40%, akin to an uninvited guest crashing a high-society ball and refusing to leave until it’s had enough fun. As of this moment, the digital gold stands awkwardly at about $89,310-down over 3% in just a day, proving that even the most confident can be brought low by a whisper of doubt.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-12-06 20:53