Oh, honey, JPMorgan just called Bitcoin the ‘Debasement Trade’-because apparently, stacking assets with hard limits is the new black. 🖤 And guess what? Bitcoin’s chart is basically doing the same sultry dance as gold’s, so brace yourselves for a $165K Bitcoin soon. *Air kiss.*

Enter Bitcoin Hyper ($HYPER), the Layer 2 hottie promising to make Bitcoin faster, cheaper, and *chef’s kiss* scalable. With a $22M presale and on-chain utility that’s actually useful, it’s like Bitcoin’s cool, younger sibling who’s about to steal the spotlight. 🌟

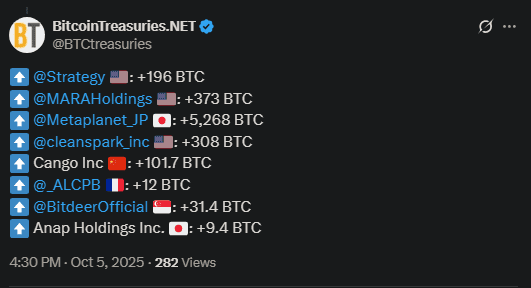

Wall Street’s still side-eyeing Bitcoin like it’s a risky fling, but the public sector? Oh, they’re *hoarding* $BTC like it’s the last slice of pizza. 🍕 Data from Bitcoin Treasuries shows cross-sector treasuries holding 3.88M $BTC, with public companies clutching 1,040,547 of them. *Mic drop.*

Michael Saylor’s Strategy is leading the pack with 640,031 coins, valued at almost $74B. *Slow clap.* And just last week, $1.2B-worth of Bitcoin fueled the largest reserves in the public sector. Metaplanet, MARA, and Strategy? They’re eating. 🤑

Predictions are wildin’-JPMorgan’s $165K by year’s end, Saylor’s $1M Bitcoin (because why not?), and everyone’s bullish AF. Crypto winter? *Not coming back,* says Saylor. So, it’s not *if* Bitcoin grows, but *how much* and *how fast.* 🚀

Expect another ATH this October, and maybe an even bigger one by year’s end, especially with Bitcoin Hyper’s Q4 release. *Cue dramatic music.*

Bitcoin Hyper: The Glow-Up Bitcoin Deserves 💅

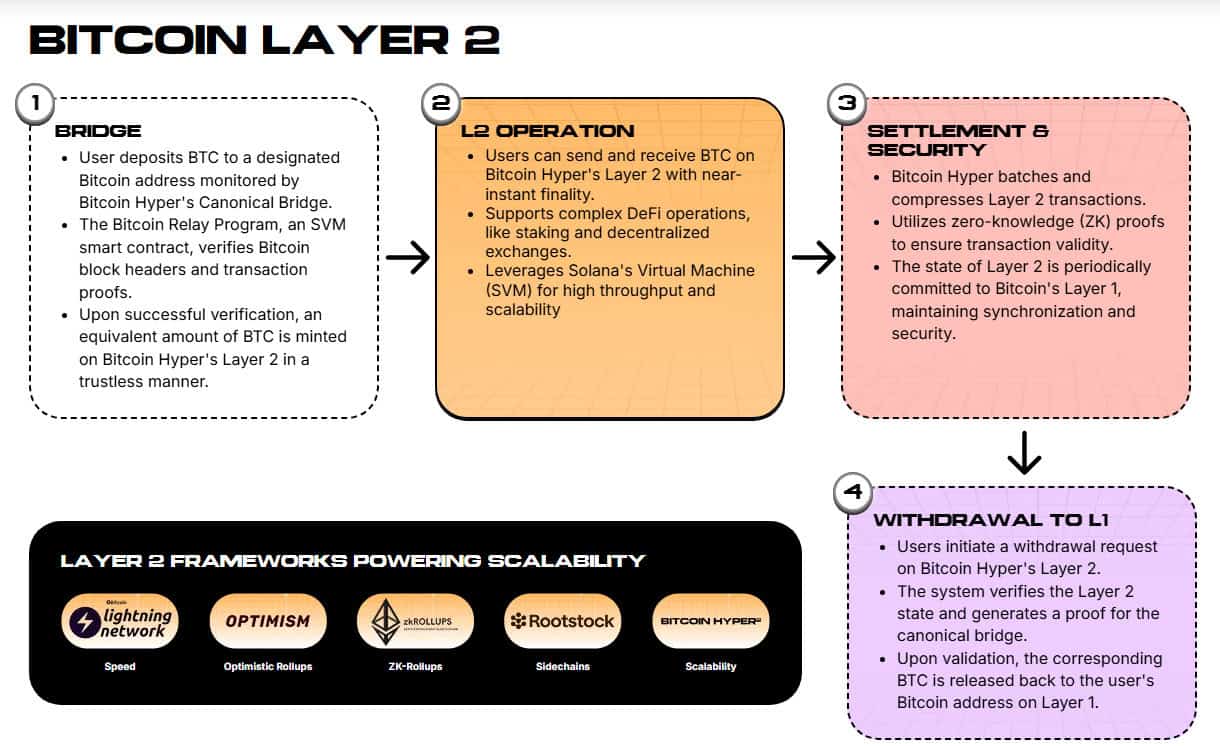

Bitcoin’s been stuck at seven transactions per second (TPS) since forever, but Hyper’s here to fix that with the Solana Virtual Machine (SVM) and the Canonical Bridge. *Finally,* someone’s addressing Bitcoin’s commitment issues. 💔

SVM brings Solana-grade speed to smart contracts and DeFi apps, while the Canonical Bridge connects Hyper’s Layer 2 to Bitcoin’s Layer 1, confirming transactions in seconds. *Chef’s kiss.* Wrapped Bitcoin? Instantly available on Layer 2. Magic. ✨

Alt text – How Hyper’s Canonical Bridge works (because even tech needs a good backstory)

Hyper’s presale hit $22M today, with $HYPER trading at $0.013065. Q4 public release? Now’s your chance to hop on the hype train. Choo choo! 🚂

Read our guide, hit the presale page, and secure your $HYPER stack today. But remember, this isn’t financial advice. DYOR, and don’t bet your cat’s college fund. 🐱

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-10-06 17:35