The cryptocurrency world has just been hit with a colossal flush, as a storm of volatility swept across the market like a tornado with a grudge. Hold on to your digital wallets, folks—Bitcoin, Ethereum, and the rest of the gang have taken a brutal ride.

Bitcoin’s Wild Ride: From Highs to Lows in 24 Hours

Oh, what a day it’s been for Bitcoin! The king of crypto has been on a rollercoaster that even the bravest would hesitate to board. From a high of $105,800 to a low of $100,400, this poor coin has been batted around like a ping-pong ball in a hurricane. And just when you think it’s over? Nope, here comes a little recovery back to $104,100.

Check out the chart below. It’s like the crypto version of a “How Not To Invest” guide.

As you can see, it’s not all doom and gloom for Bitcoin, though. It’s only down by a measly 2%. Other coins, however, are not as lucky. Ethereum is still sinking at almost 6%, and Dogecoin? It’s down about 7%. Ouch.

So, what caused this crypto chaos? Well, it’s none other than the legendary feud between President Trump and Elon Musk. A spat in the Oval Office turned into a full-blown social media brawl, with Musk accusing Trump of, well… being involved in the Epstein files. Things escalated quickly, and the crypto market paid the price.

The Crypto Liquidation Frenzy: $1 Billion Goes Down the Drain

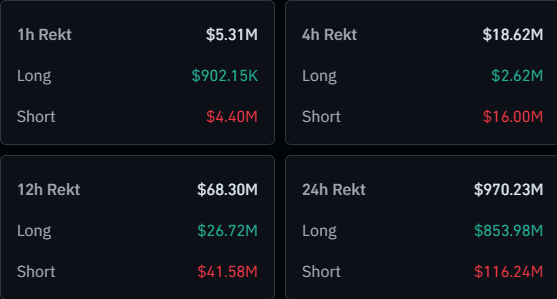

After the dust settled from the Musk-Trump drama, the crypto derivatives market faced the consequences. According to CoinGlass, the market has experienced a liquidation frenzy to the tune of $970 million in just 24 hours. What’s that? You don’t know what a liquidation is? Allow me to enlighten you: It’s when open contracts are forcibly closed because they’ve lost too much value. It’s like the market saying, “You’ve had your fun, now go home.”

Out of that $970 million, $854 million (88% of the total) came from long investors who were probably sitting there with their bags of digital regret. This is no surprise, given the overall downward trend in prices.

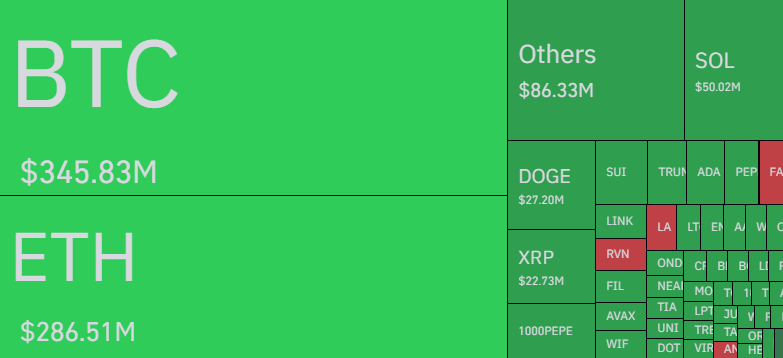

Bitcoin and Ethereum, unsurprisingly, were the big losers here, with $346 million and $286 million in liquidations, respectively. The market’s favorite duo couldn’t escape the chaos.

This whole mess is called a “squeeze,” where the market essentially forces out investors who were betting on prices going up. With long investors making up the vast majority of the victims, this one’s a “long squeeze” through and through. But hey, that’s crypto for you, right? Wild, unpredictable, and always leaving you questioning your life choices.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-06-07 11:47