Ah, the notorious Bitcoin price drop! Traders, those eternal optimists, were busy sharpening their pencils, expecting a euphoric rise to $95,000 after a brief consolidation-only to see the token slip beneath the psychological barrier of $86,800, and tumble to an intraday low of $84,756. Naturally, the burning question echoes across the digital market space: Are the whales circling, licking their lips to buy the dip, or are they just waiting for the storm to pass? 🤔

On-chain data has been kind enough to shed some light. Apparently, these gargantuan investors aren’t panicking just yet, but they are certainly being picky about where they lay down their colossal stacks of Bitcoin. Let’s peel back the layers of this mystery, shall we?

Whales Aren’t Panicking-They’re Just Waiting for Their Discount

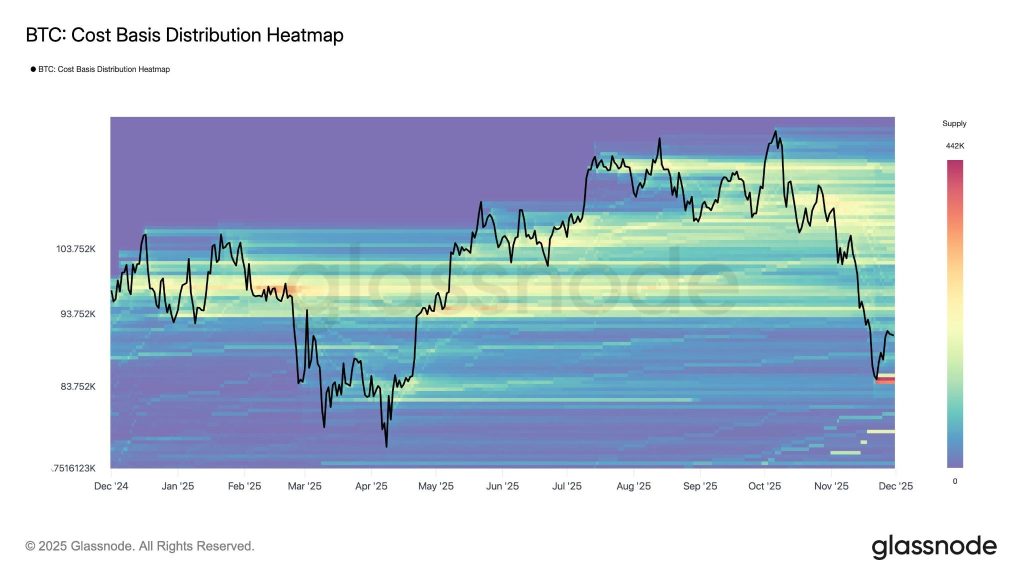

Ah, the sweet music of whale behavior! One of the strongest signs of their actions during a correction is where their cost basis clusters gather like ants at a picnic. And lo and behold, they’re not dumping their treasures just yet. The data reveals that they’re sitting pretty, waiting for a further dip into their golden “buy zone.” The Bitcoin Cost Basis Distribution Heatmap is practically glowing with anticipation. 💸

Now, let’s consult the sage-like Glassnode data to track the whale movements. Turns out, these big fish haven’t been selling like a fire sale. Instead, they’re eyeing that sweet range between $83,000 and $88,000. Why? Because that’s where they’ve scooped up most of their tokens in the past. And guess what? There’s a new cluster forming near the recent lows, suggesting that they’re ready to dive in for more-assuming the price stays in this range. Can we call it a game of waiting? Or just classic whale patience? 🦈

This behavior mirrors past accumulation cycles-whales buying low while retail investors watch from the sidelines, sipping their iced lattes. Seems like deja vu, doesn’t it?

Are the Whales Actually Buying Bitcoin? The Suspense is Killing Me!

The chart above shows the possibility that the whales have started accumulating again. But, and this is important, the action is still on the horizon. The whale addresses holding more than 1,000 Bitcoin took a nosedive just before this current pullback. But wait-don’t jump to conclusions just yet. The levels have since stabilized, and should these whales decide to fill their coffers once more, Bitcoin’s price may very well see a robust recovery. A twist in the tale, perhaps? 📈

And if this accumulation continues in the $83,000-$88,000 zone, Bitcoin could be laying the groundwork for a structural bottom. This, dear reader, is where the magic happens. Historically, these whale cost-basis zones act like springboards once the market stabilizes and liquidity starts flowing in again. Watch closely, for these are the stages before:

- The selling pressure finally lightens (hallelujah!),

- Resistance levels begin to crumble like a sandcastle in the tide, and

- We see a possible trend reversal in the medium term. 🎉

So, if that chart starts climbing, guess what? Whales are back in the game. Historically, that’s about as bullish as a bull in a china shop. 🐂💥

What’s Next for Bitcoin’s Price? Place Your Bets!

The current pullback has, without a doubt, confirmed the bearish pressure on the token. BTC has managed to confirm its third consecutive lower high and low following a rejection at the all-time high. The bulls? Well, they’re not exactly charging ahead. Despite several attempts, they haven’t been able to force a recovery above $87,000. Looks like Bitcoin’s preparing for another plunge. Will we break the $80,000 support? Grab your popcorn! 🍿

As the chart shows, the RSI has decided to take a joyride back into the overbought range, while the Chaikin Money Flow (CMF) is whispering sweet nothings of a bullish divergence. Hmm. Despite being in the negative zone, it indicates a sneaky influx of liquidity. Oh, and let’s not forget the Bollinger Bands-those guys are getting ready to squeeze. That could mean only one thing: big moves are ahead. 🚀

So, what’s in store? Bitcoin could very well test the $82,918 support, and if that holds, a recovery might be on the horizon. But until the whales start their feeding frenzy, the price could just keep fluctuating with a pattern of lower highs and lows. Stay tuned! 🤑

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-12-01 19:42