So, BlackRock is diving into digital assets like a kid in a candy store, but guess what? Bitcoin is the star of the show. In a chat with the Empire podcast, Samara Cohen, the big boss at BlackRock for ETFs, spilled the tea on why Bitcoin is the prom queen of the crypto world. Spoiler alert: Ethereum is, well, the awkward cousin standing in the corner.

BlackRock launched the iShares Bitcoin Trust (IBIT) and Cohen basically made it sound like the moment was a cosmic alignment of investment thesis, client demand, and regulatory red tape (yawn). But the key takeaway? Investors were basically screaming for Bitcoin, and BlackRock was like, “Okay, okay, we’ll give it to you.”

But hold your horses, because this wasn’t BlackRock’s first dance with Bitcoin. Back in 2022, they quietly dropped a private Bitcoin trust for institutional clients, and that’s when they really got cozy with the world of crypto. Cohen said, “We didn’t get our hands dirty until we launched that institutional product,” as if they were waiting for the right moment to join the crypto cult.

And guess what? Bitcoin turned out to be way more popular than anyone expected. IBIT is now the most successful ETP launch in history, and Cohen’s like, “Well, yeah, half of IBIT’s holders are basically your average Joe investors who just wanted their Bitcoin in an ETP wrapper.” You know, the type who probably googled “What the heck is an ETP?” before buying. 🤷♂️

Bitcoin Vs. Ethereum

Now, let’s talk about Ethereum. Cohen doesn’t exactly sound like she’s ready to throw a party for it. BlackRock has dipped its toes into Ethereum with some ETPs, but let’s be real — demand is still somewhere between “meh” and “not happening.” Ethereum is like that friend who talks a big game about their startup but hasn’t actually figured out how to make any money.

Cohen’s got her doubts about Ethereum’s future in institutional investing. “You might love the utility of the public Ethereum blockchain, but good luck figuring out how that translates into actual money,” she quipped. Basically, Ethereum’s story is still a work in progress. It’s like trying to explain the appeal of a Netflix show after only watching one episode. Too many unknowns.

But wait, there’s more. Beyond just the confusing narrative, there’s the whole crypto data mess. Cohen’s like, “Crypto’s got a data problem.” I mean, isn’t that the understatement of the year? Traditional markets have clear metrics like cash flow and governance, but in crypto? It’s a free-for-all. Good luck organizing that mess into a portfolio. 🧐

Bitcoin, on the other hand, is easy to love. It’s got a clear scarcity factor, a predictable issuance schedule, and a market structure that doesn’t make you want to pull your hair out. BlackRock’s recommendation? A sweet 1-2% Bitcoin allocation for investors. Go beyond that, and the risk just skyrockets. Because, you know, too much Bitcoin is like too much cake. Delicious but potentially messy. 🍰

Ethereum’s future is still up in the air. Sure, it’s making moves in decentralized finance, but until it figures out how to be a predictable asset with clear value, BlackRock’s advice remains: Proceed with caution.

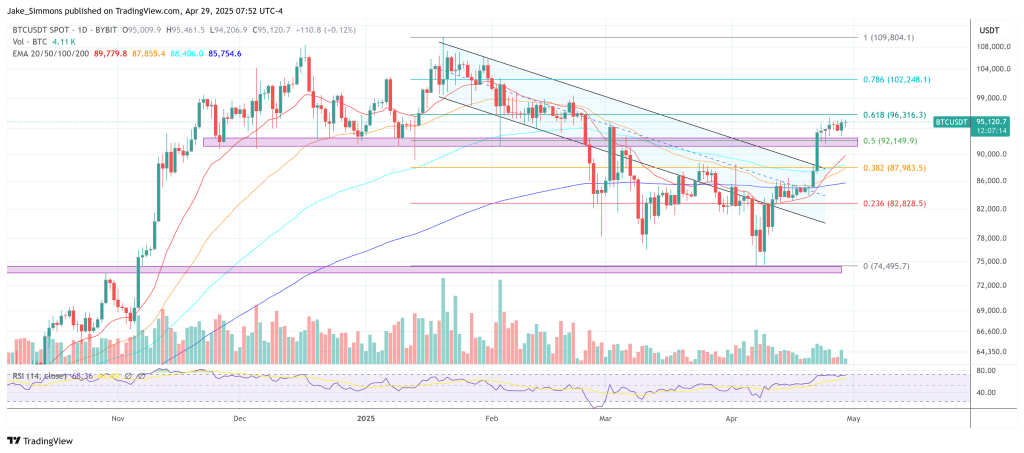

And for those keeping score, at press time, BTC was chilling at $95,120. Who’s laughing now? 😂

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-30 07:02