ARK Invest has once again donned their fortune-teller hat and whispered into the void: Bitcoin might just balloon to $2.4 million by 2030. This is a shiny upgrade from their earlier forecast of $1.5 million, apparently fueled by institutional interest, national treasuries, and investors in places where “stable currency” is basically a punchline. 🤑

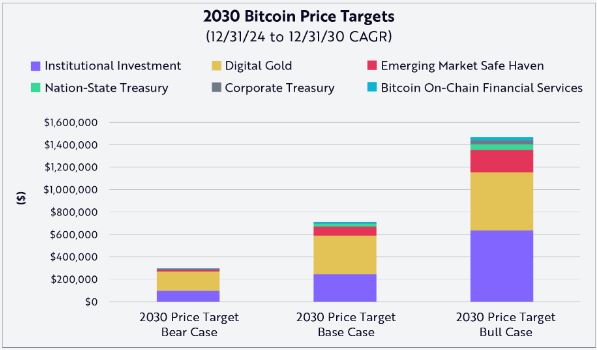

In their latest manifesto (a.k.a. “report”), ARK lays out three Bitcoin price scenarios. Even their cautious guess now slaps Bitcoin at a cool $500,000—up from $300,000 before. Their “most likely” scenario? A casual $1.2 million. No big deal. Just some pocket change, right?

All this number-crunching is based on how much of the global financial pie Bitcoin can nibble off—and they’re thinking big.

We’ve published our bitcoin price forecast through 2030. Read our research from @dpuellARK and share your thoughts.

— ARK Invest (@ARKInvest) April 24, 2025

Leading this crystal ball gazing is David Puell, who posits that the real rocket fuel will be those suit-and-tie institutional investors. If Bitcoin grabs a mere 6.5% of the $200 trillion global financial buffet (excluding gold, because that’s apparently someone else’s dinner), it could soar to the $2.4 million stratosphere.

Speaking of dinner, Bitcoin is also starting to look like “digital gold.” ARK argues that by 2030, Bitcoin could snatch up to 60% of gold’s $18 trillion sparkle stash. 🏆 That’s a lot of shiny virtual bling.

Emerging markets, where inflation is the uninvited guest who never leaves, could also be the secret sauce pushing Bitcoin’s value higher. ARK thinks this could account for about 13.5% of Bitcoin’s value in their “silver lining” scenario.

And let’s not forget the nation-states and corporations that have started stashing Bitcoin under their mattresses. Plus, Layer 2 networks and tokenized Bitcoins—because regular Bitcoin clearly wasn’t complicated enough—add to the bullish banquet.

Interestingly, ARK isn’t eyeballing total Bitcoin supply. They cut out the “lost to the blockchain void” coins and those that haven’t moved since your grandma got her first smartphone. This “active” supply approach makes $2.4 million seem less like fantasy and more like… well, still fantasy, but at least dressed up nicely.

If Bitcoin actually hits $2.4 million, we’re talking a $49 trillion market cap—almost the combined GDP of the U.S. and China. Bitcoin would then claim the crown as the world’s most valuable asset, leaving gold sulking in the corner. Sorry, old buddy.

Of course, even ARK’s “bear” estimate of $500,000 demands a 32% annual return from here to 2030. Their base case? A sweaty-palmed 53% yearly growth rate. For an asset already worth over a trillion, that’s the financial equivalent of saying, “Hold my coffee.”

Timing-wise, this forecast drops just as Bitcoin bounces from $75,000 earlier this year to nearly $94,000—not exactly a moonshot, but hey, it’s climbing. And, in a move no one saw coming, the U.S. (yes, under the Trump administration) created a Strategic Bitcoin Reserve. Because why not store your digital eggs in the same basket that sends rollercoasters on a daily basis?

In other words, ARK is betting big on Bitcoin’s future. Will it hit $2.4 million? Who knows. But one thing’s clear: Wall Street’s swagger has evolved from skeptical sneers to cautious courtship—and everyone’s looking for a seat at the crypto table. 🍽️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-04-25 07:56