Bitcoin Surges Again! Is the Fed Playing Hide and Seek? 🎩💰

Hold onto your Bitcoin wallets, folks! The US CPI just announced inflation went up in May—snapped their summer vacation since February! And Bitcoin? Oh boy, it’s inching closer to that sweet $110,000 mark like a kid chasing an ice cream truck. 🍦💸

But wait! There’s more, folks! Beyond the CPI circus, everyone’s watching US jobs and PPI—like a high-stakes game of economic “Where’s Waldo?”—due to drop this Thursday. Stay tuned or miss out, capiche?

Inflation rises to 2.4% in May—US CPI confirms it! 🎉

The US Bureau of What’s-That-Now? Just kidding, the BLS, released the Consumer Price Index, which says inflation was a tiny bit spicy at 2.4% in May, up from 2.3% in April. First time since… hold your breath—January 2025—that inflation decided to wake up from its nap. 💤🥁

CPI 0.1% MoM, Exp. 0.2%

CPI Core 0.1% MoM, Exp. 0.3%CPI 2.4% YoY, Exp. 2.4%

CPI Core 2.8% YoY, Exp. 2.9%— zerohedge (@zerohedge) June 11, 2025

Long story short—after months of snoozing, inflation decided to hit the gym! Bitcoin? It’s doing its happy dance, nudging toward $110k like a kid craving a new LEGO set. 🚀

Everyone was guessing, “Will inflation grow or stay sleepy?” Well, it grew a little. Expectations? A tiny 0.2% rise monthly, which pretty much everyone shrugged at—like a bad joke you’ve heard a million times.

Maybe, just maybe, folks expecting inflation to climb are the reason Bitcoin got a little boost—because it was *already* baked into the cake! 🎂

“If CPI > 2.5%, expect a sell-off as the Fed will drop rates faster than a hot potato. If CPI = 2.5%, a sell-off, but hey, it’s a bargain sale! If CPI < 2.5%, pump-and-dump, but we’ll end in the green unless you blinked too slow,” said Analyst Cas Abbé. 🍿

Many banks, those lovely clairvoyants, predicted a mild inflation dance—nothing too crazy, just a gentle waltz, really.

What caused this inflation rollercoaster? Well, folks, Trump’s tariffs—Yes, *that* Trump!—like a bad break-up, hittingched on goods’ prices, especially oil. No, it’s not magic, it’s tariffs, and they’re pushing the prices up—like a bad hair day. 💇♂️💥

“It’s the tariffs, baby! More oil and tariffs making the prices go up—like that one relative who always asks, ‘Where’s my gift?’” joked analyst Daan Crypto Trades.

This week’s act? More US drama—jobs reports and PPI—playing out like a Hollywood blockbuster on June 12. And next week? The Federal Reserve’s big mystery show, with Jerome Powell starring in “Will They Cut or Not?” 🎬🍿

The CPI is like the odd kid in class—always lagging behind but causing the biggest fuss. Its influence on the Fed’s rate? Bigger than a king’s ransom—meaning, it’s worth watching or whatever.

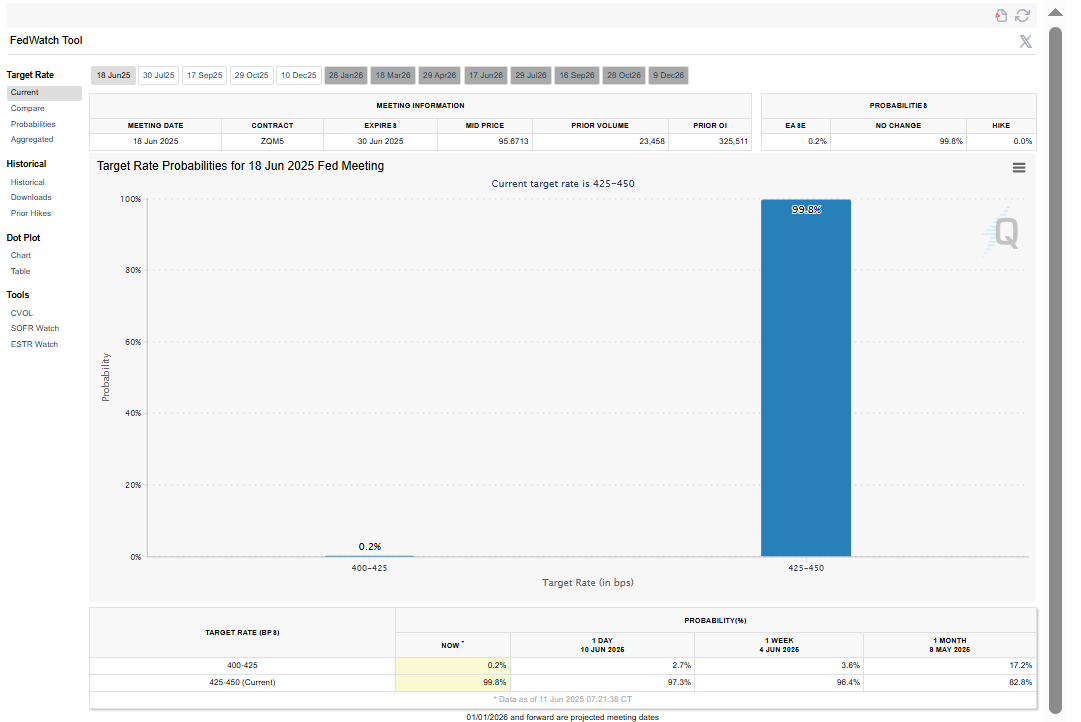

According to the fancy CME FedWatchTool, 99.8% think rates will stay put at 4.25-4.50% next meeting. So exciting! And Powell? He’s as predictable as a cat—says he won’t bow to political pressure, even if Trump’s tariffs do a little dance. 🐱💵

Inflation’s stubborn, floating above the Fed’s cozy 2% nest egg, so brace yourselves for cautious moves—like walking a tightrope with a blindfold. 🎪

“The market’s just waiting like a kid at Christmas—expecting the Fed to play it safe and not rock the boat until they get their act together,” whispered Bitunix analysts. 🚤

And let’s not forget—the labor market! If it stays resilient, Bitcoin might just get that rate cut it dreams about—like finding a unicorn in your backyard. 🦄

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-06-11 15:52