Well, would you look at that! Bitcoin has rocketed past $116,000—because who needs gravity, right? It’s set a new all-time high, nipping at the heels of its May 2025 peak. And this time, instead of just the usual gang of thrill-seekers, there’s a sturdy institutional backing giving it a push. Could this be the kind of rally that doesn’t end in tears? 🎢

In somewhat shocking news that didn’t involve a cat video, South Korea’s K Wave Media has snagged 88 BTC as part of a hefty $1 billion treasury plan. So here’s the burning question—can this BTC price escape the jaws of another meltdown like that harrowing tumble to $98,000 in May? Buckle up as we dissect the on-chain drama and chart shenanigans!

Exchange Inflows Drop; Where’s the Selling?

According to CryptoQuant, Bitcoin’s exchange inflows have taken a nosedive to a measly 3,200 BTC daily (while I’m still trying to count the change in my couch cushions). That’s the lowest it’s been since 2015! Back in December 2024, things were different—around 97,000 BTC were flying to exchanges faster than I can make coffee during a Monday meeting.

That’s a truly staggering fall. Even at this jaw-dropping high, it appears holders are hanging onto their coins tighter than a squirrel with a hoard of acorns; a distinct signal of optimism that might just stave off another May-style meltdown.

Exchange inflows track how many coins are sent to exchanges, typically because someone feels like selling. A big drop hints confidence is high: the whales and the weekend retail gurus don’t seem eager to cash out—at least not yet. If anything, this tells us the chances of a massive downturn are looking pretty slim, at least structurally.

In an interview that made us all nod wisely, Alexander Zahnd, Ziliqa’s interim CEO, remarked that the momentum appears to be quite real, as opposed to my last diet attempt.

“In the near term, the momentum appears real – institutional demand is rising, ETF inflows are strong, and companies continue to add Bitcoin to their balance sheet,” Zahnd told BeInCrypto. Sounds like someone’s been reading his crystal ball! 🔮

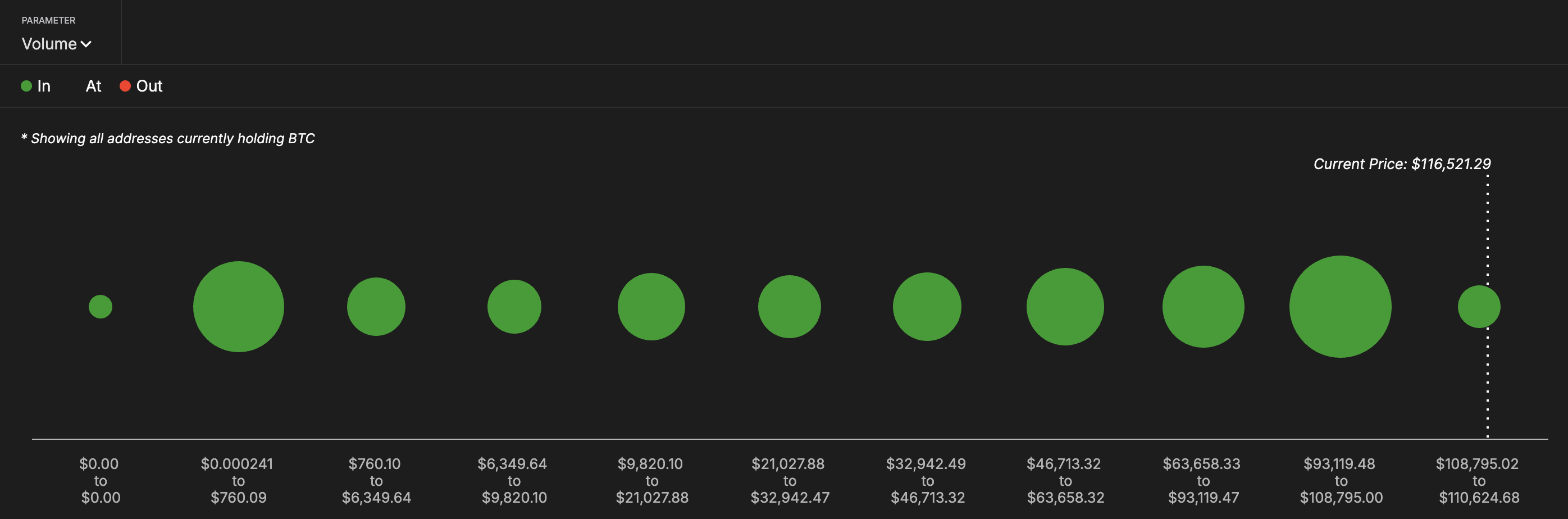

Wallet Clusters Offer Support to the Bitcoin Price

Alright, time for some defensive chatter. Thanks to IntoTheBlock’s In/Out of Money Around Price (IOMAP) metric that sounds more complicated than calculus, we see that over 645,000 addresses bought BTC between $108,795 and $110,624. That’s 476.65K BTC held around current levels, forming what I like to call a ‘major demand wall’—or the equivalent of a cozy blanket on a chilly night.

Last May, we witnessed a free-fall because support zones cracked faster than eggs at a particularly enthusiastic breakfast. This time, provided Bitcoin hangs out above this address cluster, it means your not-so-distant relatives—er, I mean short-term buyers—are still hanging onto a profit, strengthening their resolve like folks who refuse to give up on their favorite show, no matter how bad it gets!

The IOMAP level reveals where past buyers stand on profitability. When big address clusters overlap nicely with price zones, it’s like a perfect match—these areas become critical support or resistance. Let’s channel some romantic energy here!

RSI Divergence Says “Caution,” But Still No Panic

Now for the party pooper. While Bitcoin has been flexing its muscles with those high climbs, the Relative Strength Index (RSI) is throwing up some caution flags with lower highs—a textbook case of bearish divergence. Think of it as a “hold your horses” sign just before an exhilarating ride. 🎠

Fear not! The RSI is still under the overheated zone (below 72), unlike its wild enthusiasm in May when it shot close to 80. So yes, there’s a divergence, but it hasn’t yet escalated into full-on panic mode. Thus, while an enormous correction might be unlikely, do brace for a wee bit of a retracement. No need to hyperventilate just yet!

RSI measures momentum, and when it diverges from the price, it signals that the enthusiasm might be fizzling. But since we haven’t crossed over the edge into overbought territory, the current uptrend may well have some more juice left in the tank. 🚀

Trend-Based Fibonacci Levels Offer Clear Upside Targets

As we dive back into the charting pool, BTC is entering price discovery mode—where nobody quite knows where it’s heading next. Trend-based Fibonacci extensions pop up like well-meaning relatives at a family gathering to help map potential resistance levels.

From the swing low of $74,543 to the May high of $111,980, combined with a cheeky little retracement back to $98,000, we’ve got our resistance beacons:

- 0.382 at $112,439

- 0.5 at $116,857

- 0.618 at $121,274

- 1.0 at $135,576

Bitcoin’s latest wiggle around $116,500 sneaks in line with the 0.5 Fibonacci extension, suggesting that if this feisty critter can leap over this barrier, it may just dance toward $121,000 and $135,000. But let’s be serious—only if the momentum keeps the party going!

So here we are, with Bitcoin above its May high, buoyed by lower sell pressure, institutional enthusiasm, and trusty support clusters. The Fibonacci roadmap even hints at potential for more upside. But remember, caution vibes are still in play. Should Bitcoin tumble below $109,632 (one of those critical support areas), we could see a repeat of the May debacle unfolding before our very eyes. Will Bitcoin transform this ATH into a sustainable rally, or are we in for another rollercoaster ride through the crypto cosmos? Let’s stay tuned!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-11 07:52