The leading cryptocurrency reaches for the stars as stocks plummet due to Trump’s 35% tariff on Canada.

BTC Ascends to New Heights While Equities Sink

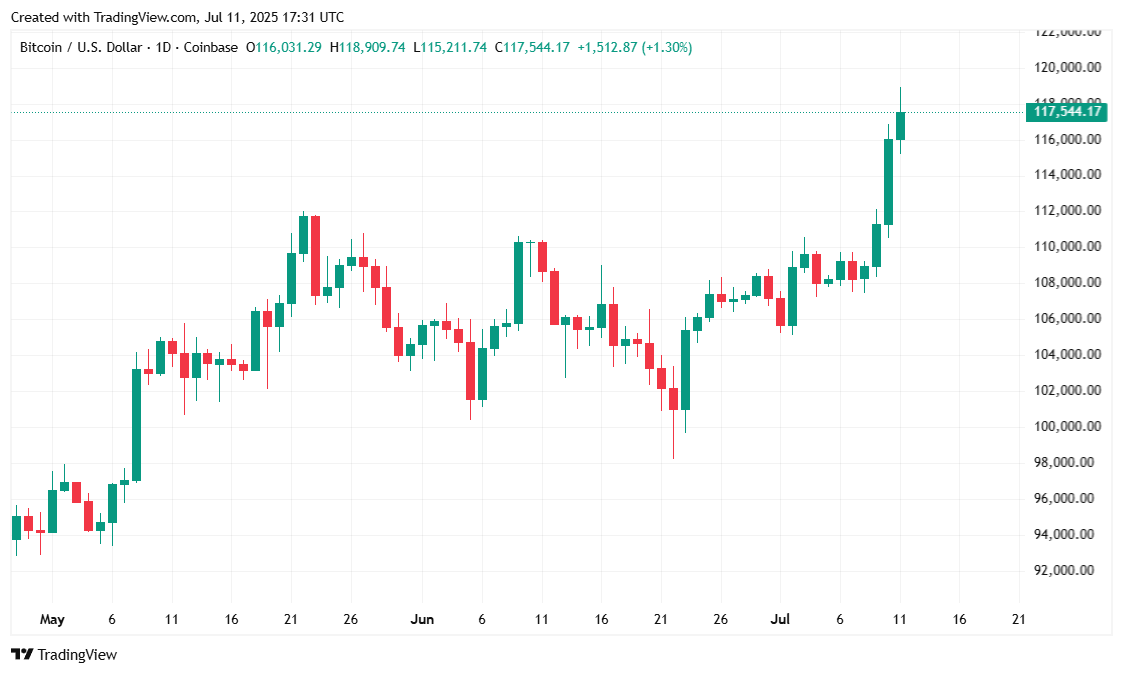

U.S. President Donald Trump, in a move that can only be described as “Trump being Trump,” decided to slap our friendly neighbors to the north with a 35% tax on all Canadian goods entering the U.S. The stock market, predictably, took a nosedive on Friday morning, with the S&P, Nasdaq, and Dow all down by varying degrees. Meanwhile, bitcoin ( BTC) soared to new heights, reaching a peak of $118,856.47 before settling down to a more modest $117K later in the day.

Canadian Prime Minister Mark Carney, who won the country’s top job on a so-called “elbows up” campaign where he promised to “stand up to Donald Trump,” has made no progress on trade negotiations thus far. The phrase “elbows up” is an ice hockey reference used when players raise their elbows to indicate a willingness to defend themselves or physically engage their opponents. Hockey is Canada’s national sport. But once Carney won the election, he went from elbows up to what CNN described as the “Trump Whisperer.” Carney fawned on the president, praising his leadership, all while Trump toyed with the idea of annexing Canada when the prime minister visited the White House. Naturally, when Trump suddenly slapped Carney with a 35% tax last night, on top of existing tariffs, Wall Street reacted, but bitcoin didn’t.

“Starting August 1, 2025, we will charge Canada a tariff of 35% on Canadian products sent to the United States, separate from all Sectoral Tariffs,” Trump wrote. “If for any reason you decide to raise your Tariffs, then, whatever the number you choose to raise them by, will be added onto the 35% that we charge.”

Overview of Market Metrics

As of this writing, bitcoin has been trading as low as $113,077.17 and topped $118,856.47 over the past 24 hours. The digital asset’s price on Coinmarketcap was $117,481.31 at the time of reporting. The quoted price represents a 3.58% jump since yesterday and a much more significant 8.94% increase over the past week.

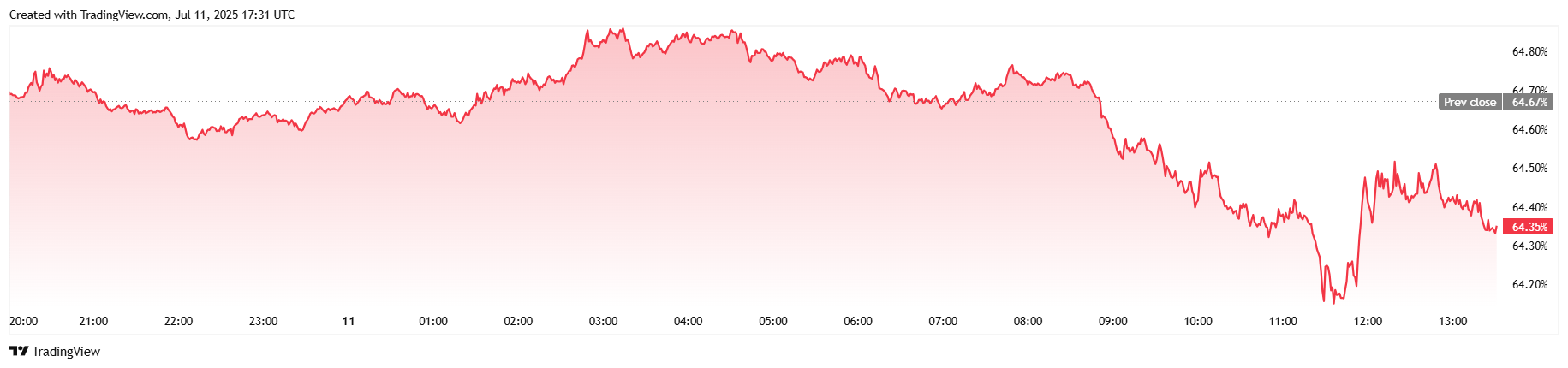

Trading volume since Thursday afternoon nearly doubled, jumping 86.52% to $124.87 billion on Friday. Bitcoin’s market capitalization rose 3.61% and was roughly $2.33 trillion at the time of reporting. Interestingly, BTC dominance tumbled 0.56% to 64.34%, an indication that several altcoins rose higher than bitcoin and ate into its share of the broader crypto market.

Total value of BTC futures contracts edged up 0.84% to $84.23 billion in the last 24 hours. Bitcoin liquidations have remained elevated since yesterday and Coinglass currently has them at $589.33 million. Today, much like Thursday, short sellers were responsible for almost all liquidations, with bears losing $554.84 million. Long positions had a much smaller but non-trivial $34.49 million liquidated.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-07-11 21:28