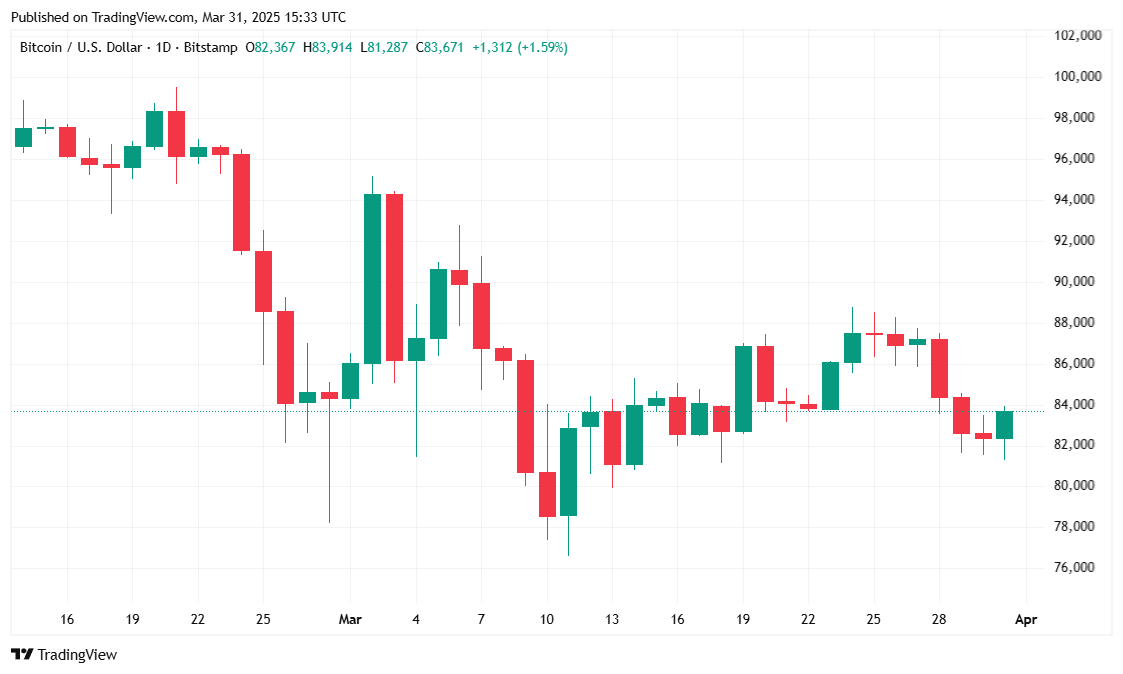

On Sunday, the value of the cryptocurrency dropped to around $81,000 and then rebounded to approximately $83,000. This surge was triggered by large-scale investors who seized the opportunity to purchase at a reduced price, commonly referred to as “buying the dip.

Bitcoin Climbs Back to $83K After a Tough Weekend

The leading digital asset dipped to $81K over the weekend, but news of Strategy (MSTR) and Metaplanet (3350) institutional purchases of $1.92 billion and $13.3 million respectively, helped buoy BTC back above the $83K threshold.

Over the previous day, Bitcoin’s value fluctuated significantly, moving between approximately $83,557.64 and $87,489.86. At the moment of reporting, its price was $83,678.74, representing a 1.01% rise in the last 24 hours but a 5.07% drop over the past week, as shown by Coinmarketcap.

Although there was a decrease in the past week, the market exhibited indications of increased momentum. The trading volume soared by approximately 90.34%, reaching $27.27 billion. However, a significant portion of this increase can be attributed to the expected drop in trading activity over the weekend. Simultaneously, bitcoin’s market capitalization experienced a minor decrease of 0.95% and now stands at $1.65 trillion.

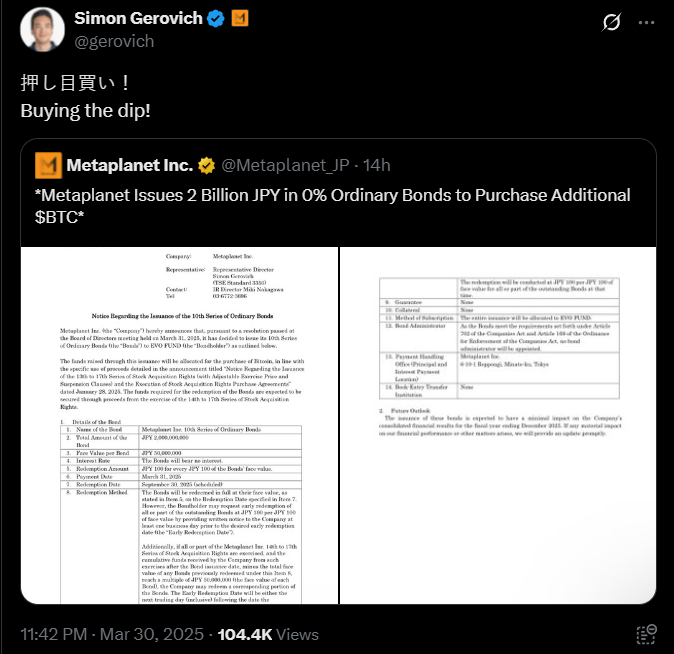

Strategy and Metaplanet Double Down on Bitcoin Purchases

Two firms that have made headlines by successfully pivoting from traditional businesses to bitcoin treasury companies, Strategy and Metaplanet, both announced bitcoin purchases of 22,048 BTC (roughly $1.92 billion) and just under 160 BTC (for roughly $13.3 million or ¥2 billion) respectively. Metaplanet announced on March 30th that it had issued zero coupon bonds for the purchase while Strategy made its purchase announcement on March 31st.

The purchases suggest that institutions have a lasting interest in digital assets, possibly implying a positive impact on Bitcoin’s future price movement over the mid to long term.

Short-Term Bitcoin Holders Dwindle

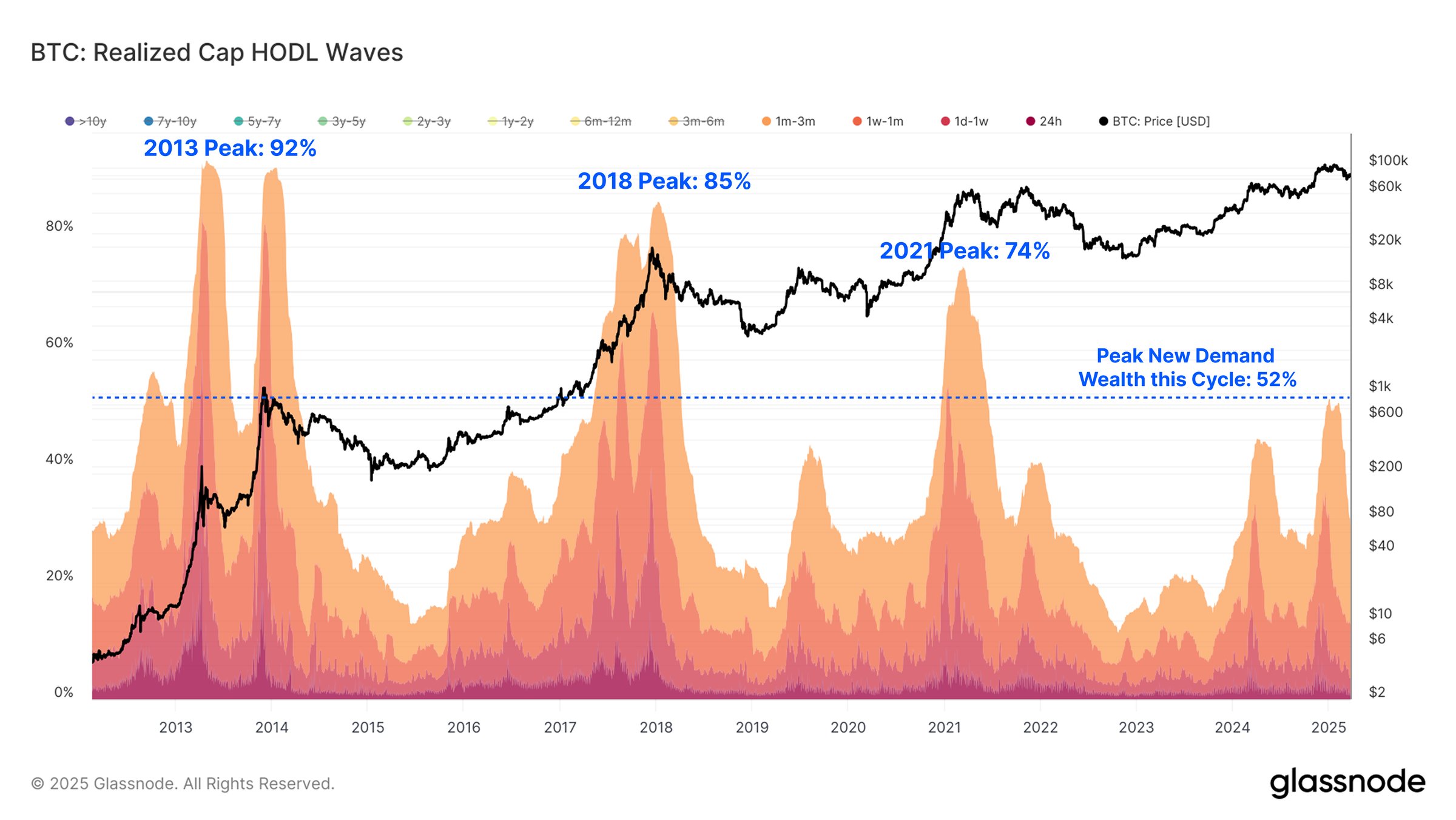

According to data from Glassnode, a well-known cryptocurrency analytics company, it appears that about 60% more of Bitcoin is now being held by long-term investors compared to earlier this year. This shift suggests that we might not see as much sudden increase in Bitcoin’s price going forward.

According to Glassnode’s explanation, the current level of new investor wealth is still relatively low compared to previous market peaks, which saw new investors accounting for 70-90% of total wealth. This indicates that the bull market we are experiencing now has been more restrained and spread out among a larger number of investors.

Market Metrics and Trends

Other key indicators paint a mixed picture for bitcoin’s short-term outlook:

- BTC dominance rose slightly to 62.42% (+0.38%), indicating bitcoin is holding up better than altcoins.

- Futures open interest dipped slightly to $53.74 billion (-0.26%), suggesting some cooling in leveraged trading.

- Liquidations totaled $8.19 million over the past day, with shorts suffering nearly all losses ($8.15 million). This signals that bearish traders were caught off guard by bitcoin’s resilience.

Bitcoin Price Outlook

Over time, Bitcoin’s underlying strengths seem robust, stemming from growing institutional interest and a more experienced pool of investors. As more long-term investors tighten their hold on the supply, market turbulence could gradually decrease, paving the way for steady price advancement in the upcoming months.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-03-31 21:06