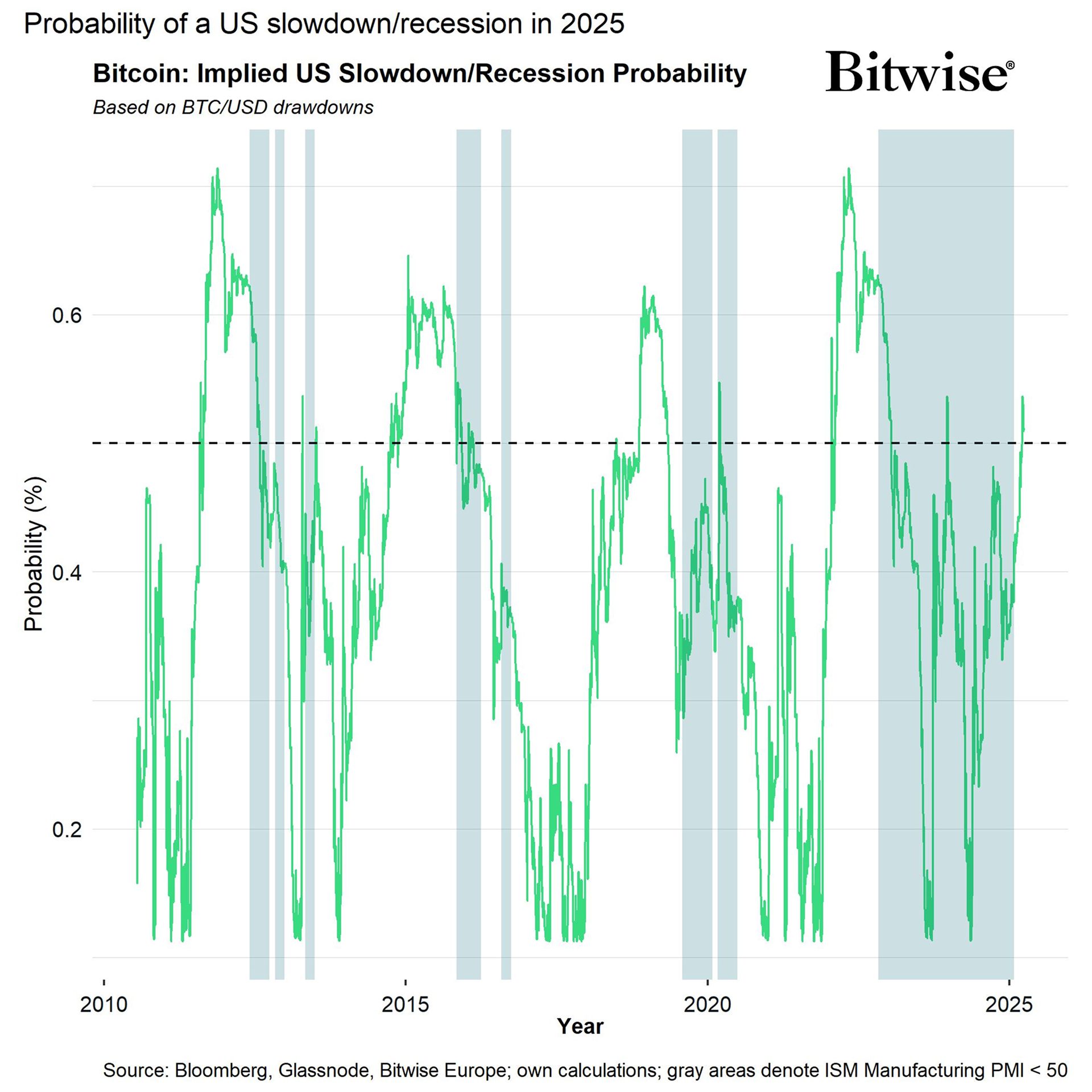

So here’s the thing: Bitcoin, our beloved digital darling, has apparently already baked in all the sposhy-poshy recession concerns according to the wise folks at Bitwise. But, and this is a big but, they’re still cautioning us that there might be some more downside if the economy decides to take a nosedive. 😬

Both Bitcoin (BTC) and its lesser-known companions (we call them altcoins) have likely already priced in most of the U.S. recession jitters. However, if the recession actually happens, watch out—there might be a bit more tumble in the works. 🚀📉

In a recent report, the crypto gurus at Bitwise went on to remind us that Bitcoin’s performance during past recessions has been a bit of a rollercoaster. Take the 2020 Covid recession, for example. Bitcoin took a 50% nosedive, yet managed to end the year up by a whopping 300%. Talk about resilience! 💪

So, based on this delightful history, the Bitwise analysts are saying it’s “quite likely that Bitcoin is going to stay under pressure if the equity markets continue to nosedive.” We’ve already seen a 27% dip from its peak, which suggests that a lot of the recession fears are already reflected in the price. But hey, who knows? 🤷♂️

“The key takeaway here is that U.S. recession fears are already being priced into bitcoin and other cryptoassets. But if a U.S. recession actually materializes, there might still be a little bit more downside left.”

— Bitwise

Yet, the analysts also see signs of “peak uncertainty.” They note that U.S. economic policy uncertainty is as high as it was during the pandemic, and Google search trends for the word ‘recession’ are also at pandemic levels. It’s enough to make you want to hide under the covers. 🛠️🔍

And just when you thought things couldn’t get more interesting, the analysts at QCP Capital noted in a Telegram post that markets are now bracing for President Donald Trump’s upcoming “Liberation Day” announcement on April 2. He’s expected to unveil new reciprocal tariffs, which could further deepen recession fears and weigh on risk assets, including our dear Bitcoin. 🚨👩Redux👨Redux

With consumer confidence at a 12-year low and equities already taking a 4-5% weekly hit, aggressive trade policies could be the icing on the cake. So, buckle up, crypto friends, it might be a bumpy ride! 🎢;

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- World Eternal Online promo codes and how to use them (September 2025)

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Hero Card Decks in Clash Royale

2025-04-02 12:37