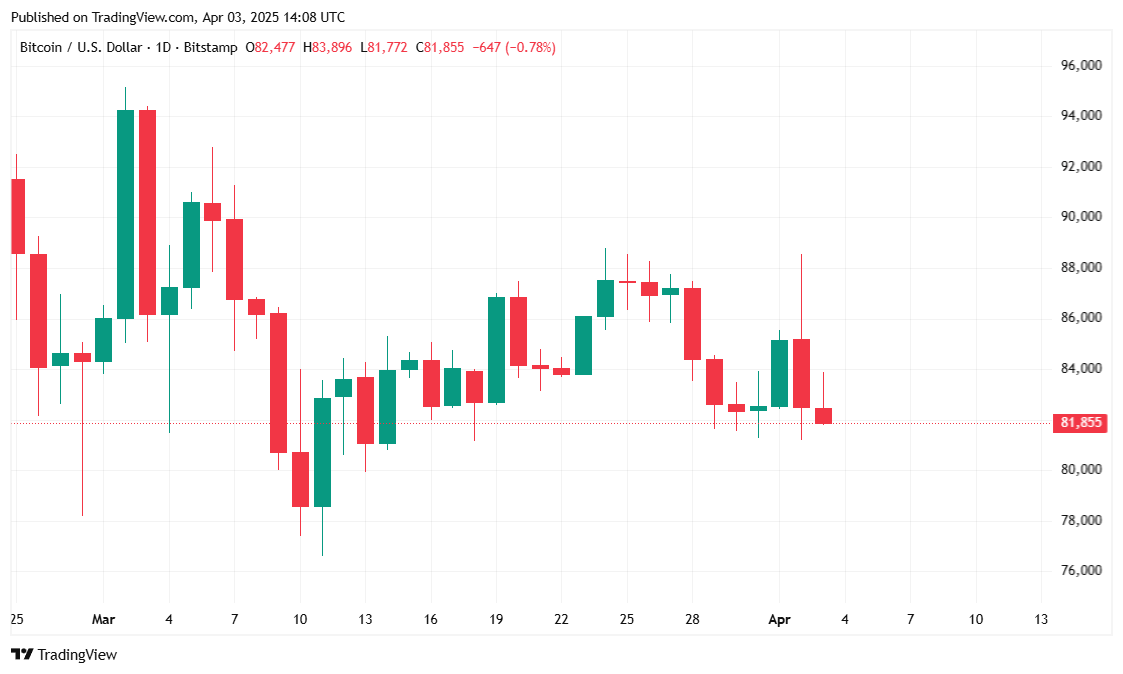

The primary cryptocurrency experienced a significant drop following Trump’s tariff declaration on Wednesday, and it has since remained below the $82,000 mark.

BTC Dives as Trump’s Tariffs Roil Markets

President Donald Trump announced aggressive new U.S. tariffs on more than 100 countries on Wednesday afternoon, sending bitcoin ( BTC) plunging to $81K from yesterday’s high of more than $88K.

Over the last day, the value of the cryptocurrency fluctuated between approximately $81,786.22 and $88,466.96, and it is currently being sold at $81,888.94. This represents a decrease of 4.15% over the past 24 hours and 5.06% in the last week.

The cryptocurrency’s price moved between about $81,786.22 and $88,466.96 during the preceding day, and it is currently being transacted at $81,888.94, marking a decrease of 4.15% in the last 24 hours and 5.06% over the past week.

Overview of Market Metrics

Over the previous 24-hour period, Bitcoin’s trading activity significantly spiked to reach approximately $54.72 billion. This surge represents an impressive 88.43% jump, triggered by apprehensive investors offloading the asset following Trump’s announcement. At present, Bitcoin’s market value stands at around $1.62 trillion, marking a 4.41% drop from its value the day before, mirroring a wider sense of investor wariness.

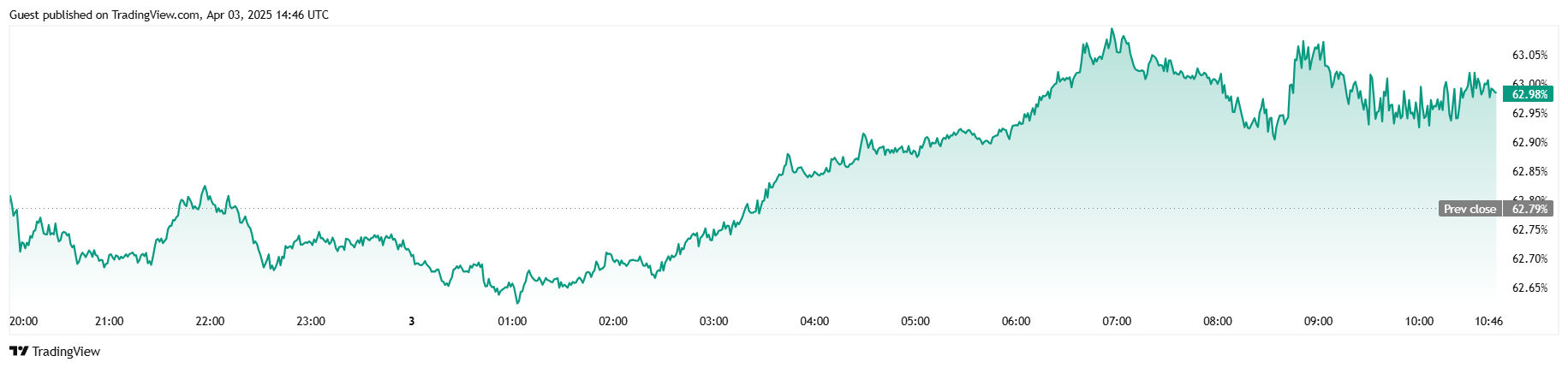

BTC dominance currently stands at 62.92%, up by 0.64% over the last 24 hours, as some traders appear to be retreating to the relative safety of bitcoin as altcoin prices take big hits. Additionally, total bitcoin futures open interest has dropped by 5.29% to $52.20 billion, suggesting that leveraged positions are being unwound in response to the volatile environment.

Yesterday’s Bitcoin liquidation data from Coinglass shows a total of $10.30 million in liquidations. The majority of these, $3.42 million, were long positions, while short positions accounted for $6.88 million. This suggests that the market moved against most bearish bets, as those who had short positions experienced more liquidations.

Markets Slump Following Trump’s “Liberation Day” Tariff Shock

As a crypto investor, I found myself bracing for turbulence last Wednesday when Trump announced his tariff decision, igniting an unforeseen trade conflict with our major trading allies. This unexpected move sent ripples through conventional and international markets, causing a sharp downturn that left me, along with many others, watching our investments plummet.

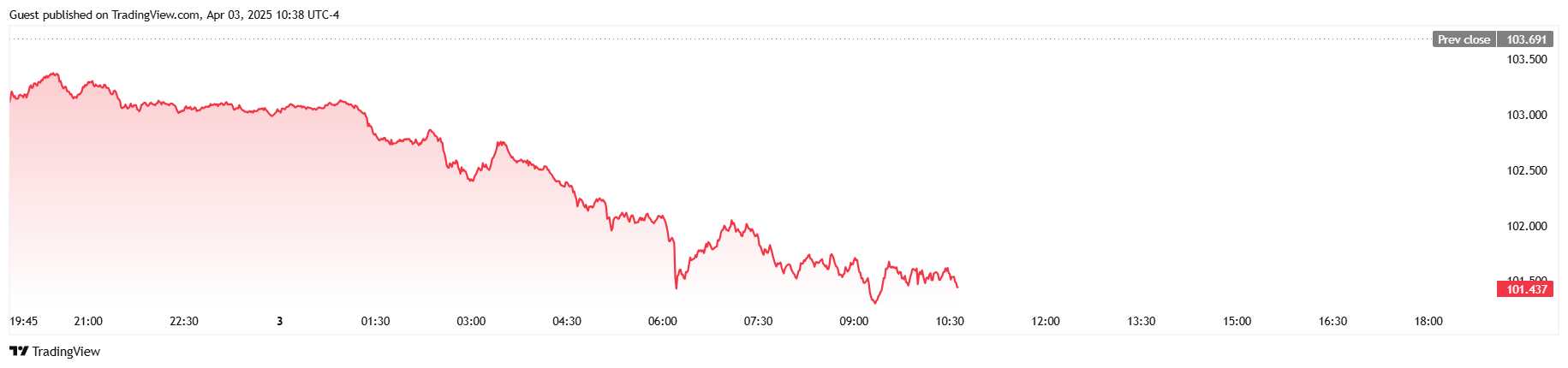

Currently, as we speak, the S&P 500 is down by 4.17%, the Dow Jones Industrial Average has plummeted by 1,464 points, and the U.S. Dollar Index, which gauges the dollar’s strength against significant global currencies, has tumbled by 2.19% to reach 101.43 – a level not seen since October 2024.

Coinmarketcap shows the global crypto market cap at $2.63 trillion, down 4.26% over 24 hours.

It’s intriguing to ponder whether investors will persist in considering Bitcoin as a secure investment option, potentially leading it to regain its previous record levels.

Bitcoin Price Outlook

As we move forward, the future of Bitcoin is uncertain with a blend of optimism and caution. While its current price drop might appeal to bargain shoppers and long-term investors anticipating a short-term decline, it’s also possible that ongoing global trade disputes and persistent economic uncertainties could cause further downward pressure on Bitcoin.

Investors will be closely watching upcoming policy developments and global market signals for clues. Analysts suggest that if BTC stabilizes above key support levels around $81,500, it may eventually rebound; however, further declines cannot be ruled out, especially given the unpredictable nature of Trump’s trade policies or what some have dubbed “The Trump Effect.”

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-04-03 19:00