Bitcoin continues to maintain its position above $115,000 following several consecutive trading days below this level, indicating a resurgence in market vigor. The optimistic sentiment is growing as Ethereum records substantial increases and various altcoins display robust movements over the recent period. For certain analysts, this might herald the long-anticipated ‘altseason’; for others, it’s just the rest of the market aligning with Bitcoin’s earlier price surge.

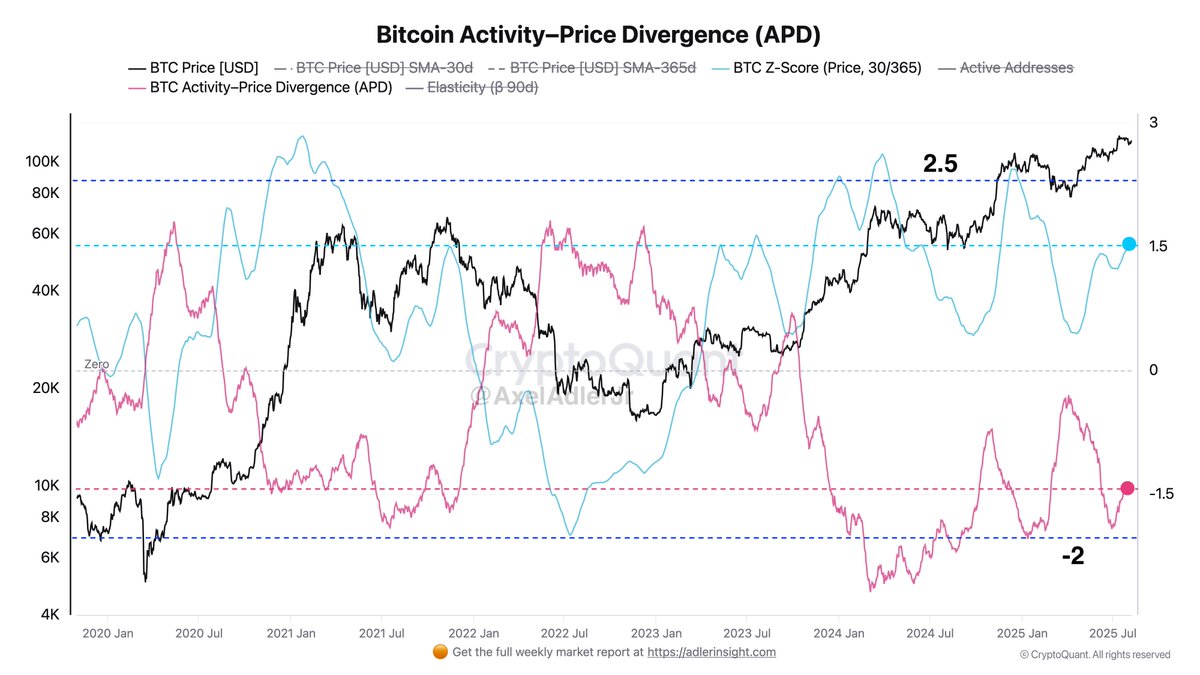

According to top analyst Axel Adler, Bitcoin’s price is currently nearly at its record high, and its BTC Z-Score (Price, 30/365) hovers around 1.5 standard deviations above its average for the past year. This figure is significantly lower than the usual +2.5 standard deviations that indicate overheating, indicating that while Bitcoin’s momentum is robust, it hasn’t yet reached extreme levels. The current market conditions appear to be supportive of further growth, with potential for the market to continue growing before reaching a state of overheating.

In simple terms, as alternative coins are becoming more popular and Ethereum’s surge is boosting market confidence, the upcoming period may show whether this is a lasting surge or simply a stage of gathering strength before the next significant shift in the market.

On-Chain Activity Still Lags Behind Price

According to Adler’s analysis, Bitcoin’s current market situation appears optimistic, but with significant notes of caution. Adler highlights that the Adjusted Price Divergence (APD) remains negative at approximately -1.5, having bounced back from lows around -2. This indicator implies that Bitcoin’s price is continuing to rise faster than on-chain activity, although the difference between the two is gradually decreasing. Essentially, while the price trend is strong, the network’s transaction volume and usage have yet to fully match this momentum.

This inconsistency leads to an intriguing market scenario. Adler suggests that the preference leans towards price, implying that the momentum is largely influenced by investor attitudes and trends rather than on-chain fundamentals. For the rally to solidify further, a more balanced situation would have APD trending closer to zero. This balance could be achieved in two possible ways: either network activity surges substantially while the price remains stable or shows minor growth, or Bitcoin’s price experiences a decrease to match current usage rates.

Adler cautions against using APD reaching zero as a clear indicator for buying or selling Bitcoin. Rather, it signals a state of normalization where the market price and the underlying network’s fundamentals are more in balance. Presently, Bitcoin’s technical and broader economic conditions are positive, but for long-term growth to be sustained, the network needs to align more closely with the price movement.

Bitcoin Price Holds Key Support Near $115K

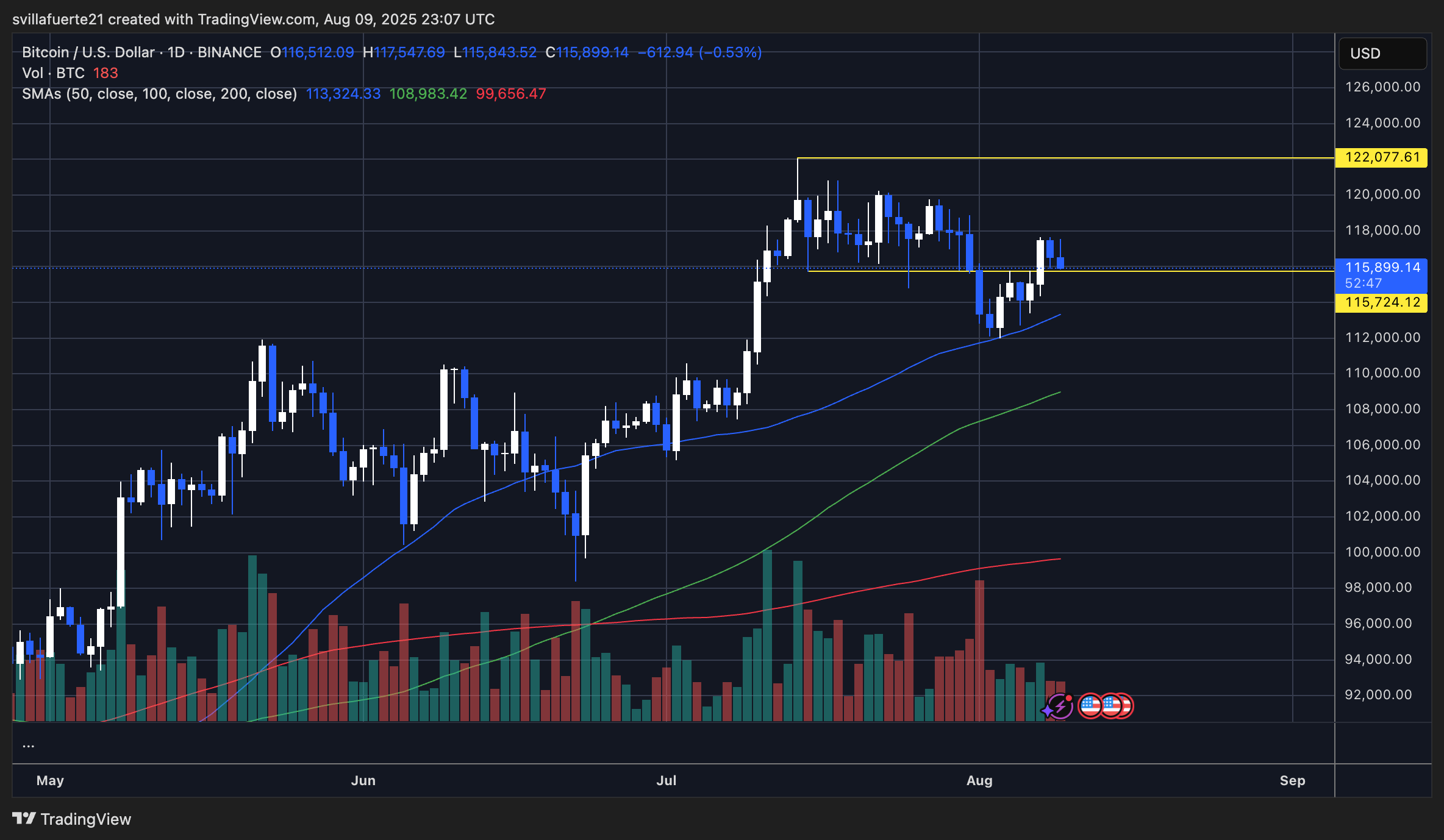

Bitcoin is holding steady above the significant support of $115,724, following a temporary drop below this point earlier in the month. On the daily chart, you can see that the price has found a balance just above the 50-day Simple Moving Average (SMA), currently around $113,324. This SMA has proven to be a robust support during the recent upward trend. In the short term, the market structure is still optimistic, with Bitcoin trading within a range defined by the support at $115,724 and the resistance at $122,077.

As an analyst, I’ve noticed a slight slowdown in the volume since the August rebound, indicating that the market might be adopting a cautious approach, anticipating a potential breakout. A clear move above $118,000 could trigger another attempt to breach the significant resistance at $122,077, a level that has repeatedly thwarted upward momentum in the past. If successful, this could pave the way for reaching new record highs.

On the negative side, a loss of $115,724 could potentially shift attention towards the 100-day Simple Moving Average (SMA) at $108,983 as the next significant support level. Until this point, the pattern of higher lows indicates that buyers are defending the mid-$115,000 region quite actively.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- What If Spider-Man Was a Pirate?

2025-08-10 10:23