Bitcoin Mining in Q1 2025: A Tale of Profits, Prices, and Peculiarities

In the cold and relentless winter of early 2025, the miners of the digital gold faced trials that would make even the sturdiest of saints question their faith. The heavens, it seemed, had decreed a halving—a divine cut in half—leaving the miners to grapple with increased difficulty, as if climbing a mountain made steeper by the gods’ own hand. 🍃

From the towering citadels of Cipher Mining to the bustling halls of Riot Platforms, the story unfolds. We shall examine their deeds—what they gained, what they lost, and how they fared amidst the chaos—like characters in a grand Tolstoy novel, caught in the relentless march of history.

Financial Pomp and Peculiarities

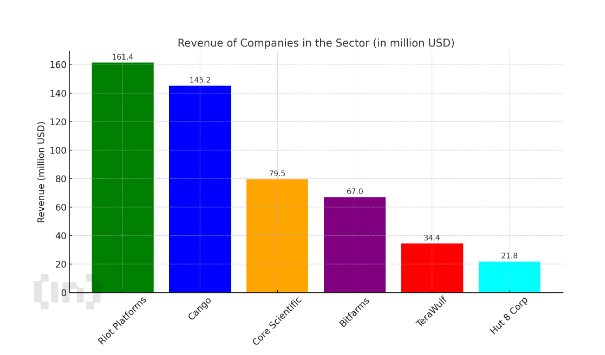

In this story, some emerged as kings, others as jesters. Riot Platforms, crowned with $161.4 million in treasure, mined 1,530 Bitcoin—yet the toll was steep: a cost of $43,808 per coin, as if purchasing each with a handful of rubles. The halving was a cruel barber, trimming profits but leaving the costs untouched—like trying to sell bread when the baker’s own costs have doubled. 😂

Meanwhile, Core Scientific, with a grin, reported a net profit of a staggering $581 million—mostly illusions and shadows, thanks to non-cash dances. Revenue slid down by over half, leaving behind a mere $79.5 million, and their EBITDA was negative—a fancy way of saying they lost more than they earned, like a miser counting his pennies only to find them turning to dust. 💰

Bitfarms, with a daring 33% leap to $67 million, saw its gross profit margin dwindle from a proud 63% to a meager 43%. They ended up with a net loss of $36 million, which, one might say, is an expensive hobby. Cango, ever ambitious, pulled in $145.2 million—almost all from mining—yet each Bitcoin cost them a fortune: $70,602 per coin, as if buying gold in a market full of jesters. 🤡

Hut 8 and TeraWulf, meanwhile, were not so fortunate. Their revenues declined by more than half, and they succumbed to losses—like characters caught in the grip of fate, unable to escape. Their stories remind us that even mighty empires can crumble under the weight of their own ambitions.

Mining Harvests and Bitcoin Hoards

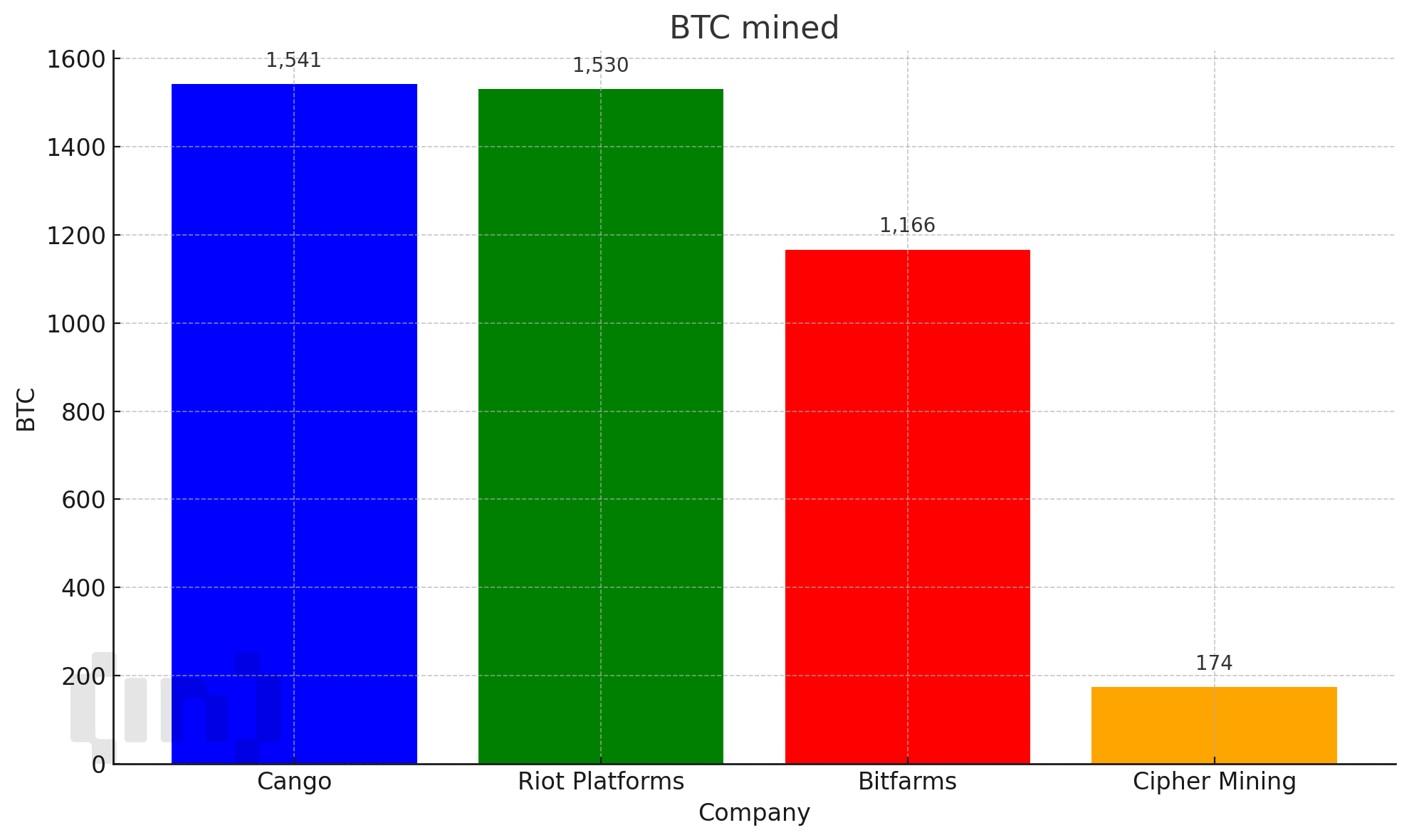

The harvest of Bitcoin’s fields saw Cango leading with 1,541 coins—more than most could dream—followed closely by Riot with 1,530, and Bitfarms with 1,166. Cipher Mining, exhausted from the previous month, mined just 174, yet sold 350, shrinking their treasure chest and leaving behind collateralized tokens—a kind of digital IOU. 🧙♂️

Riot’s treasury held 19,223 Bitcoin—more than some monasteries’ relics—while Bitfarms kept a modest 1,166. Cango, ever the financier, boasted $347.4 million in cash and investments, like a merchant counting his gold coins in a tavern. Core Scientific, elusive about holdings, focused on managing money through expanding services, preparing to generate $360 million by 2026—an ambitious prophecy, perhaps exaggerated like a traveling bard’s tale.

Thus, the first quarter of 2025 proved a tumultuous chapter in the saga of Bitcoin miners. They battled halving’s cruel cut, increased difficulty, and their own greed. Some emerged victorious in output and revenue, while others faltered—like all stories of human endeavor, woven with humor, hubris, and a touch of madness. 😂🌀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-06-05 10:15