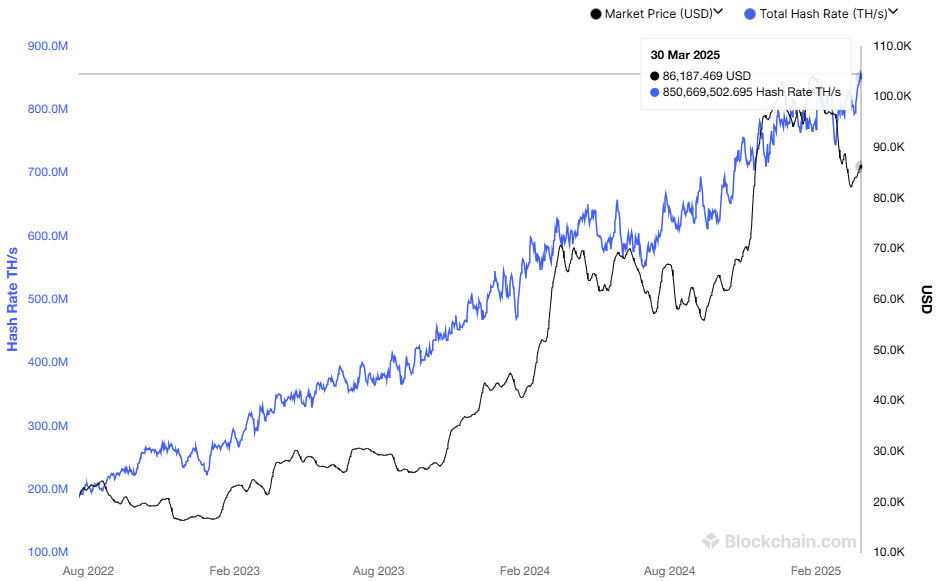

Good heavens! The Bitcoin mining industry is galloping forward like a horse on a race day, what with the network’s hashrate reaching a jaw-dropping all-time high (ATH) of a staggering 850 million TH/s by the end of March 2025! 🐎💨

But wait a tick! If you think all that glitters is gold, you might need to polish your spectacles. Rising production costs and pesky tariffs, especially in the good ol’ US of A, are throwing a spanner in the works. Yes, it seems those crafty factors are putting the squeeze on the mining companies, and we might be in for a bumpy ride ahead! 🎢

The Hashrate is Up, Up, and Away — But So Are Costs!

Now, let us not get our knickers in a twist without knowing what hashrate actually means. It measures the total computing power employed by our dear miners to fend off nefarious villains seeking to threaten the network’s integrity whilst validating transactions. This is expressed in terahashes per second (TH/s), signifying the number of hash calculations taking place as quickly as a Jack Russell on a squirrel hunt every second! 🐶💥

According to our chums over at Blockchain.com, Bitcoin’s hashrate has surged past that glittering 850 million TH/s mark in March. This is not just a puff of hot air; it shows a surge of miners enthusiastically joining the fray, fueled by a newfound confidence in Bitcoin’s value and robustness. Quite the sight, isn’t it? 🎉

“Each time the network gets stronger, Bitcoin becomes harder to attack, harder to ignore, and more justified in commanding a higher valuation. This isn’t just code. It’s economic gravity. Bitcoin has become the most secure monetary network humanity has ever seen. And it’s only getting stronger.” — Thomas Jeegers, CFO & COO of Relai, wisdom incarnate! 🧙♂️✨

Alas, dear reader! Even with this soaring hashrate, mining profits seem to be playing hard to get. A report from the fortune-tellers over at Macromicro indicates that mining one Bitcoin has doubled in cost since early 2024—now an eye-watering $87,000! The culprits? Rising electricity prices and the astronomical expenses associated with specialized mining hardware, known as ASICs. It appears the mine is becoming more like a money pit! 💸🔧

With Bitcoin’s price doing its best impression of a roller coaster, many miners are at risk of operating in the red unless they can sharpen their efficiency. Smaller miners, bless their hearts, are finding it especially arduous as they lack the scale or cheap electricity that the big boys enjoy.

The Tariff Tango and Our Dependence on Chinese Hardware

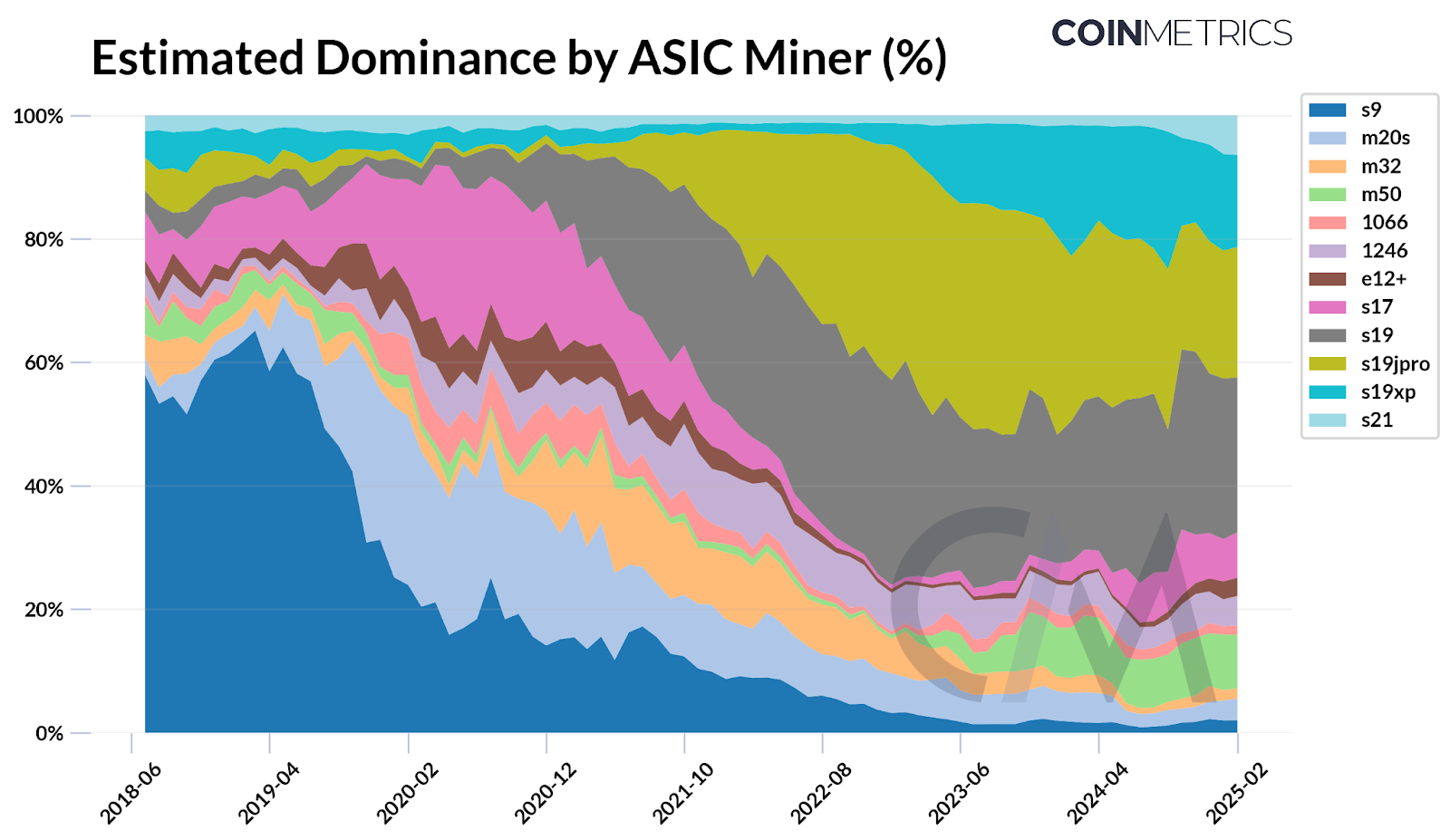

Now, we stumble upon yet another mountain for Bitcoin miners to scale: trade restrictions in the United States. According to those clever folks at CoinMetrics, a whopping 59%–76% of Bitcoin’s total hashrate comes courtesy of ASIC miners produced by Bitmain, a company perched in China. Oh, the irony! 🇨🇳🔍

Bitmain has long held the reins of mining hardware, with shining stars like the Antminer S19 and S21 known for their spiffy efficiency. However, like a cat stuck in a tree, some US mining companies faced a jolly good delay in receiving their Bitmain shipments due to tighter customs and new tariffs on Chinese imports. Fancy that! 🐱⏳

“With Bitmain accounting for a majority of Bitcoin’s network hashrate, reliance on a single manufacturer, despite having distributed supply chains, presents a potential risk. Since Bitmain is primarily based in China, its dominance highlights how geopolitical dependencies can affect the stability of mining operations,” CoinMetrics reported, quite rightly, I must say. 🌍⚖️

These tariffs are not something plucked from thin air; indeed, the US has been applying duties of up to 27.6% on imported mining equipment from China since 2018. However, new measures reflect increasing regulatory scrutiny and trade pressures, leading to inflated costs that would make even Scrooge McDuck clutch his coins in despair. 💰😱

Recently, in a surprising twist, Hut 8 Corp., a Bitcoin mining operation and high-performance computing firm, decided to join forces with none other than Eric Trump and Donald Trump Jr. to establish the American Bitcoin Corp. The aim? To become the biggest and the most efficient Bitcoin mining operation under the stars while amassing a robust Bitcoin reserve. It’s a bit like the Wild West — only with less gold and more digital wampum! 🤠💻

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-03-31 17:52