If you ever want to see a bunch of grown adults sweat through their Patagonia vests, put them in front of a live Bitcoin chart. Friday, May 9 was one of those days—the price hit $103,800, which is astronomical and also just sounds made up. Then, that reliable post-frenzy sluggishness set in. Nothing says “crypto weekend” like millions of people watching a graph climb, fall asleep, then wake up straining toward $114,000 like it’s a middle-aged dad at a CrossFit class.

You’d think after four halvings in 2024 (that’s crypto-speak for “we pressed the ‘make it harder’ button again”), the only people more jittery than market participants would be the miners themselves. These miners, who used to dump coins on the market faster than I dump my journals before a family visit, are suddenly acting like hoarders on a cable special. Yep, the on-chain data says the miners are… holding. And holding. Picture Gollum, but if Smeagol was really into GPUs and had no idea how to swim.

Are Bitcoin Miners Just Sitting There and Fanning Themselves With Dollar Bills?

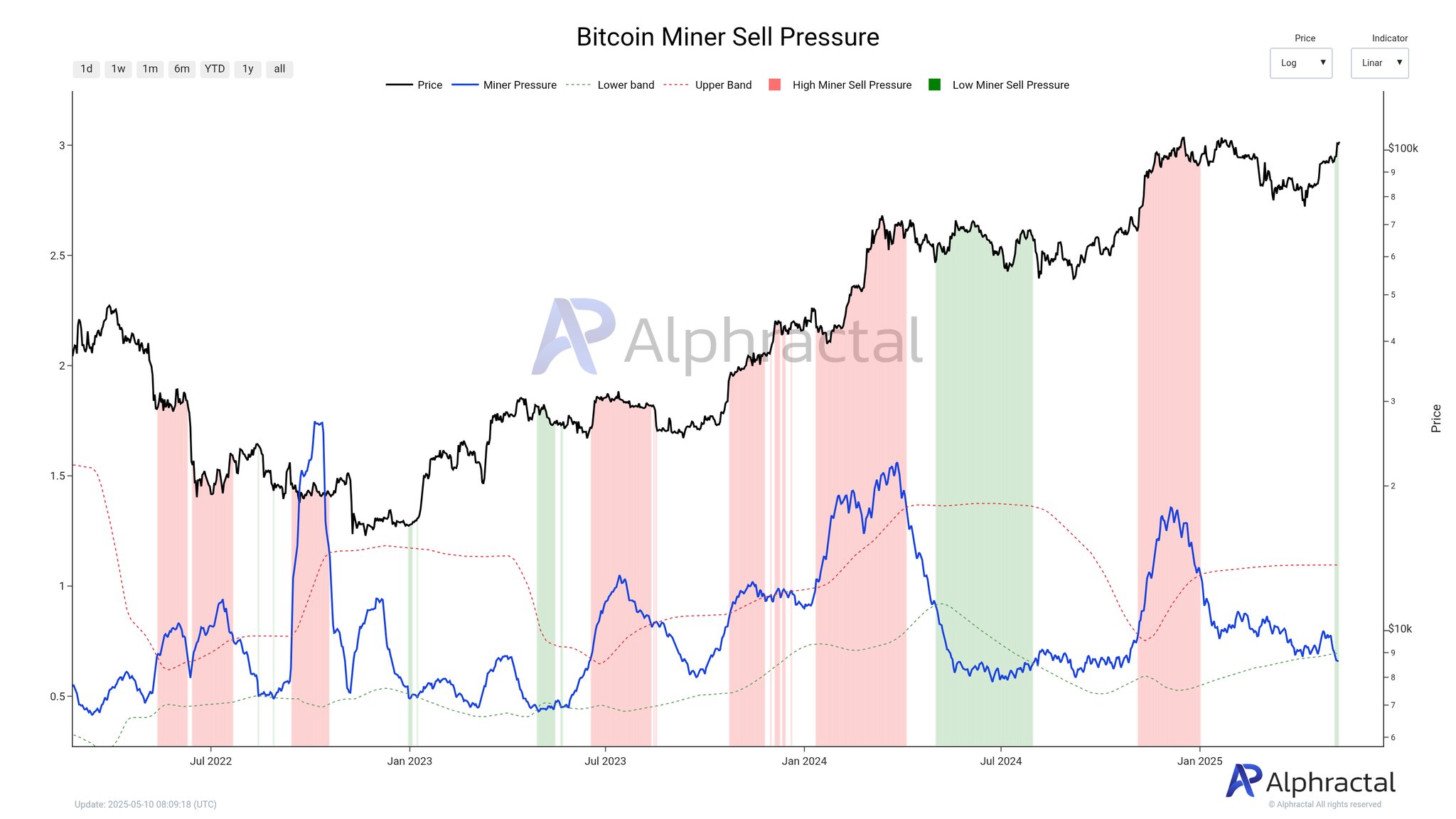

Alphractal, which honestly sounds like a Pokémon that dabbles in technical analysis, leaked on X (yes, we’re calling it that now, apparently) that miners aren’t selling. Instead, they’re pretending those mining rewards are fine art, or worse, Beanie Babies circa 1997. This is measured by the “Miner Sell Pressure” indicator—which sounds scary but is just a number comparing coins miners are chucking on the market versus coins they’re stashing under the crypto-mattress. If it’s high, miners are in “fire sale” mode and everyone panics. If it’s low, we all pretend everything is fine and maybe even bullish. 🍀

To illustrate: red means panic (or “market sluggishness,” which is industry lingo for someone’s about to lose their shirt). Green means everyone is so chill you’d think they’ve discovered meditation. (Spoiler: they haven’t—they just want higher prices.)

This cartoonish chart shows the blue line (Miner Pressure) zigzagging around the red and green like it’s avoiding social interaction at a conference. When blue crosses above red, miners are selling everything and probably screaming into a pillow. But when the blue slithers under green (which just happened), they’ve basically locked their wallets and swallowed the key.

So yes, the current miner pressure is at its lowest since 2024, which is sort of like saying, “I haven’t eaten carbs since this morning,” but for Bitcoin. Miners are clearly hoping for a price jump before they cash out and buy another ergonomic chair.

Will this restraint matter? Maybe, maybe not. There’s a whole debate about how much miners really drive prices anymore. Some say they’re now just background noise—like a Roomba running over LEGO bricks. Still, in theory, fewer miners dumping coins is a good omen, unless it lulls everyone into a false sense of security, which is basically the central theme of all Bitcoin stories.

Bitcoin Price: At-a-Glance (Don’t Blink, It Moves Fast)

Right now, BTC is hovering at $104,250, which is up more than 1% in 24 hours—impressive, unless you expect your own savings to do that. But let’s be real, you don’t.

In conclusion: the miners are hoarding, the price is climbing, and everyone’s pretending not to be nervous. Just another day in cryptoland, where the charts are always going up… or down… or whatever direction gets the most emojis on X. 🚀😅

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-05-11 19:35